Groww and Angel One are among the top stock brokers in India. In this article, we are going to do a Groww Vs Angel One comparison to find out their pros and cons. Groww is known for its user-friendly and accessible features, Angel One – on the other hand – is best known for its years of experience in the industry and its market research reports. Both of them are doing their best in the industry to dominate and preserve their market share. Let’s dive into the features they offer to get an idea about which is a more preferable online stock broking platform.

Company Background

Groww is a Bengaluru-based financial technology company that was founded in 2016 by four former Flipkart employees – Lalit Keshre, Harsh Jain, Neeraj Singh, and Ishan Bansal. The company started with a vision to simplify the investment process and make it accessible to the masses.

Angel One, is one of the oldest and most established stockbroking firms in India. It was founded in 1987 by Dinesh Thakkar and is headquartered in Mumbai, Maharashtra. The company started as a sub-broker to serve investors in the Mumbai region but rapidly expanded its operations to become a full-service retail and institutional brokerage.

Also Read: All About Unpaid Dividend and How to Claim It.

Groww Vs Angel One Charges

- Groww Vs Angel One – Account Opening Charges and AMC

| Account opening and Demat charges | Groww | Angel One |

| Equity Trading Account Opening Charges | Zero | Zero |

| Commodity Account Opening Charges | N/A | Zero |

| Trading Account AMC Charges | Zero | Zero |

| Demat Account Opening Charges | Zero | Zero |

| Demat Account AMC Charges | Zero | Zero (Up to INR 50,000) INR 100 + GST (Between INR 50,000 to 2,00,000) |

Read Also: State-wise IPO in India

- Groww Vs Angel One Brokerage Charges

| Particulars | Groww | Angel One |

| Equity Delivery | INR 20 per order or 0.1% whichever is lower | Zero |

| Equity Intraday | INR 20 per executed order or 0.1% whichever is lower | INR 0 brokerage up to INR 500 for first 30 days* Then, lower of INR 20 or 0.01% per executed order |

| Equity Futures | INR 20 per executed order | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Equity Options | INR 20 per executed order | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Currency Futures | N/A | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Currency Options | N/A | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Commodity Futures | N/A | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Commodity Options | N/A | INR 0 brokerage up to INR 500 for first 30 days* Then, INR 20 per executed order |

| Call & Trade Charge | N/A | INR 20 per order |

| Minimum Brokerage | INR 20 or 0.1% in Equity Intraday, Delivery | 0.03% in Equity Intraday |

| P&L/CMR Charges | INR 20 + INR 100 (courier charge) + 18% GST for subsequent requests | Nil |

Also Read: Zerodha Vs Upstox – Detailed Broker Comparison

- Groww Vs Angel One – Transaction Charges

| Particulars | Groww | Angel One |

| Equity Delivery | NSE: 0.00297% | BSE: 0.00375% (Both Buy and Sell) | NSE: 0.00297% (Both Buy & Sell) |

| Equity Intraday | NSE: 0.00297% | BSE: 0.00375% (Both Buy and Sell) | NSE: 0.00297% (Both Buy & Sell) |

| Equity Futures | NSE: 0.00173% | BSE: 0 (Both Buy and Sell) | NSE: 0.00173% l BSE: Nil (Both Buy & Sell) |

| Equity Options | NSE: 0.03503% | BSE: 0.0325% (on premium) | NSE: 0.03503% | BSE: Sensex 50/Stock options 0.0050%, Sensex/Bankex options 0.0325% |

| Currency Futures | N/A | NSE: 0.00035%| BSE: 0.00045% |

| Currency Options | N/A | NSE: 0.0311%| BSE: 0.001% |

| Commodity Futures | N/A | MCX: 0.00210% | NCDEX: 0.0058% |

| Commodity Options | N/A | MCX: 0.0418% | NCDEX: Options: 0.03%, Guar seeds options 0.015% |

- Groww Vs Angel One – Other Statutory Charges

| Particulars | Groww | Angel One |

| STT/CTT Equity Delivery | 0.1% (Both Buy and Sell) | 0.1% (Both Buy and Sell) |

| STT/CTT Equity Intraday | 0.025% on the Sell Side | 0.025% on the Sell Side |

| STT/CTT Equity Futures | 0.02% on Sell Side | NSE: 0.02% | BSE:0.02% on the Sell Side |

| STT/CTT Equity Options | 0.1% on Sell Side (on Premium) | NSE: 0.1% | BSE:0.1% on the Sell Side |

