IEPF Full Form and Meaning

The IEPF full form stands for Investor Education and Protection Fund. Investors who wish to claim unpaid dividends and shares from the IEPF can do so by filing the IEPF Form 5 application with the Investor Education and Protection Fund Authority. As per the Companies Act, 2013 (‘Act’), the company is obligated to transfer the amounts in its unpaid dividend account to the IEPF in accordance with Section 125(2)(c) and Rule 7(1) of the Act.

Who Should File IEPF Form 5?

Under Section 124(6) of the Companies Act, 2013, companies must transfer all shares for which dividends are unclaimed or unpaid for seven consecutive years to the IEPF. Shareholders of unpaid dividends, matured deposits, or matured debentures can claim a refund of the unpaid amount transferred to the IEPF by filing form IEPF-5, as stated in Section 125(3)(a) of the Act.

Read Also: Unclaimed Dividend – All about unpaid dividend and how to claim it

What Can be Claimed by Shareholders in IEPF?

Shareholders can claim the following amounts through the IEPF (Investor Education and Protection Fund) by submitting the IEPF 5 form on the MCA (Ministry of Corporate Affairs) portal, along with the prescribed fees set by the IEPF Authority, as per Rule 7(1) of the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer, and Refund) Rules 2016:

- Unclaimed dividend

- Matured debentures, Matured deposits, and shares

- Refundable application fees

- Interest in fractional share sale proceeds

- preference share redemption proceeds, etc.

Read Also: How many IPOs have withdrawn in India?

Procedure for IEPF Claim Through IEPF Login

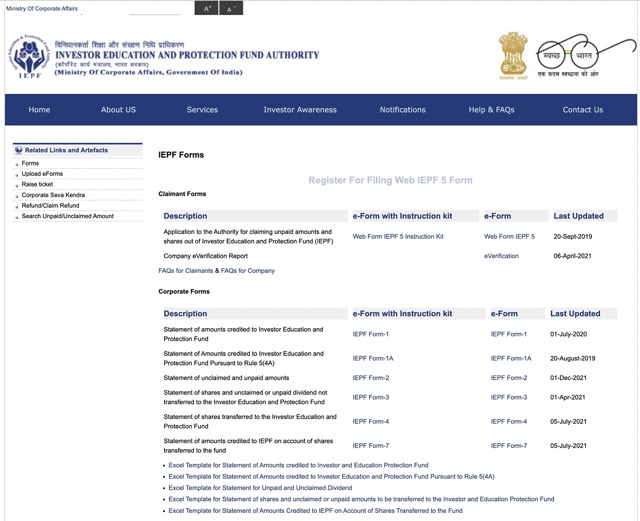

- Visit the official IEPF website and download “IEPF Form 5” for claiming the refund.

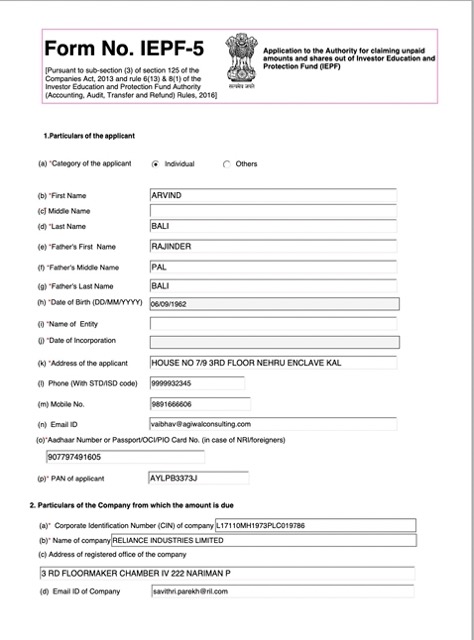

- The IEPF form 5 would be generated as shown in the picture

- provide the following information Provide the required information in the application form as follows:

| Subject | Instructions |

| a-Particulars of the Applicant | Enter Name, Address, and contact details. |

| b- Particulars of the Company | Find the CIN by entering the company’s existing registration number or name using the ‘Find CIN’ service on the MCA website under the menu MCA Services. |

| c-Details of shares claimed | Include the share folio ID. |

| d-Details of Amount Claimed | Enter the amount and number of claims to be made. |

| e- Aadhar Number or Passport/OCI/PIO Card No | Provide the Aadhaar number for Indian Nationals & OCI/PIO Card number for NRIs. |

| f-Details of Adhar linked bank account | Include Bank account number, Bank name, Bank branch, Type of account, and IFSC code. For Indian Nationals, the Bank Account Number must be Aadhaar linked. |

| g-Demat Account Number | |

| h-Declaration | Check the box after reading and accepting the terms & conditions. |

