Introduction

Contemporary employers commonly offer compensation packages that include unfamiliar terms like RSU (Restricted Stock Units) and ESOP (Employee Stock Ownership Plans), in addition to the traditional elements such as basic pay, special allowance, EPF contribution, and gratuity contribution. These comprehensive packages are often referred to as “CTC – Cost to Company.”

RSUs and ESOPs are strategically integrated into the CTC to attract and retain employees, particularly in the case of startups approaching IPOs. However, many job seekers accept these packages without fully comprehending their worth or considering the potential tax implications. In this article, we delve into the RSU vs. ESOP debate and highlight crucial points that individuals must be aware of.

Table of Contents

Benefits of RSU and ESOP

As mentioned earlier, both RSU (Restricted Stock Units) and ESOP (Employee Stock Ownership Plans) serve as effective employee retention tools. Beyond providing financial rewards, these stock options also foster a sense of commitment among employees toward the organization’s success. When employees have a personal stake in the company, they are motivated to perform exceptionally, benefiting both the firm and the individual.

However, for those unfamiliar with these acronyms, RSU and ESOP may seem more like a confusing alphabet soup than actual benefits. Even if you have received documentation from human resources, you might still be unclear about what these tools entail and how they function.

Read Also: Highest IPO Subscription

RSU (Restricted Stock Unit)

Restricted Stock Units (RSUs) represent a method through which companies offer equity to their employees. The term “restricted” indicates that these units are subject to a vesting schedule, which could be tied to either the duration of employment or the achievement of performance goals. Additionally, RSUs may be constrained by transfer or sale restrictions imposed by the employing firm.

RSUs (Restricted Stock Units) come with a vesting schedule, which is typically tied to specific milestones that employees must achieve before being granted the RSUs. These milestones can be based on performance targets or the number of years of service with the company. The RSUs are considered worthless until the vesting requirements are fulfilled. Once the requirements are met, the employee is entitled to receive the shares, with a certain percentage withheld for income tax purposes. After receiving the shares, the employee can freely decide when to sell them, unless there are any restrictions on transferring the shares.

Also read: Top 10 Most Expensive Stocks In India

How do RSUs Work?

Assume you join a firm on 1 April 2022, and you are assigned 100 RSUs on 10 April 2022. If the corporation specifies that the RSUs would vest in four 25% tranches over four years, the first tranche of 25 stocks will be available for sale/holding on 10 April 2023. The remaining RSUs will then vest at 25 stocks apiece on 10 April of the following year.

The award date is the date on which the RSUs are assigned to you. Even if you have been issued RSUs, you cannot sell them right now. Every year, a specific number of stocks (also known as tranches) become available for sale. It is known as the vesting of shares, the price of the stock on that day is known as the vesting price, and the date is known as the vesting date. After vesting, you can either keep the stock or sell it.

Read Also: Best IPOs in 2023

ESOP (Employee Stock Option Plan)

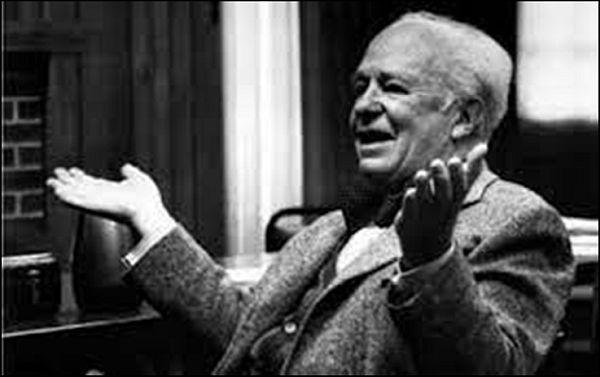

The concept of Employee Stock Ownership Plans (ESOPs) has a rich history dating back seven decades. Louis O. Kelso, a renowned political economist, and corporate lawyer, is credited with pioneering this unique form of ownership in the 1950s, earning him the title “Father of the Employee Stock Ownership Concept.”

The term “ESOP” refers to a set of incentives or investments designed for the employees of a business. In precise terms of Company Law, it represents an option granted to full-time directors, executives, or employees, allowing them to subscribe to the company’s securities at a future time and at a predetermined rate. As mentioned earlier, ESOPs serve as an innovative approach to motivate, reward, remunerate, and retain employees, granting them partial ownership of the company.