| STT/CTT Currency Futures & Options | N/A | Zero |

| STT/CTT Commodity Futures | N/A | 0.01% Only on Non-Agri on the Sell Side |

| STT/CTT Commodity Options | N/A | 0.05% on the Sell side |

| SEBI Turnover Charges | INR 10/crore | INR 10/crore |

| GST | 18% | 18% |

| Stamp Equity Delivery | 0.015% or INR 1500/crore on buy-side | 0.015% or INR 1500/crore on buy-side |

| Stamp Equity Intraday | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side |

| Stamp Equity Futures | 0.002% or INR 200/crore on buy-side | 0.002% or INR 200/crore on buy-side (Both NSE & BSE) |

| Stamp Equity Options | 0.003% or INR 300/crore on buy-side | 0.003% or INR 300/crore on buy-side (Both NSE & BSE) |

| Stamp Currency Futures | N/A | 0.0001% or INR 10/crore on buy-side |

| Stamp Currency Options | N/A | 0.003% or INR 30/crore on buy-side |

| Stamp Commodity Futures | N/A | 0.002% or INR 200/crore on buy-side |

| Stamp Commodity Options | NA | 0.003% or INR 300/crore on buy-side |

| DP (Depository participant) Charges | INR 18.25 per company only on Sell (INR 0 < 100 Debit Value) | INR 20 per scrip |

| Pledging Charges | INR 20 per ISIN, for Pledge/Unpledge Order | INR 15 per scrip |

| Auto Square off Charges | INR 50 per squared-off position | INR 20 per executed order |