Read Also: All-time largest IPOs in India at a glance

4. Save the duly signed IEPF Form 5 on your PC after completing the declaration.

5. Go to the IEPF portal and choose the upload option

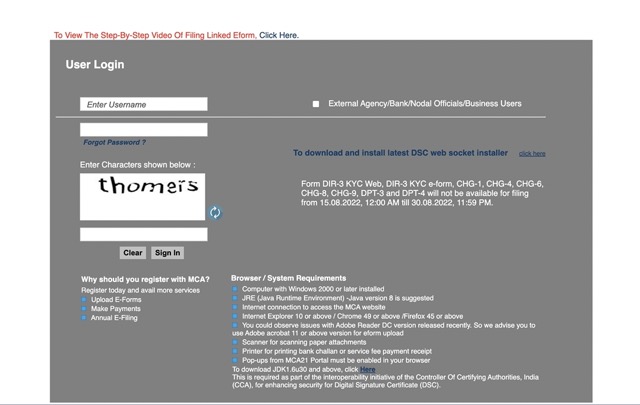

6. You will be redirected to MCA21 for form upload. Log in with your ID and password or register yourself if you are a new user by providing the necessary information.

7. After logging in, select the “normal upload” option. Attach the saved IEPF Form 5 by clicking on the “Browse” button. Then, click “Submit.” A Service Request Number (SRN) will be generated, and you will be prompted to choose a payment method (Pay Now or Pay Later).

8. Once the payment is successful, you will receive an acknowledgment with the SRN.

9. Take a printout of the IEPF Form 5 and the acknowledgment receipt for your records.

Read Also: RSU Vs ESOP – Which one is better in 2022?

IEPF Claim Additional Documents

To initiate the verification process for the IEPF claim, the user must send the following additional documents to the Nodal Officer (IEPF) of the company at its registered office. The envelope should be marked as “Claim for a refund from IEPF Authority”:

- Print out a duly completed and uploaded claim form with the claimant’s signature. If joint holders are involved, the claim form must be signed by all joint holders.

- The claimant’s attested copy of the acknowledgment bearing the SRN No.

- Advance Stamped Receipt (Original) in case of a refund of the matured deposit, debenture, or bonds, along with the original certificate related to the investment.

- Copy of the AADHAAR Card of the claimant, and if joint holders are involved, a copy of the AADHAAR Card of all joint holders.

- Copy of PAN Card.

- Client Master List duly attested by the claimant.

- Original Share Certificate (applicable if shares are in Physical Form).

- Proof of Entitlement (Certificate of share/interest warrant Application No., etc.).

- Original Cancelled Cheque Leaf.

- Copy of Passport, OCI, and PIO card in the case of foreigners and NRIs.

- In case any Joint Holder is deceased, a copy of the Death certificate must be attached.

Read Also: Best IPOs that Doubled Investors’ Money

How to Check IEPF Claim Status?

To check the status of an IEPF claim, follow these steps:

- Login to the MCA21 application.

- Click on the “MCA Services” tab, which will display a list of available services.

- Select the “Track SRN/ Transaction Status” menu. This will lead you to the Track SRN/ Transaction Status page.

- Click on the “Track SRN/ Transaction Status for Company Related Transaction” link. This action will again take you to the Track SRN/ Transaction Status page.

- Under the “Services” tab, click on the “Track Transaction Status” menu.

- Enter the SRN (Service Request Number) that you want to track in the designated SRN field.

- Specify the time range when the transaction was completed by filling in the “Start Date” and “End Date” fields.

- From the “Service Type” drop-down list, select the relevant option related to the IEPF claim.

- Click the “Search” button to proceed with the search. The status of the specified SRN will be displayed on the screen.

By following these steps, you can easily track the status of your IEPF claim. Happy Investing!

When registered with mca.gov.in I got my email id as my username with which I am unable to download iepf form 5. mca21 requires me to use my username with 8-11 alphanumeral characters. I have neither been allotted nor able to obtain it due to technical glitch at your end. For the last six months, I am trying my level best to set right the matter. No one replies to my emails. I have got my registration deactivated several times, but while registering I do not get a chance to obtain a username and password as the “login details” column is not opening up.

raise a complaint stating the same reason in MCA.gov.in under MCA Services –> Complaints –> create Service Related Complaints by providing all details. Ensure you give your PAN no, Name, Contact no & email Id while raising complaint.

raise a complaint stating the same reason in MCA.gov.in under MCA Services –> Complaints –> create Service Related Complaints by providing all details. Ensure you give your PAN no, Name, Contact no & email Id while raising complaint.

I have the same with the above. can not login with the ID (email)

File a consumer case before the appropriate Consumer Commission for redressal