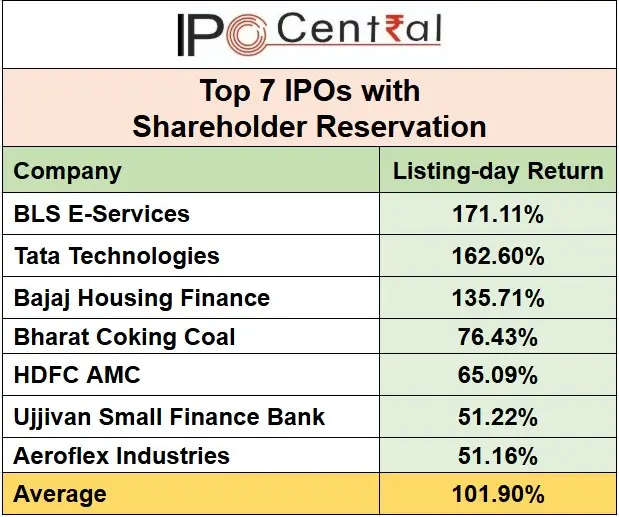

Holding a few shares of companies whose subsidiaries plan IPOs is often beneficial for investors to increase their allotment chances. As we will see in this article, shareholder quota in IPOs is a great way to boost allotment chances. Thus, we have compiled this list of upcoming IPOs with shareholders quota which should come in handy for investors.

Table of Contents

Before we begin defining the Shareholder Quota in IPOs or Shareholder Reservation Portion, let’s look at the categories that investors are familiar with. Among these well-known categories are

- Retail Individual Investor (RII): Generally, 35% of the offer is reserved for the RII category

- Non-institutional Investor (NII): 15% of the shares in an IPO are reserved for the NII category

- Qualified Institutional Bidders (QIB): 50% – 75% of the offer size is reserved for QIBs

What is the Shareholder Quota in IPOs?

There is one more category that is known as the shareholder quota in IPOs. When a subsidiary of a listed company issues an IPO, it generally reserves some shares for shareholders of the parent company. This is known as shareholder quota in IPOs. Generally, it is 5% – 15% of the offer.

As one can imagine, this quota is beneficial for both parties i.e. investors as well as the company bringing the IPO. Investors have a great way of boosting their IPO allotment chances by picking just one share of the parent company. On the other hand, the IPO company would also like to see a higher subscription for its offer.

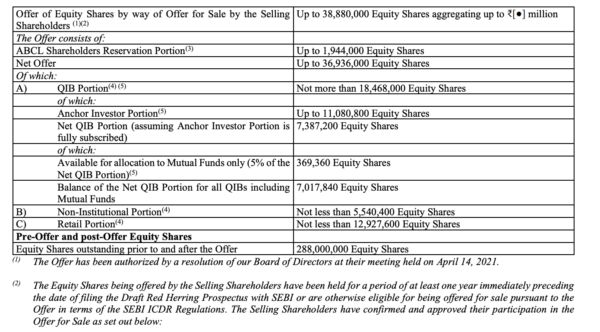

Let’s understand this with an example. In the case of Aditya Birla Sun Life AMC, the company made an offer of 38,880,000 shares and reserved 1,944,000 shares for shareholders of its parent company Aditya Birla Capital Limited (ABCL). These shareholders could be individuals as well as Hindu Undivided Families (HUFs).

Who Can Apply Under the Shareholder Category in IPOs?

HNI, Retail investors, and Employees of the parent company can apply under the shareholder quota in IPOs if holding at least one share of the parent company as on the record date which is usually the date when the Red Herring Prospectus (RHP) is filed. It is worth highlighting that shares of the parent company need to be in the investors’ demat accounts on the record date. Since we follow the T+2 settlement cycle in India, it means that investors need to purchase the parent company shares two days ahead of the record date to be eligible.