| API Subscription Charges | Zero | Zero |

Also Read: Top Stock Brokers In India

- Angel One Vs Groww – Feature Comparison

| Feature | Groww | Angel One |

| 3 in 1 Account | No | Yes |

| Algo Trading | No | Yes |

| Charting | Yes | Yes |

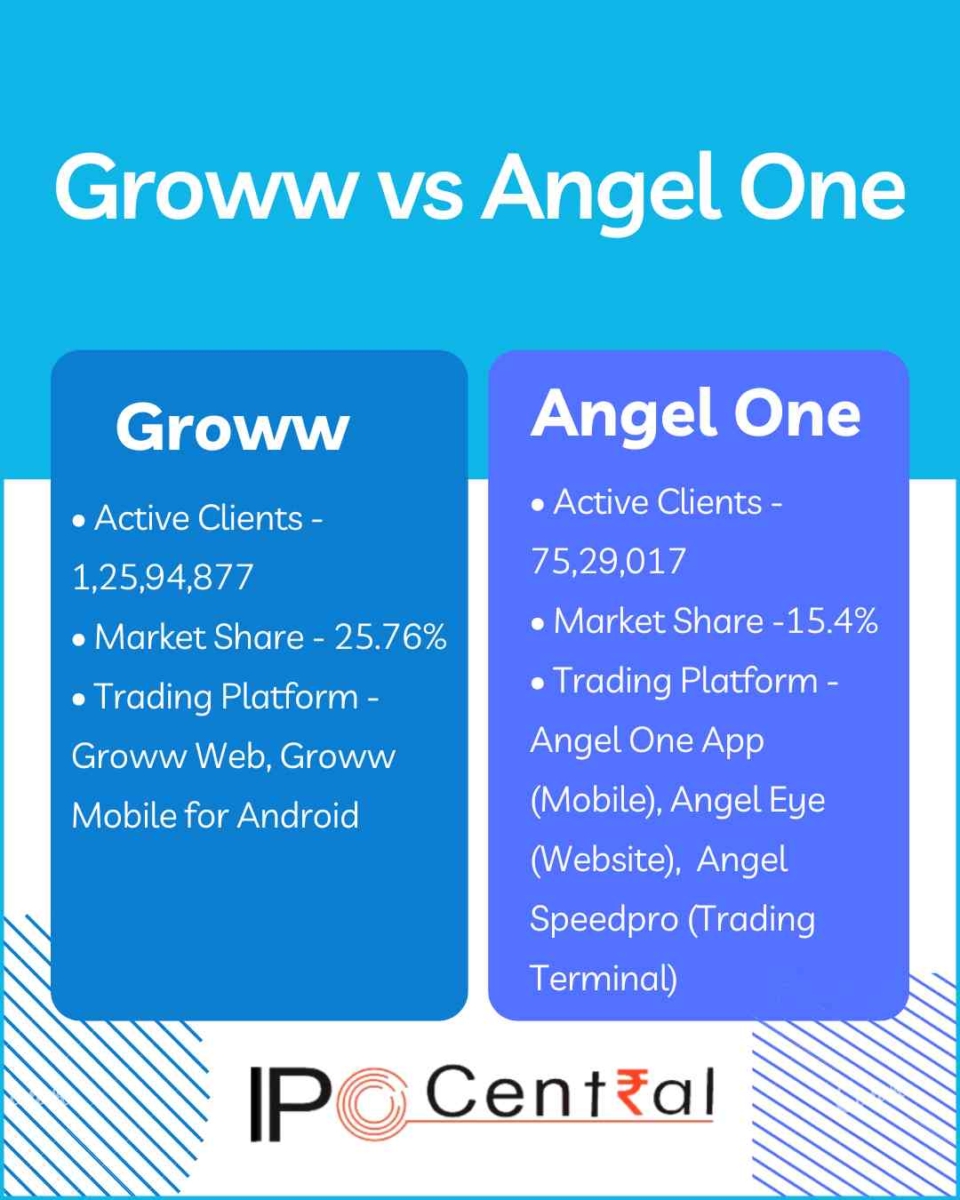

| Trading Platform | Groww web, Groww Mobile for Android | Angel One App (Mobile) Angel Eye (Website) Angel Speedpro (Trading Terminal) |

| SMS Alerts | No | Yes |

| Online Demo | No | Yes |

| Online Portfolio | Yes | Yes |

| Margin Trading Funding Available | Yes | Yes |

| Margin Against Shares (Equity Cash) | Yes | Yes |

| Margin Against Shares (Equity F&O) | Yes | Yes |

| Intraday Square-off Time | 3:20 PM | 3:15 PM |

| Referral Program | Yes | Yes |

Also Read: Click here for Groww’s Brokerage Calculator

Angel One Vs Groww – Active Clients and Market Share

| Particulars | Groww | Angel One |

| Number of Active Clients | 1,25,94,877 | 75,29,017 |

| Market Share | 25.76% | 15.40% |

| Complaints | 1,523 | 1,259 |

Read Also: Top Drone Stocks in India

Groww Vs Angel One – Pros and Cons

| Groww | Angel One | |

| Pros | 1. Zero Account opening fee 2. Zero Maintenance Charges 3. India’s No. 1 broker in terms of the number of active clients 4. A straightforward pricing model with affordable trading fees 5. Seamlessly apply for IPOs online 6. Instant paperless account opening 7. Benefit from a direct Mutual Fund platform that can boost your returns by an additional 1.5% 8. Enjoy free Mutual Fund investments with complete transparency and no hidden fees 9. Open an account instantly without the need for paperwork 10. Access a wealth of knowledge through E-books, Resources, and Blogs that cover the fundamentals and market updates | 1. Brokerage-free equity delivery trades 2. The brokerage of flat INR 20 per trade in Intraday and F&O 3. Margin trading facility and securities as collateral are available 4. Free research reports and trading tips 5. Easy-to-use online trading platforms 6. Do not charge for NEFT/fund transfers 7. Free advisory/tips for stocks and mutual funds 8. Local sub-broker/RM services even at a discount brokerage 9. Facility to call RM if there are issues |

| Cons | 1. Commodity and currency segment trading is not offered 2. Margin against shares is not available 3. Stock tips, research reports, or recommendations are not offered 4. Call and Trade services are unavailable 5. Branch support is not provided 6. There is no Margin trading facility 7. Advanced order types like BO, CO, AMO, and GTT are not supported 8. NRI Trading services are not offered. 9. Trailing stop loss orders are not available in the Groww app 10. Doesn’t offer trading in SME shares | 1. Angel broking doesn’t offer trading in SME share 2. Angel RM and the sales team tries to cross sale other products and services 3. Margin funding is given to the customers without notice. This causes major confusion and customers pay hefty interest charges 4. GTC/GTT order facility not available 5. Doesn’t offer a 3-in-1 account |

Read Also: Best IPOs that Doubled Investors’ Money

Conclusion

The stock broking industry is booming in India and evolving with new market trends, and new trading and investing platforms. Investors need to look for the right platform and the most efficient one. Our articles help summarize the pros and cons of the stock broking industry. Therefore, choose the platform that aligns with your goals and mindset.

We hope this Groww vs Angel One broker comparison has helped you with valuable information. Please let us know your thoughts in the comments below.

Open Your Demat Account with Zerodha, Angel One, 5 Paisa, Upstox, and Groww.

Your blog post was a captivating read. I enjoyed how you presented complex concepts in a simplified manner, making it easy for readers to grasp the main ideas. To gain more knowledge on this subject, click here.

Your post discusses the potential of becoming a virtual assistant and offering administrative support to busy professionals or entrepreneurs. It’s a versatile role with money-making potential.