The Indian banking industry has significantly changed in recent years due to wide-ranging regulatory revamps. Among the relatively new terms in the banking world, NACH in banking has revolutionized interbank transactions in India. The Indian banking sector has experienced substantial transformations in recent years, primarily driven by comprehensive regulatory reforms. Among the emerging concepts in this landscape, the National Automated Clearing House (NACH) has emerged as a pivotal innovation, fundamentally altering the dynamics of interbank transactions across India.

Table of Contents

What is NACH in banking and how does it work?

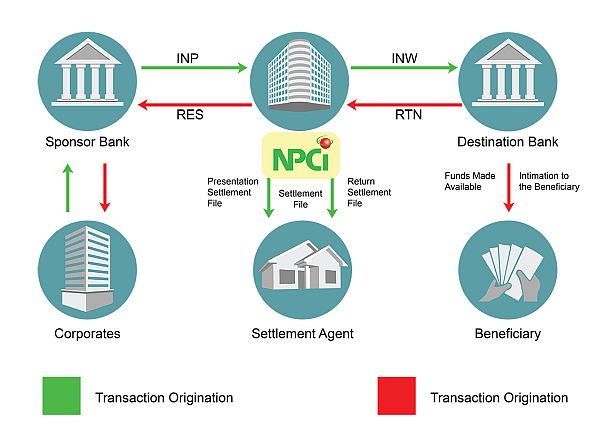

The National Automated Clearing House (NACH) is an electronic clearing service in India that has significantly transformed interbank transactions. Managed by the National Payments Corporation of India (NPCI), NACH enables high-volume, repetitive, and periodic transactions with exceptional ease and efficiency.

Consider NACH as your comprehensive solution for all electronic transaction requirements. Launched on 1 May 2016, this system supports a wide range of transactions, including direct debits for loan repayments, recurring payments for utility bills and insurance premiums, as well as bulk transactions such as government benefits and salaries.

To utilize NACH, entities like banks or companies must register with NPCI as “Originators.” These Originators can create and submit a mandate—an electronic authorization from customers—to NPCI. This mandate contains the customer’s bank account details and grants permission for the Originator to debit or credit the account. The Originator then sends a transaction file to NPCI, which processes and validates the transactions, providing status updates back to the Originator.

Transactions initiated through NACH in the banking system are processed on a T+2 basis, meaning that the transactions are settled on the second working day after initiation. This applies to transactions initiated on all days of the week, including weekends and holidays. Talk about efficiency!

Also Read: Top Artificial Intelligence Stocks in India

Benefits of NACH

- Error and Fraud Reduction: NACH offers numerous advantages due to its electronic nature, significantly reducing the risk of errors and fraud.

- Time and Cost Efficiency: The system saves time and costs associated with manual processing, streamlining transaction workflows.

- Elimination of Physical Cheques: NACH eliminates the need for physical cheques and paper-based transactions, addressing longstanding issues in the banking system.

- Advanced Security Features: NACH employs advanced security measures to safeguard against fraud and unauthorized transactions.

- Two-Factor Authentication: It utilizes a two-factor authentication system, verifying customer bank accounts through both account numbers and Indian Financial System Codes (IFSC).

- Secure Data Transmission: Originators must use secure channels to transmit transaction files to NPCI, which uses advanced encryption techniques to protect transmitted data.

- Revolutionizing Electronic Transactions: NACH has revolutionized the banking system’s electronic transactions landscape in India, simplifying automation for recurring payments and various electronic transactions.

Latest Content From IPO Central

- Upcoming IPOs in March 2026

- Why Shree Ram Twistex IPO Allotment Might Feel Like a Loss Already

- Top Startups Eyeing IPOs in 2026: 44 in the Pipeline

- Largest Stock Brokers in India 2026

- Top Steel Companies in India

- Is Reliance Industries Undervalued Or Jio and Retail Overvalued?

- Upcoming PSU IPOs with Shareholder Quota

- Upcoming Mega IPOs in 2026

Difference between ECS and NACH in Banking

While discussing electronic clearing services in banking, it is essential to differentiate between ECS and NACH.

| Feature | ECS (Electronic Clearing Service) | NACH (National Automated Clearing House) |

|---|---|---|

| Purpose | Bulk debit and credit of bank accounts | Interbank clearing of various electronic transactions |

| Initiation | Initiated by organizations (companies, government agencies) | Initiated by registered entities as “Originators” |

| Clearing Authority | Reserve Bank of India (RBI) | National Payments Corporation of India (NPCI) |

| Typical Transactions | Salary payments, dividends, interest payments | Loan repayments, utility bill payments, government benefits distribution |

| Cost Efficiency | Higher processing costs for banks | Lower operational costs due to automation |

| Dispute Management | No dedicated system; handled by banks | Well-defined online dispute management system |

| Processing Time | T+1 basis; settled on the next working day after initiation | T+2 basis; settled on the second working day after initiation |

Recent Enhancements in NACH in Banking

In 2024, the National Automated Clearing House (NACH) in India saw several key developments to improve electronic payment systems. Notable updates include:

- Auto-Deduction for PLI/RPLI Premiums: In January 2024, the Department of Posts introduced NACH mandate integration for the automatic deduction of Postal Life Insurance (PLI) and Rural Postal Life Insurance (RPLI) premiums from bank accounts to reduce policy lapsing.

- Enhanced Bulk Transaction Capabilities: NACH continues to efficiently handle bulk transactions, such as salary and recurring bill payments, streamlining processes for businesses and government agencies.

- One-Time Mandate for Pre-Authorized Transactions: Starting 31 July 2024, the NPCI introduced a one-time mandate feature under UPI 2.0 that allows customers to pre-authorize transactions for future payments. This feature enables users to authorize a specific amount to be deducted from their accounts at a later date.

- Alternative Authentication Framework: The RBI released a draft framework on 31 July 2024, proposing alternatives to SMS-based OTPs for electronic payments to improve security, with implementation beginning in April 2025.

- Financial Inclusion Focus: NACH supports financial inclusion by providing a reliable payment infrastructure, including Aadhaar-based transactions for government subsidies.

- Security Enhancements: The system maintains strict security protocols to protect transaction confidentiality and integrity as electronic transactions grow in volume and complexity.

Conclusion

NACH in banking is a transformative element in India’s electronic transaction landscape, delivering enhanced efficiency, security, and cost-effectiveness. It simplifies the process of recurring payments and various electronic transactions for both businesses and individuals, acting like a personalized digital assistant for their financial requirements. While both ECS and NACH play crucial roles in facilitating interbank transactions, NACH stands out due to its flexibility and the effectiveness of its operator, NPCI. This positions NACH as a key player in reshaping the banking sector, making it more responsive to the needs of users and promoting a streamlined approach to financial management across the country.

FAQs on NACH in Banking

What is NACH in Banking?

In India’s banking system, NACH refers to an electronic clearing service that enables high-volume, repetitive, and periodic transactions with ease and efficiency.

What are the benefits of NACH?

Since it is an electronic system, there are some inherent advantages with regard to reducing the risk of errors and fraud, and saving time and costs associated with manual processing.

What is the difference between ECS and NACH?

ECS is primarily used for bulk transactions such as salary payments, whereas NACH is used for a wide variety of transactions including direct debit, recurring and bulk transactions.

What is NACH full form in banking?

National Automated Clearing House is the full form of NACH in banking.