A dividend represents a portion of a company’s profits that is distributed to its shareholders. The dividend per share is determined and declared by the Board of Directors. There are two types of dividends: final dividends, which are declared at the end of the fiscal year, and interim dividends, which are declared quarterly or half-yearly. Dividends are paid on predetermined dates. An unclaimed dividend occurs when the company has already paid it, but the shareholder has not yet claimed or availed of it. The company is liable for paying the unclaimed dividend upon demand.

Difference Between Unpaid Dividend and Unclaimed Dividend

When a company distributes dividends to its shareholders, ideally, the shareholders should claim and receive them accordingly. However, in certain instances, dividends may go unclaimed due to various reasons, such as outdated contact information or incorrect bank account details in the company’s records. These unclaimed dividends are recorded as “unclaimed dividends.”

Conversely, ‘unpaid dividends’ refer to the situation when a company announces the payment of dividends to its shareholders but fails to fulfill the payment. In such cases, the unpaid dividends are set aside and kept in a separate account known as the “unpaid dividend account.”

Read Also: All About SBFC Finance IPO GMP, Subscription, Timetable, Allotment

Unclaimed Dividend is Shown Under Which Side in Balance Sheet?

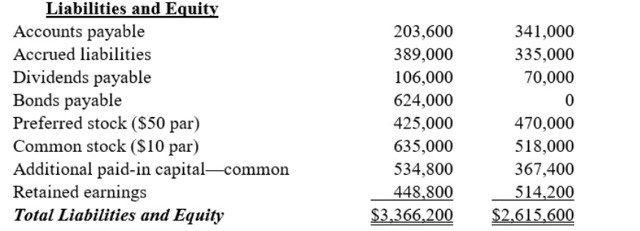

In the balance sheet, unclaimed dividends are shown under the liability side. They are considered a liability for the company because they need to be paid by the company whenever they are demanded. Typically, unclaimed dividends fall under the category of current liabilities since they are expected to be settled within a period of 12 months. Both unpaid and unclaimed dividends are recorded as current liabilities on the company’s balance sheet. Once unpaid and unclaimed dividends are paid, they are cleared from the current liabilities account.

Claiming Unclaimed Dividend From IEPF

To claim unclaimed dividends from the Investor Education & Protection Fund (IEPF), certain procedures must be followed. When dividends remain unpaid or unclaimed for more than 7 years, the company transfers the amount along with the accrued interest to the IEPF. To facilitate this transfer, the company submits a statement in Form IEPF-1 to the IEPF Authority, providing all the necessary details.

Once the transfer is completed, the IEPF Authority takes charge of administering the fund. In return, they issue a receipt to the company, serving as proof of the successful transfer.

The complete procedure for claiming unclaimed dividends from the IEPF, along with other eligible amounts like matured debentures, matured deposits, application money due for refund, interest, sale proceeds of fractional shares, redemption proceeds of preference shares, etc., from the IEPF, is detailed in Rule 7 of the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer, and Refund) Rules, 2016.

Investors who wish to claim their dues from the IEPF must carefully follow the specific procedure outlined in this Rule to ensure a successful recovery of their unclaimed or unpaid amounts.

Section 124: Unpaid Dividend Account

Section 124 of the Companies Act 2013 addresses the concept of the Unpaid Dividend Account. According to this section:

- Where a dividend has been declared by a company but has not been paid or claimed within 30 days from the date of the declaration to any shareholder entitled to the payment of the dividend, the company shall, within 7 days from the date of expiry of the said period of 30 days, transfer the total amount of dividend which remains unpaid or unclaimed to a special account to be opened by the company in that behalf in any scheduled bank to be called the Unpaid Dividend Account. If a company declares a dividend but fails to pay or if shareholders do not claim it within 30 days from the declaration date, the company must transfer the total unpaid or unclaimed dividend to a special account called the Unpaid Dividend Account within 7 days after the 30-day period.

- The company shall, within a period of 90 days of making any transfer of an amount to the Unpaid Dividend Account, prepare a statement containing the names, their last known addresses, and the unpaid dividend to be paid to each person and place it on the website of the company, if any, and also on any other website approved by the Central Government for this purpose, in such form, manner, and other particulars as may be prescribed.

- If any default is made in transferring the total amount referred to in subsection (1) or any part thereof to the Unpaid Dividend Account of the company, it shall pay, from the date of such default, interest on so much of the amount as has not been transferred to the said account, at the rate of 12% per annum and the interest accruing on such amount shall ensure to the benefit of the members of the company in proportion to the amount remaining unpaid to them.

- Any person claiming to be entitled to any money transferred under sub-section (1) to the Unpaid Account of the company may apply to the company for payment of the money claimed.

- Any money transferred to the Unpaid Dividend Account of a company which remains unpaid or unclaimed for a period of 7 years from the date of such transfer shall be transferred by the company along with interest accrued, if any, thereon to the Fund established under sub-section (1) of section 125 and the company shall send a statement in the prescribed form of the details of such transfer to the authority which administers the said Fund and that authority shall issue a receipt to the company as evidence of such transfer.

- All shares in respect of which dividend has not been paid or claimed for seven consecutive years or more shall be transferred by the company in the name of IEPF along with a statement containing such details as may be prescribed:

Provided that any claimant of shares transferred above shall be entitled to claim the transfer of shares from Investor Education and Protection Fund in accordance with such procedure and on submission of such documents as may be prescribed. - If a company fails to comply with any of the requirements of this section, such company shall be liable to a penalty of INR1 lakh and in case of continuing failure, a further penalty of INR5,000 for each day after the first during which such failure continues, subject to a maximum of INR10 lakh and every officer of the company who is in default shall be liable to a penalty of INR25,000 and in case of continuing failure, with a further penalty of INR100 for each day after the first during which such failure continues, subject to a maximum of INR2 lakh.

We hope this article has helped you understand the nature of unclaimed and unpaid dividends better. Ensure you follow the necessary steps to claim your unpaid dividends and make the most of your investments.

Happy Investing!