India is a market with strong growth in IPO volumes, thanks to its dynamic regulatory framework, robust domestic capital market, and large retail investor base. In 2023, India witnessed as many as 60 mainboard equity public offers, exactly five every month. The figure could have been higher if not for the unsuccessful attempts by Adani Enterprises and PKH Ventures.

Before applying for IPOs, investors typically look into Grey Market Premium (GMP), which is the additional amount investors (mostly HNIs) are willing to pay over the IPO allotment price. As such, IPO premium acts as an effective indicator of the listing price even before the shares are listed on the stock exchange. However, the accuracy of IPO GMP is something nobody will vouch for. Most investors only have vague ideas and approximations.

Usually, the GMP for shares is positive because the demand for shares is high in unofficial markets. However, the GMP can also be negative in some cases. Investors keep an eye on grey premiums before applying, as GMP starts 5-10 days before opening, and in some cases more than that too. While it is well-known that GMP is one of the most referred figures by IPO investors, its accuracy is often under the cloud.

Is GMP accurate for IPOs?

Is grey market premium reliable?

IPO Central analyzed all the mainboard IPOs that were listed in 2023 to find an answer to these questions.

Methodology: Accuracy of IPO GMP in 2023

Excluding the 2 public offers which were withdrawn midway, the India primary markets saw 60 companies getting listed through IPOs within the calendar year 2023. Further, two offers from the pack – Radiant Cash and Yatra Online – had no meaningful activity in the grey market. Therefore, these IPOs have been removed from our analysis.

We analyzed the correlation between Grey Market Premiums and actual listing performance. In a high-correlation scenario, high GMPs should consistently get translated into similar listing gains.

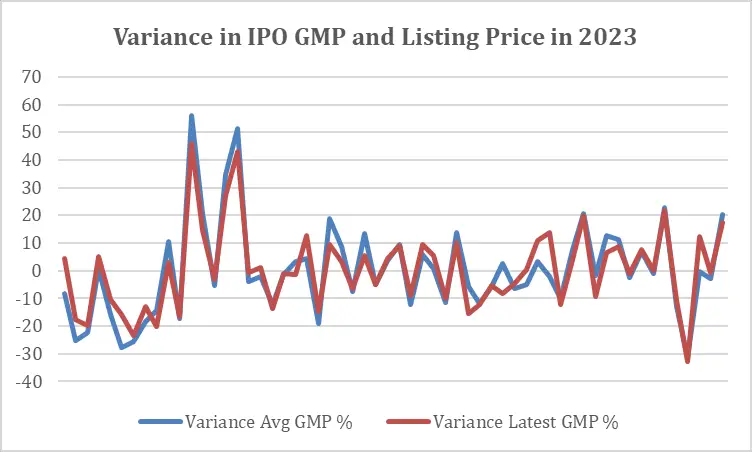

For this, we calculated the average GMP of each of the 58 IPOs in 2023 and calculated the difference between the actual listing price and the indicative listing price according to the median GMP. Since a lot of factors change between subscription and listing, we also took similar readings for the GMP rates a day prior to listing. Both sets are presented in the table below.

| Name | IPO Price | Avg GMP | Latest GMP | Listing price | Variance Avg GMP (%) | Variance Latest GMP (%) |

