India is a market with strong growth in IPO volumes, thanks to its dynamic regulatory framework, robust domestic capital market. India has emerged as a hotspot for IPO activity, driven by a progressive regulatory environment, a well-established domestic capital market, and a vast base of retail investors. In 2025 alone, the country saw around 90 mainboard IPOs—averaging nearly 7 to 8 each month.

Before subscribing to IPOs, investors should consider the accuracy of IPO GMP. The GMP represents the extra amount—above the IPO issue price—that investors, particularly High Net-Worth Individuals (HNIs), are willing to pay. This unofficial indicator is commonly used to gauge the likely listing price of a stock, even before it hits the exchanges.

While GMP is a widely followed metric, its reliability remains uncertain. Many investors rely on rough estimates rather than concrete data, as the grey market lacks transparency.

Typically, a positive GMP signals strong demand in the unofficial market, but it can also turn negative, indicating weak sentiment. Since GMP figures start surfacing 5 to 10 days before the IPO opens—and sometimes even earlier—investors closely track these premiums during the pre-listing phase. Despite its popularity, the actual predictive value of GMP is still debated and should be approached with caution.

Is GMP accurate for IPOs?

Is grey market premium reliable?

IPO Central analyzed all the mainboard IPOs that were listed in 2024 to find an answer to these questions.

Methodology: Accuracy of IPO GMP in 2024

India’s primary markets saw 90 companies get listed through IPOs within the calendar year 2025. Further, four offers from the pack – Sagility India, Godawari Biorefineries, Niva Bupa Health Insurance and Carraro India– had no meaningful activity in the grey market. Therefore, these IPOs have been removed from our analysis.

We analyzed the correlation between Grey Market Premiums and actual listing performance. In a high-correlation scenario, high GMPs should consistently get translated into similar listing gains.

For this, we calculated the average GMP of each of the 86 IPOs in 2024 and calculated the difference between the actual listing price and the indicative listing price according to the median GMP. Since a lot of factors change between subscription and listing, we also took similar readings for the GMP rates a day prior to listing. Both sets are presented in the table below.

| Name | IPO Price | Avg GMP | Latest GMP | Listing price | Variance Avg GMP % | Variance Latest GMP % |

| Unimech Aerospace | 785 | 518 | 675 | 1,376.25 | 5.62 | -5.74 |

| Senores Pharmaceutical | 391 | 205 | 250 | 557.05 | -6.54 | -13.10 |

| Ventive Hospitality | 643 | 58 | 70 | 704.35 | 0.48 | -1.21 |

| Concord Enviro Systems | 701 | 70 | 90 | 827.10 | 7.28 | 4.56 |

| DAM Capital | 283 | 147 | 165 | 415.10 | -3.47 | -7.34 |

| Sanathan Textiles | 321 | 50 | 90 | 388.35 | 4.68 | -5.51 |

| Mamata Machinery | 243 | 178 | 260 | 630.00 | 49.64 | 25.25 |

| Transrail Lighting | 432 | 164 | 190 | 553.55 | -7.12 | -11.00 |

| International Gemmological Institute | 417 | 111 | 105 | 471.15 | -10.77 | -9.74 |

| Inventurus Knowledge Solutions | 1,329 | 393 | 400 | 1,960.85 | 13.87 | 13.41 |

