CIAL Share Price Description – Cochin International Airport, owned and operated by Cochin International Airport Limited (CIAL), holds the distinction of being the first airport in India developed under a public-private partnership (PPP) model, and it is globally recognised as the world’s first fully solar-powered airport. Located about 28 km northeast of Kochi, the airport is the busiest in Kerala, handling over 63% of the state’s total air passenger traffic.

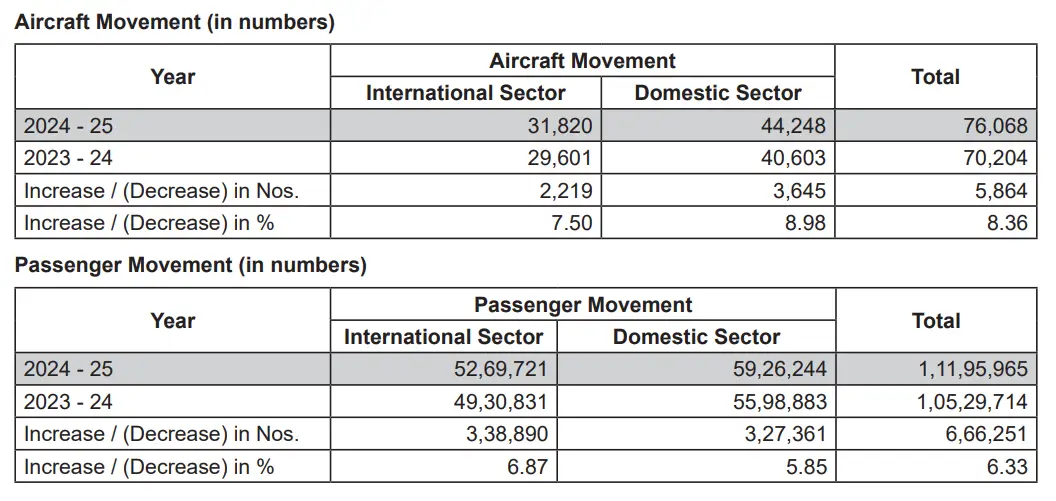

In FY 2024–25, CIAL delivered a strong operating year with 76,068 aircraft movements and 1,11,95,965 passengers, reflecting continued post-pandemic demand recovery and network expansion. The airport operates three passenger terminals (Domestic, Business Jet/Chart with dedicated cargo facilities, supporting diversified passenger and aviation service flows.

CIAL’s sustainability model remains a key differentiator. As per the FY25 annual report, CIAL’s installed solar capacity stood at 50 MW, and the company received international recognition at the Green Airports Recognition 2025 awards by Airports Council International (ACI) for its terrain-based solar initiative (Payyannur, Kannur).

Cochin International Airport Terminals

Cochin International Airport comprises three primary terminals: domestic, business jet, and international. Additionally, it houses a domestic cargo terminal and international export and import cargo terminals. Together, these three terminals have a peak-hour capacity of 8,000 passengers.

- Terminal 1 (Domestic): Terminal 1 is the airport’s main domestic terminal and handles the bulk of domestic departures and arrivals. It is built with modern passenger processing infrastructure—check-in and baggage handling systems, security screening, arrival processing, and a wide range of passenger amenities (retail/food, lounges, improved circulation). The terminal has also been aligned with CIAL’s sustainability approach through energy-efficiency upgrades and clean-energy integration (such as solar-linked parking/utility systems where applicable).

- Terminal 2 (Business Jet Terminal): Terminal 2 is a dedicated Business Jet/Charter terminal, created to provide a premium, customised experience for private and charter aviation. It supports VIP and high-net-worth traveller movements, charter operations, and special delegations with tailored services such as dedicated handling areas, lounge-style spaces, and a more privacy-focused passenger flow.

- Terminal 3 (International): Terminal 3 is the airport’s principal international terminal, designed for high-volume international passenger handling with robust check-in, immigration, and boarding infrastructure. It supports a wide spectrum of international passenger services—airside/landside retail, lounges, and efficient circulation systems for faster processing.