| Innova Captab | 448 | 143.3 | 70 | 541.4 | -8.4 | 4.5 |

| Azad Engineering | 524 | 384.4 | 300 | 677.5 | -25.4 | -17.8 |

| Credo Brands | 280 | 122.8 | 110 | 312.2 | -22.5 | -19.9 |

| RBZ Jewellers | 100 | 4.3 | 0 | 105 | 0.7 | 5 |

| Happy Forgings | 850 | 374 | 300 | 1030.8 | -15.8 | -10.4 |

| Muthoot Microfin | 291 | 77.5 | 25 | 266.15 | -27.8 | -15.8 |

| Motisons Jewellers | 55 | 84.3 | 80 | 103.55 | -25.6 | -23.3 |

| Suraj Estate | 360 | 49.8 | 25 | 334.5 | -18.4 | -13.1 |

| INOX India | 660 | 438.1 | 520 | 939.95 | -14.4 | -20.3 |

| DOMS Industries | 790 | 411.4 | 500 | 1326.05 | 10.4 | 2.8 |

| India Shelter Finance | 493 | 165.6 | 160 | 544.7 | -17.3 | -16.6 |

| Tata Technologies | 500 | 342.2 | 400 | 1313 | 55.9 | 45.9 |

| Flair Writing | 304 | 69.6 | 90 | 450.9 | 20.7 | 14.4 |

| Fedbank Financial Services | 140 | 8.2 | 5 | 140.25 | -5.3 | -3.3 |

| Gandhar Oil | 169 | 54.6 | 68 | 301.4 | 34.8 | 27.2 |

| IREDA | 32 | 7.6 | 10 | 60 | 51.5 | 42.9 |

| ASK Automotive | 282 | 40.3 | 30 | 310.1 | -3.8 | -0.6 |

| Protean eGov | 792 | 108.8 | 80 | 883 | -2 | 1.3 |

| ESAF Small Finance Bank | 60 | 18.6 | 20 | 69.05 | -12.1 | -13.7 |

| Honasa Consumer (Mamaearth) | 324 | 18 | 17 | 337.1 | -1.4 | -1.1 |

| Cello World | 648 | 117.3 | 155 | 791.7 | 3.4 | -1.4 |

| Blue Jet Healthcare | 346 | 49.5 | 21 | 413.4 | 4.5 | 12.6 |

| IRM Energy | 505 | 79.8 | 50 | 473.15 | -19.1 | -14.7 |

| Plaza Wires | 54 | 16.8 | 23 | 84.2 | 18.9 | 9.4 |

| Valiant Laboratories | 140 | 16.7 | 25 | 170.25 | 8.7 | 3.2 |

| Updater Services | 300 | 7.6 | 3 | 283.9 | -7.7 | -6.3 |

| JSW Infra | 119 | 19.6 | 30 | 157.3 | 13.5 | 5.6 |

| Manoj Vaibhav Gems | 215 | 11.7 | 12 | 215.5 | -4.9 | -5.1 |

| Sai Silks Kalamandir | 222 | 14.3 | 13 | 244.9 | 3.6 | 4.2 |

| Signature Global | 385 | 34.4 | 35 | 458.55 | 9.3 | 9.2 |

| Zaggle Prepaid Ocean Services | 164 | 16.5 | 10 | 158.35 | -12.3 | -9 |

| Samhi Hotels | 126 | 9.5 | 5 | 143.4 | 5.8 | 9.5 |

| RR Kabel | 1,035 | 154.5 | 100 | 1198.05 | 0.7 | 5.6 |

| EMS Limited | 211 | 105 | 100 | 279.9 | -11.4 | -10 |

| Jupiter Life Line Hospitals | 735 | 211.9 | 240 | 1075.75 | 13.6 | 10.3 |

| Ratnaveer Precision Engineering | 98 | 39.1 | 55 | 129.35 | -5.6 | -15.5 |

| Rishabh Instruments | 441 | 61.4 | 65 | 443.15 | -11.8 | -12.4 |

| Vishnu Prakash Punglia | 99 | 55.5 | 55 | 145.7 | -5.7 | -5.4 |

| Aeroflex Industries | 108 | 51.4 | 70 | 163.25 | 2.4 | -8.3 |

| Pyramid Technoplast | 166 | 23.5 | 20 | 177.65 | -6.3 | -4.5 |

| TVS Supply Chain Solutions | 197 | 14.3 | 3 | 201 | -4.9 | 0.5 |

| Concord Biotech | 741 | 173 | 110 | 942.8 | 3.2 | 10.8 |

| SBFC Finance | 57 | 37.1 | 24 | 92.2 | -2 | 13.8 |

| Yatharth Hospital | 300 | 71.2 | 80 | 333.85 | -10.1 | -12.1 |

| Netweb Technologies | 500 | 347.3 | 375 | 910.4 | 7.5 | 4 |

| Utkarsh Small Finance Bank | 25 | 14.8 | 15 | 48 | 20.6 | 20 |

| Senco Gold | 317 | 95.8 | 130 | 405.3 | -1.8 | -9.3 |

| Cyient DLM | 265 | 107.7 | 130 | 420.6 | 12.8 | 6.5 |

| IdeaForge Technology | 672 | 491.2 | 520 | 1294.95 | 11.3 | 8.6 |

| HMA Agro | 585 | 16 | 8 | 585.7 | -2.5 | -1.2 |