| One Mobikwik Systems | 279 | 127 | 157 | 528.00 | 30.05 | 21.10 |

| Vishal Mega Mart | 78 | 18 | 18 | 111.93 | 16.59 | 16.59 |

| Sai Life Sciences | 549 | 38 | 70 | 764.65 | 30.26 | 23.53 |

| Suraksha Diagnostic | 441 | 7 | 7 | 417.25 | -6.86 | -6.86 |

| Enviro Infra | 148 | 36 | 55 | 207.07 | 12.54 | 2.00 |

| NTPC Green Energy | 108 | 12 | 3 | 121.65 | 1.38 | 9.59 |

| Zinka Logistics | 273 | 16 | 0 | 260.05 | -10.02 | -4.74 |

| Swiggy | 390 | 38 | 0 | 456.00 | 6.54 | 16.92 |

| ACME Solar | 289 | 15 | 5 | 253.15 | -16.73 | -13.89 |

| Afcons Infrastructure | 463 | 56 | 0 | 474.20 | -8.63 | 2.42 |

| Deepak Builders and Engineers | 203 | 42 | 35 | 161.95 | -33.90 | -31.95 |

| Waaree Energies | 1,503 | 1360 | 1200 | 2,338.90 | -18.31 | -13.47 |

| Hyundai Motor India | 1,960 | 196 | 0 | 1,819.60 | -15.60 | -7.16 |

| Garuda Construction and Engineering | 95 | 5 | 11 | 106.36 | 6.36 | 0.34 |

| Diffusion Engineers | 168 | 63 | 60 | 203.17 | -12.05 | -10.89 |

| KRN Heat Exchanger | 220 | 238 | 260 | 478.79 | 4.54 | -0.25 |

| Manba Finance | 120 | 50 | 50 | 152.25 | -10.44 | -10.44 |

| Arkade Developers | 128 | 65 | 67 | 165.86 | -14.06 | -14.94 |

| Western Carriers | 172 | 43 | 20 | 159.44 | -25.84 | -16.96 |

| Northern Arc Capital | 263 | 169 | 160 | 323.40 | -25.14 | -23.55 |

| PN Gadgil Jewellers | 480 | 245 | 300 | 793.30 | 9.42 | 1.71 |

| Kross Limited | 240 | 44 | 30 | 259.81 | -8.52 | -3.77 |

| Bajaj Housing Finance | 70 | 49 | 70 | 165.00 | 38.66 | 17.86 |

| Tolins Tyres | 226 | 31 | 30 | 239.40 | -6.85 | -6.48 |

| Shree Tirupati Balajee Agro | 83 | 25 | 40 | 94.50 | -12.50 | -23.17 |

| Gala Precision | 529 | 245 | 250 | 757.15 | -2.18 | -2.80 |

| Baazar Style Retail | 389 | 100 | 62 | 400.00 | -18.20 | -11.31 |

| ECOS Mobility | 334 | 137 | 150 | 443.15 | -5.91 | -8.44 |

| Premier Energies | 450 | 330 | 410 | 839.90 | 7.68 | -2.34 |

| Orient Technologies | 206 | 60 | 80 | 302.40 | 13.68 | 5.73 |

| Interarch Building Products | 900 | 312 | 330 | 1,195.70 | -1.34 | -2.79 |

| Saraswati Saree Depot | 160 | 46 | 50 | 203.70 | -1.12 | -3.00 |

| Brainbees Solutions | 465 | 63 | 62 | 679.10 | 28.62 | 28.86 |

| Unicommerce eSolutions | 108 | 37 | 60 | 210.08 | 44.88 | 25.05 |

| OLA Electric | 76 | 5 | 20 | 91.20 | 12.59 | -5.00 |

| Ceigall India | 401 | 63 | 21 | 386.75 | -16.65 | -8.35 |

| Akums Drugs and Pharmaceuticals | 679 | 161 | 100 | 796.25 | -5.21 | 2.21 |

| Sanstar | 95 | 38 | 33 | 115.07 | -13.48 | -10.10 |

| Emcure Pharmaceuticals | 1,008 | 309 | 360 | 1,359.15 | 3.20 | -0.65 |

| Bansal Wire | 256 | 67 | 72 | 350.35 | 8.47 | 6.81 |