Read Also: Sterlite Power Unlisted Shares

CIAL Unlisted Share Price – Aircraft, Passenger, and Cargo Movement

Cochin International Airport Green Initiatives

Cochin International Airport (CIAL) continues to invest in clean energy and sustainability-led infrastructure to reduce its carbon footprint and strengthen long-term energy resilience. In 2015, CIAL became the world’s first fully solar-powered airport with the commissioning of a dedicated solar plant. Later, the company expanded into hydropower through a 4.5 MW hydroelectric project at Arippara (Kozhikode district).

CIAL further scaled its renewable portfolio with additional solar projects, including the 12 MWp terrain-based solar plant at Payyannur (Kannur). As per the FY 2024–25 annual report, CIAL’s installed solar capacity stood at 50 MW during the year, and the Payyannur model was also recognised internationally at the Green Airports Recognition 2025 awards by Airports Council International (ACI).

During FY 2024–25, CIAL’s renewable energy arm reported cumulative generation of ~436 million kWh from solar and ~42.2 million kWh from hydropower, reinforcing its position among Kerala’s largest power producers.

During FY 2024–25, the company reported total electricity units (including solar power generation) of 502.61 lakh kWh (vs 484.06 lakh kWh in FY 2023–24).

Read Also: Rekha Jhunjhunwala Portfolio, Net Worth, and More Details

CIAL Unlisted Share Price – Subsidiaries

CIAL has three wholly-owned subsidiaries:

- CIAL Duty-Free and Retail Services Ltd (CDRSL), which manages the duty-free business in the airport.

- CIAL Infrastructures plans and implements green energy production.

- Cochin International Aviation Services Ltd (CIASL), which facilitates MRO activities and operates two hangars.

- Air Kerala International Services (AKISL), aims to establish a low-cost airline based at Cochin International Airport to benefit the large population of non-resident Keralites in the Middle East.

Cochin International Airport Share Price – Board of Directors

- Shri. Pinarayi Vijayan, Chief Minister of Kerala, Chairman

- Shri. P. Rajeev, Director

- Shri. K. Rajan, Director

- Shri. Dr. A. Jayathilak IAS, Director

- Shri. E. K. Bharat Bhushan, Director

- Smt. Aruna Sundararajan, Director

- Shri. M.A. Yusuff Ali, Director

- Shri. N. V. George, Director

- Shri. Dr. Varghese Jacob, Director

- Shri. S. Suhas IAS, Managing Director

Key Highlights FY 2024 – 25

- As of May 2025, Cochin International Airport (CIAL) has launched the INR 200-crore CIAL 2.0 project to digitise operations and boost security with AI, automation, and India’s first airport cyber defence centre.

- Cochin International Airport has opened the five-star Taj Cochin International Airport hotel, built by CIAL and operated by the Taj Group after a global tender.

- A hydrogen fuel cell bus was deployed at Cochin Airport in Kerala as part of India’s first PoC project, advancing clean mobility and green hydrogen adoption.

- CIAL has achieved a gross income of INR 1,142.17 crore in FY 2024–25 (12.62% YoY growth), driven by UDF collections and AERA-approved aeronautical tariff increase.

- CIAL delivered its highest-ever profit in FY 2024–25, with profit after tax at INR 489.85 crore (vs INR 412.58 crore in FY 2023–24).

- CIAL recorded 76,068 aircraft movements (International: 31,820 | Domestic: 44,248), up from 70,204 in the previous year.

- CIAL handled 1,11,95,965 passengers (International: 52,69,721 | Domestic: 59,26,244), up from 1,05,29,714 in the previous year.

- CIAL received international recognition at the Green Airports Recognition 2025 Awards by Airports Council International (ACI) for its terrain-based solar plant (Payyannur, Kannur); total installed solar capacity stood at 50 MW as of FY 2024–25.

- Enhancing international connectivity, AirAsia launched a direct flight service between Kochi and Phuket during the year.