| IKIO Lighting | 285 | 92.8 | 90 | 403.85 | 6.9 | 7.7 |

| Nexus Select REIT | 100 | 5.5 | 4 | 104.26 | -1.2 | 0.2 |

| Mankind Pharma | 1,080 | 78.1 | 90 | 1422.3 | 22.8 | 21.6 |

| Avalon Technologies | 436 | 21.9 | 10 | 398 | -13.1 | -10.8 |

| Udayshivakumar Infra | 35 | 11 | 12 | 31.5 | -31.5 | -33 |

| Global Surfaces | 140 | 31.8 | 12 | 171.05 | -0.5 | 12.5 |

| Divgi TorqTransfer | 590 | 34.1 | 20 | 605.2 | -3 | -0.8 |

| Sah Polymers | 65 | 9.1 | 11 | 89.25 | 20.4 | 17.4 |

| Average | 0.1 | 0.4 |

When we plot the figures on a line chart, we notice that the difference between the listing prices of average and last-day GMPs isn’t substantial and gets canceled out in the large data set.

However, a few IPOs stand out as exceptions. These are Tata Technologies, IREDA, and Udayshivakumar Infra which had a significant variance in listing price from what the grey market was indicating. Tata Technologies had a variance of nearly 46% from the latest GMP, while the figure for IREDA stood at around 43%. On the other hand, Udayshivakumar Infra listed 33% down from GMP indications.

Tata Technologies and IREDA offers were among the biggest IPOs of the year at INR 3,042 and INR 2,150 crore, respectively, and had garnered strong subscriptions. In such cases, panic buying by unsuccessful IPO investors creates such scenarios. Udayshivakumar Infra comes across as a genuine case where the grey market failed to see what was coming, especially as the broader market sentiment was negative at the time of listing.

So How Accurate is IPO Grey Market Price?

The majority of the remaining listings had variances within the 25% range. While this isn’t ideal, investors need to understand that the grey market isn’t and can’t be as efficient as the regulated stock market.

Key Takeaway 1

High subscription can lead to a reverse squeeze situation which can take listing day performance way above what the grey market indicates.

Key Takeaway 2

Investors can do better by discounting GMP of up to 25%. A closer look at the above table reveals several instances where premiums melted after subscription dates.

Overall, IPO grey premiums offer a glimpse into pre-listing demand and can be valuable, but they may not always indicate the actual listing performance of the IPO. In other words, the accuracy of IPO GMP is not up to the mark. Therefore, investors should use GMP as one of the many tools to make informed decisions about investing in IPOs.

What is the accuracy of IPO GMP?

According to the data analyzed by IPO Central of 58 IPOs, majority of the public offers had a variance of 25% between GMP-led indicative price and actual listing price.

Is Grey Market Premium reliable?

The informal or grey market is not reliable in every case, although it serves as a good indicator of listing price. Nevertheless, accuracy of IPO GMP is not up to the mark.

How can investors improve the accuracy of IPO GMP?

Investors can put a discount factor of 20-25% on prevailing IPO premium to make it more reliable and accurate, showed a comprehensive study by IPO Central.