Many large firms in India, especially those in the IT sector listed outside of India, offer Employee Stock Option Plans (ESOPs) to their workforce. Similar to RSUs, ESOPs are utilized as a means to retain valuable human resources. While both RSUs and ESOPs work towards employee retention, a notable distinction in the RSU vs ESOP debate is that ESOPs are often issued at a discount to the prevailing market price, making them more enticing for employees.

Regarding the regulatory aspect of ESOPs in India, it is essential to consider various statutes, including Company Law, Income-Tax Law, Securities Laws, and Foreign Exchange Regulations. Being aware of and adhering to these regulations is crucial for companies implementing ESOPs as part of their compensation and retention strategies.

Also Read: Virtual Trading InTradingView In 2022 – Here’s why It’s The Best

How do ESOPs Work?

Assume you join a company on 1 April 2022, and your company offers you the opportunity to acquire 100 stocks on 1 October 2022, at a price of INR200 per share. This is against the market price of INR300 per share and with a vesting period of 1 year. So, on 1 October 2023, you have the option to acquire the shares at a committed price of INR200 per share. Depending on the prevailing share price, this option may or may not be exercised.

The day on which you are offered this option is known as the “grant date.” The day on which you exercise the option is known as the “exercise date” and the price payable by you is known as the “exercise price.” As mentioned above, the exercise price is mostly lower than the market price. In case of exercise, price is higher than the market price, there is no incentive for an employee to exercise the option. The selling window for such bought equities is similarly limited. Every year, a specific number of stocks (also known as tranches) become available for sale.

Difference Between ESOP and RSU

| ESOP | RSU |

| An option to buy company shares at a predetermined price | RSUs are granted directly by the company |

| The employee bears no cost | Shares are transferred as soon as they are vested |

| Tax is applied when an employee chooses to exercise shares | The cost is calculated as follows: Exercise price X number of options exercised |

| Optionality – Employees exercise ESOP only when the market price is greater than the exercise price | No optionality in RSU since there are no costs for employees |

| Tax is applied when employee chooses to exercise shares | Taxed as soon as vested |

Read Also: Best IPOs that Doubled Investors’ Money

ESOP vs RSU – Which One is Better?

When considering ESOPs and RSUs, both have their own advantages and disadvantages, making it challenging to determine which one is better. In general, RSUs are considered less risky for employees because they do not involve any cost to obtain the shares. On the other hand, ESOPs come with a cost, and if the stock price declines after the shares vest, employees may face losses in the long term. This cost factor is a significant difference between ESOP and RSU.

RSUs offer protection that stock options (ESOPs) do not provide. If the company’s stock price drops below the exercise price of the options, they lose value, potentially becoming worthless. In contrast, RSUs retain their value from the start to the finish, even if their worth decreases over time. Moreover, RSUs do not require an upfront investment from the employee. The only circumstance that can render RSUs worthless is if the company goes out of business, which is less likely than a decline in the stock price over the vesting period.

Given these factors, RSUs are often considered a better choice if an employee has to choose between ESOP and RSU. However, keep in mind that companies typically offer either ESOP or RSU, not both, as part of their compensation packages. It is essential to thoroughly understand the details of the plan you are offered before making a decision on your total compensation package.

In conclusion, the key differences between ESOP and RSU should be carefully considered, and understanding how each plan functions will aid in making an informed choice. We hope this explanation helps you understand the ESOP vs RSU debate and assists you in making the right decision based on your individual circumstances.

Sub: RSU v ESOP, which one is better (:

Personal Reaction-

“……In precise Company Law terms, it is an option granted to full-time directors, executives, or employees to subscribe to the company’s securities at a future period BUT AT A SPECIFIED RATE”…..

FONT< Does that mean /imply that unlike RSU, in respect of ESOP that is allotted, besides others, employees, ALWAYS FOR A PREDETERMINED PRICE . In other words, unlike RSU known to be allotted either free of cost or at a discounted price.

If so provoked/inspired, you are suggested to mindfully look through the personal but independent viewpoints, impersonally shared / reshared on inter alia the social websites- FB and Linkedin on the Topic of, – Propriety/legality or otherwise of taxing RSU (as perquisite on vesting/ CG on sale) ; do so, to the end of forming a well reasoned opinion and sharing it for the benefit/ to the advantage of the beneficiaries- employees and others.

Great breakdown of RSUs and ESOPs! It’s fascinating to see how each has its advantages depending on the company’s growth trajectory. I appreciate the insights on tax implications too. Looking forward to seeing how these trends evolve in 2025!