- The Board recommended a 50% dividend for FY 2024–25; INR 239.11 crore is required towards dividend (subject to AGM approval).

- Through its renewable-energy arm, CIAL commissioned a total 50 MWp solar capacity (including 12 MWp terrain-based Payyannur) and emerged as Kerala’s second-largest power producer after Kerala State Electricity Board (KSEB).

Read Also: HDFC Securities Unlisted Share Price

Cochin International Airport Unlisted Share Details

| Name | CIAL Unlisted Share Price Details |

| Face Value | INR 2 per share |

| ISIN Code | INE02KH01019 |

| Lot Size | 100 shares |

| Demat Status | NSDL, CDSL |

| CIAL Share Price Today | INR 468 per share |

| Market Cap | INR 22,381 crore |

| Total number of shares | 47,82,18,436 shares |

| Website | www.cial.aero |

Read Also: Motilal Oswal Home Finance Unlisted Share Price

CIAL Unlisted Share Price Details – Shareholding Pattern

Shareholding pattern of the company as of 31 March 2024:

| Shareholder Name | % to Holding | No. of shares |

| His Excellency, The Governor of Kerala | 33.38 | 15,96,48,207 |

| Mr. Yusuffali M A | 12.11 | 5,79,14,913 |

| Mr. N V George | 5.94 | 2,83,95,210 |

CIAL Share Price – Financial Metrics

| Particulars | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 267.59 | 502.30 | 939.64 | 1,158.43 | 1,309.95 |

| Revenue Growth (%) | (65.75) | 87.71 | 87.07 | 23.28 | 13.07 |

| Expenses | 419.68 | 475.64 | 563.14 | 635.02 | 709.50 |

| Net income | (92.87) | 34.99 | 292.76 | 447.75 | 515.54 |

| Margin (%) | (34.71) | 6.97 | 31.16 | 38.65 | 39.36 |

| ROE (%) | (6.00) | 2.00 | 19.00 | 22.00 | 20.49 |

| ROCE (%) | (3.00) | 4.00 | 15.00 | 21.00 | 22.89 |

| EPS | (2.37) | 0.83 | 7.57 | 9.52 | 10.78 |

| Debt/Equity | 0.45 | 0.43 | 0.38 | 0.22 | 0.16 |

CIAL Share Price – Annual Reports

Cochin International Airport Annual Report FY 2024 – 2025

Cochin International Airport Annual Report FY 2023 – 2024

Cochin International Airport Annual Report FY 2022 – 2023

Cochin International Airport Annual Report FY 2021 – 2022

Cochin International Airport Unlisted Share Peer Comparison

| Company | 3-yr Sales CAGR (%) | PE Ratio | Net Margin (%) | ROCE (%) | MCap (INR crore) |

| Cochin International Airport | 62.98 | 43.41 | 39.36 | 22.89 | 22,381 |

| GMR Airports | 31.3 | – | (7.85) | 6.92 | 99,138 |

| Adani Enterprises | 12.1 | 93.8 | 8.18 | 9.45 | 2,33,191 |

Read Also: Bira 91 Unlisted Share Price

Cochin International Airport Unlisted Share FAQs

Is it safe to purchase unlisted shares in India?

While there are risks associated with unlisted shares, purchases made from credible brokers and after conducting due diligence considerably lower these risks.

What is the Cochin Airport share price?

Cochin International Airport share price today is INR 468 per share. Shares are purchased in lots of 100 shares.

Who determines the Cochin International Airport share price?

The unlisted share price is determined by a variety of factors, including recent transaction price, supply and demand, valuation in the latest funding round, profitability, and return ratios.

When is the CIAL IPO planned?

CIAL IPO date is currently under discussion, but nothing has been finalized yet. The company is considering going public in the next 3–4 years.

Like to purchase CIAL share

Like to purchase swiggy shares

When we can Expect? Exactly.

I want to sell CIAL unlisted 1408 shares @ the current saleable rate.