| Vraj Iron and Steel | 207 | 60 | 70 | 252.00 | -5.62 | -9.03 |

| Allied Blenders and Distillers | 281 | 68 | 45 | 317.90 | -8.91 | -2.48 |

| Stanley Lifestyles | 369 | 141 | 160 | 474.75 | -6.91 | -10.26 |

| Akme Fintrade | 120 | 36 | 25 | 133.35 | -14.52 | -8.03 |

| Dee Development | 203 | 70 | 90 | 335.32 | 22.83 | 14.44 |

| Le Travenues Technology | 93 | 28 | 30 | 165.72 | 36.96 | 34.73 |

| Kronox Lab Sciences | 136 | 59 | 38 | 159.32 | -18.30 | -8.44 |

| Awfis Space | 383 | 108 | 120 | 421.75 | -14.10 | -16.15 |

| Go Digit General Insurance | 272 | 32 | 25 | 306.00 | 0.66 | 3.03 |

| TBO Tek | 920 | 472 | 450 | 1,406.30 | 1.03 | 2.65 |

| Aadhar Housing Finance | 315 | 68 | 55 | 329.45 | -13.98 | -10.96 |

| Indegene | 452 | 230 | 270 | 570.90 | -16.29 | -20.93 |

| JNK India | 415 | 56 | 105 | 694.55 | 47.46 | 33.57 |

| Bharti Hexacom | 570 | 56 | 93 | 813.30 | 29.92 | 22.67 |

| SRM Contractors | 210 | 76 | 117 | 226.00 | -20.98 | -30.89 |

| Krystal Integrated | 715 | 53 | 40 | 712.85 | -7.18 | -5.58 |

| Popular Vehicles | 295 | 24 | 5 | 276.15 | -13.43 | -7.95 |

| Gopal Snacks | 401 | 69 | 15 | 362.70 | -22.83 | -12.81 |

| JG Chemicals | 221 | 40 | 7 | 184.65 | -29.25 | -19.01 |

| R K Swamy | 288 | 50 | 25 | 263.25 | -22.12 | -15.89 |

| Mukka Proteins | 28 | 20 | 30 | 42.25 | -11.98 | -27.16 |

| Platinum Industries | 171 | 74 | 90 | 221.20 | -9.71 | -15.25 |

| Exicom Tele-Systems | 142 | 122.08 | 150 | 224.95 | -14.82 | -22.96 |

| GPT Healthcare | 186 | 14 | 15 | 200.70 | 0.35 | -0.15 |

| Juniper Hotels | 360 | 8.28 | 5 | 401.50 | 9.02 | 10.00 |

| Vibhor Steel Tubes | 151 | 120.5 | 130 | 446.25 | 64.36 | 58.81 |

| Entero Healthcare | 1,258 | 68 | 15 | 1,149.55 | -13.31 | -9.70 |

| Rashi Peripherals | 311 | 67.5 | 60 | 321.50 | -15.06 | -13.34 |

| Capital Small Finance Bank | 468 | 30.7 | 7 | 435.00 | -12.77 | -8.42 |

| Jana Small Finance Bank | 414 | 66.5 | 30 | 368.15 | -23.38 | -17.08 |

| Apeejay Surrendra Park Hotels | 155 | 66.5 | 30 | 203.55 | -8.10 | 10.03 |

| BLS E-Services | 135 | 138.18 | 175 | 366.00 | 33.98 | 18.06 |

| Nova Agritech | 41 | 21.4 | 23 | 57.75 | -7.45 | -9.77 |

| EPACK Durable | 230 | 22.8 | 10 | 207.60 | -17.88 | -13.50 |

| Medi Assist Healthcare | 418 | 47.36 | 35 | 464.10 | -0.27 | 2.45 |

| Jyoti CNC Automation | 331 | 66 | 45 | 434.20 | 9.37 | 15.48 |

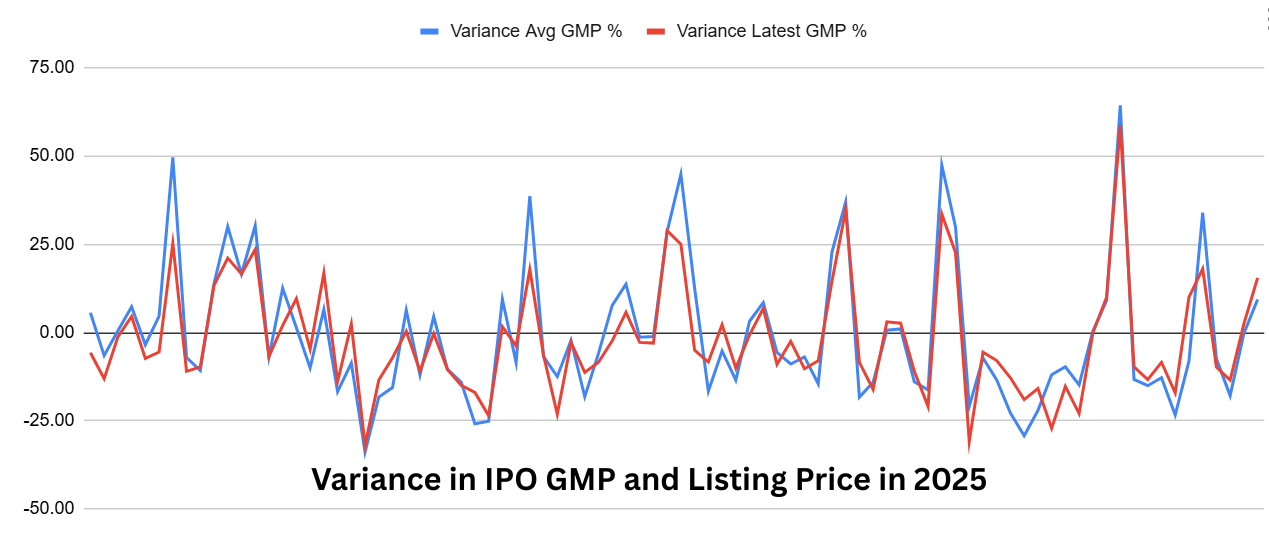

When we plot the figures on a line chart, we notice that the difference between the listing prices of average and last-day GMPs isn’t substantial and gets canceled out in the large data set.