To participate in the shareholding quota in IPOs, applicants must apply in the shareholder’s IPO category. To sum it up, buying shares of parent company coming up with subsidiary company IPO is a great way of boosting allotment chances.

Maximum Shares That Can Be Applied Under Shareholder Quota?

There are two cases for investors if they are applying under shareholder quota in IPOs.

Case 1 – Applying only in Shareholder quota

- The maximum limit in shareholder quota is the total number of shares reserved for the category. In the case of Aditya Birla Sun Life AMC IPO, one could have applied for all the 1,944,000 shares available under the shareholder quota if they were holding at least one share of Aditya Birla Capital as on the record date.

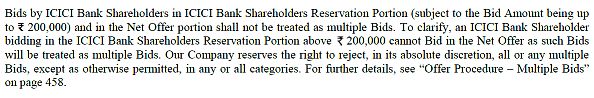

Case 2 – Applying in both Shareholder quota and Retail category

- Investors applying in both categories need to be mindful that their combined application amount should not exceed INR 200,000. Simply put, one can invest a total of INR 200,000 if applying to both categories.

- Combined application amounts in both categories exceeding INR 200,000 will be considered multiple bids and thus rejected.

- However, there have been instances where the IPO-bound company issued addendums and allowed shareholder application of INR 2,00,000 in addition to retail quota application and both were considered valid. A recent example is Bajaj Housing Finance IPO.

| Category | Maximum Limit |

| Applying only in Shareholder quota | Total shares reserved |

| Applying in shareholder and retail categories | INR 2,00,000 |

Read Also: Live IPO Subscription Status

What are the Benefits of Shareholder Quota in Subsidiary IPO?

There are several advantages to selecting a shareholder quota for investing in IPOs. To reap the benefits of upcoming IPOs with shareholders quota, one should keep track of them and own at least one share of their parent company. Some of the key advantages of the shareholder quota category are as follows

#1 Better allotment chances in Shareholder Quota

Generally, the retail category gets more subscriptions as compared to the shareholder quota. One classic example is the IPO of Ujjivan Bank, where the retail category was subscribed 48 times while the shareholder category was only covered four times. Needless to say, the chances of allotment are significantly higher in the shareholder category due to one extra layer of eligibility criteria of holding parent company share.

#2 Taking advantage of large applications

The retail category has a maximum limit of INR 200,000 per application and this is problematic for someone who has more funds and wants to take advantage of the same. On the other hand, the shareholder category allows investors to make large applications by simply purchasing one share of the parent company.

In the example of Ujjivan Bank, the IPO had a reservation amounting to INR 77.08 crore for Ujjivan Financial Services shareholders. By purchasing just one share of Ujjivan Financial Services, investors made themselves eligible to put in applications as big as INR 77.08 crore. This is especially attractive for HNIs as they can mobilize such funds and usually suffer from poor allotment due to high subscriptions in the category.

#3 Getting more shares allotted

Applying in both retail and shareholder categories is even more beneficial for investors as they enjoy higher allotment probability by having two applications in the reckoning. Applications in both categories will be accepted and investors have a better chance of allocation. Nevertheless, there is a cap of INR 200,000 per PAN in such cases as indicated above.

Upcoming IPOs with Shareholders Quota

Here is a list of companies whose IPO is likely to have shareholders quota since their parents are already listed. This list of upcoming IPOs with shareholders quota is provisional, and the IPO launch may take some time but it is worth keeping an eye on.

| Subsidiary IPO Name | Parent Company | SEBI IPO Status |

| PNGS Reva Diamond Jewellery* | PN Gadgil | IPO approved |

| Hero FinCorp | Hero MotoCorp | IPO approved |

| Greaves Electric Mobility | Greaves Cotton | IPO approved |

| Prestige Hospitality Ventures* | Prestige Estates | IPO approved |

| SIS Cash Services* | SIS Limited | IPO approved |

| EAAA India Alternatives | Edelweiss Financial Services | DRHP filed |

| Advanta Enterprises* | UPL Limited | DRHP filed |

| Central Mine Planning & Design Institute | Coal India | DRHP filed |

| SBI Funds Management | SBI | Merchant Bankers hired |

| ILJIN Electronics | Amber Enterprises | Merchant Bankers hired |

| Gretex Share Broking | Gretex Corporate Services | DRHP awaited |

| SJVN Green Energy | SJVN | DRHP awaited |

| Tata Passenger Electric Mobility | Tata Motors | DRHP awaited |

| Reliance Retail | Reliance Industries | DRHP awaited |

| Reliance Jio | Reliance Industries | Merchant Bankers hired |

| LIC Mutual Fund | LIC | DRHP awaited |

| Indian Gas Exchange | Indian Energy Exchange | Board approval secured |

| Mahanadi Coalfields | Coal India | Board approval secured |

| South Eastern Coalfields | Coal India | Board approval secured |

| NLC India Renewables | NLC India | Board approval secured |

| Mahindra Last Mile Mobility | Mahindra & Mahindra | – |

| IIFL Home Finance | IIFL Finance | – |

| Avro Recycling | Avro India | – |

| Fleur Hotels | Lemon Tree Hotels | – |

| NHPC Renewable | NHPC | – |

| ONGC Green | ONGC | – |

| HDFC Ergo | HDFC Bank | – |

| Kotak AMC | Kotak Mahindra Bank | – |

| PNB MetLife Insurance | Punjab National Bank | – |

| Bajaj Energy | Bajaj Hindusthan Sugar | – |

| Reliance General Insurance | Reliance Capital | – |

| Axis AMC | Axis Bank | – |

| Jeevansathi.com | Info Edge | – |

| Bajaj Allianz Life Insurance | Bajaj Finserv | – |

| Bajaj Allianz General Insurance | Bajaj Finserv | – |

One final word of advice. There have been cases where shareholder quota wasn’t specified in the DRHP but was included in the RHP anyway. One such example is Aeroflex Industries where many investors didn’t buy shares of its parent Sat Industries and thus, rightly felt lost out when the RHP was filed.

Happy Investing!

Latest Content From IPO Central

- SEBI IPO Approvals This Week

- Top Startups Eyeing IPOs in 2026: 44 in the Pipeline

- Vijay Kedia Portfolio Tanks 38% in a Year! Which Stocks Dragged It Down?

- Smart Wearables Brand GoBoult Plans IPO by Mid-2027

- Fintech Razorpay Lines Up Four Lead Bankers for ₹6,300 Cr IPO

- Top Steel Companies in India

- Is Reliance Industries Undervalued Or Jio and Retail Overvalued?

- Upcoming IPOs in February 2026: Expected ₹24,000 Cr+ Fundraising

- Upcoming PSU IPOs with Shareholder Quota

- Upcoming Mega IPOs in 2026

Shareholder Quota FAQs

How many shares of the parent company do I need to purchase to be eligible for shareholder quota in IPOs?

You need to be a shareholder irrespective of the number of shares. Therefore, you can have just one share in your demat account to be eligible.

How is record date important in shareholder quota?

You need to have the shares in your demat account as on the record date to qualify for shareholder quota in the subsidiary company IPO. This means that you need to purchase the parent company shares a couple of days in advance.

What is the best way to become eligible for shareholder quota in IPOs?

The simplest hack is to purchase just one share of the parent company as soon as DRHP is filed. Parent companies coming up with IPOs of subsidiaries

What is the maximum limit of the shareholder quota in IPOs?

In case applying only in shareholders reservation, one can bid for all the reserved shares.

In the case of twin applications in shareholder and retail categories, the combined application value should not cross INR 200,000.

Can investors in shareholder quota bid at the cutoff price?

Yes, eligible shareholders bidding in the shareholder’s reservation portion are entitled to bid at the cut-off price.