However, a few IPOs clearly stood out for the variance between their listing price and the grey market premium (GMP) expectations. Vibhor Steel Tubes, for instance, had a remarkable variance of nearly 59% from the latest GMP, indicating a strong disconnect between GMP predictions and actual market enthusiasm. Unicommerce eSolutions also surprised with a 25% variance from its latest GMP, showcasing a sharp upside not fully captured in grey market whispers.

On the flip side, Deepak Builders and Engineers saw a sharp 32% downside from its latest GMP estimates, pointing to a significant overestimation by the grey market. Similarly, Udayshivakumar Infra listed 33% below its GMP, revealing how off-track informal pricing signals can be—especially during phases of weak broader market sentiment.

In some large-cap IPOs like Unicommerce and Vibhor Steel Tubes, the high listing prices were possibly driven by panic buying from investors who missed allotment during oversubscription. In contrast, the case of Deepak Builders and Engineers looks like a genuine misreading by the grey market, where the IPO failed to live up to even modest expectations.

So How Accurate is IPO Grey Market Price?

The majority of the remaining listings had variances within the 25% range. While this isn’t ideal, investors need to understand that the grey market isn’t and can’t be as efficient as the regulated stock market.

Key Takeaway 1

High subscription can lead to a reverse squeeze situation which can take listing day performance way above what the grey market indicates.

Key Takeaway 2

Investors can do better by discounting GMP of up to 25%. A closer look at the above table reveals several instances where premiums melted after subscription dates.

Overall, IPO grey premiums offer a glimpse into pre-listing demand and can be valuable, but they may not always indicate the actual listing performance of the IPO. In other words, the accuracy of IPO GMP is not up to the mark. Therefore, investors should use GMP as one of the many tools to make informed decisions about investing in IPOs.

What is the accuracy of IPO GMP?

According to the data analyzed by IPO Central of 86 IPOs, majority of the public offers had a variance of 25% between GMP-led indicative price and actual listing price.

Is Grey Market Premium reliable?

The informal or grey market is not reliable in every case, although it serves as a good indicator of listing price. Nevertheless, accuracy of IPO GMP is not up to the mark.

How can investors improve the accuracy of IPO GMP?

Investors can put a discount factor of 20-25% on prevailing IPO premium to make it more reliable and accurate, showed a comprehensive study by IPO Central.