As Diffusion Engineers prepares to enter the market with its IPO, investors need to understand the key aspects of the company and how it fits into the broader industrial landscape. Diffusion Engineers is a specialized player in the manufacturing and service sector, facilitating production of industrial equipment used in core industries such as cement, steel, power, mining, and more. In Diffusion Engineers IPO Review, we cover 10 points every investor should know.

#1 Diffusion Engineers IPO Review: Strong Industry Presence and Diversified Offerings

Diffusion Engineers operates in a niche but crucial space, manufacturing a variety of products, including welding consumables, wear plates, wear parts, and heavy engineering machinery. The company also provides repair and reconditioning services for heavy industrial machinery, which is critical for sectors like cement, steel, and power plants. The comprehensive range of products, combined with repair services, allows the company to position itself as a “total wear solutions” provider.

The market for welding consumables in India was valued at approximately INR 51 billion in FY 2024 and is projected to grow to INR 64 – 66 billion by FY 2027, driven by infrastructure developments like roads, bridges, and ports. This market outlook provides a robust growth runway for the company.

#2 Diffusion Engineers IPO Review: Offer Details

Diffusion Engineers IPO is scheduled for 26 to 30 September 2024, with a price range of INR 159 to 168 per share, and shares are scheduled to make a debut on the BSE, and NSE on Friday, 4 October 2024. The IPO is purely a fresh issue of 94,05,000 shares, valuing the offering between INR 149.54 – 158 crores. The minimum bid size is 88 shares, priced at INR 14,784, and retail investors are to be allotted 35% of the shares.

#3 Diffusion Engineers IPO Review: Strong Financial Performance

Diffusion Engineers has demonstrated consistent financial growth over the past few years. The company’s revenue has grown from INR 87.84 crore in FY 2013 to INR 257.13 crore in FY 2024, registering a CAGR of 10.26% over the past 11 years. Profit After Tax (PAT) also grew from INR 7.32 crore to INR 23.40 crore during the same period, reflecting a CAGR of 11.14%.

Among industry peers, Diffusion Engineers stands out with a CAGR of 21% in operating income between FY 2021 and FY 2024, the third-highest in the industry. Additionally, it achieved a 38% CAGR in profit after tax and a 33% CAGR in EBITDA during the same period, indicating strong profitability and efficient cost management.

| FY 2022 | FY 2023 | FY 2024 | |

| Revenue | 204.59 | 254.88 | 278.14 |

| Expenses | 187.65 | 233.14 | 245.58 |

| Net income | 17.05 | 22.15 | 30.80 |

| Margin (%) | 8.33 | 8.69 | 11.07 |

#4 Diffusion Engineers IPO Review: Forward Integration Advantage

One of Diffusion Engineers’ unique strengths lies in its forward integration model. The company not only manufactures welding consumables such as special-purpose electrodes and flux-cored wires but also integrates these products into its wear plates and heavy engineering equipment. This enables the company to control its supply chain, reduce dependency on third-party suppliers, and optimize production costs.

The wear plates market in India, another important segment for Diffusion Engineers, was valued at INR 22 billion in FY 2024 and is projected to grow at a CAGR of 8-9%, reaching INR 28 billion by FY 2027. As industries like power, steel, and cement continue to grow, demand for wear plates, which protect heavy equipment from wear and tear, will rise in tandem.

#5 Diffusion Engineers IPO Review: Strategic Location and Capacity Utilization

Diffusion Engineers’ four manufacturing units are strategically located in Nagpur, Maharashtra, which is a central hub for transportation and logistics in India. This location allows for the efficient sourcing of raw materials and faster delivery times to clients across the country, reducing logistical costs and enhancing operational efficiency.

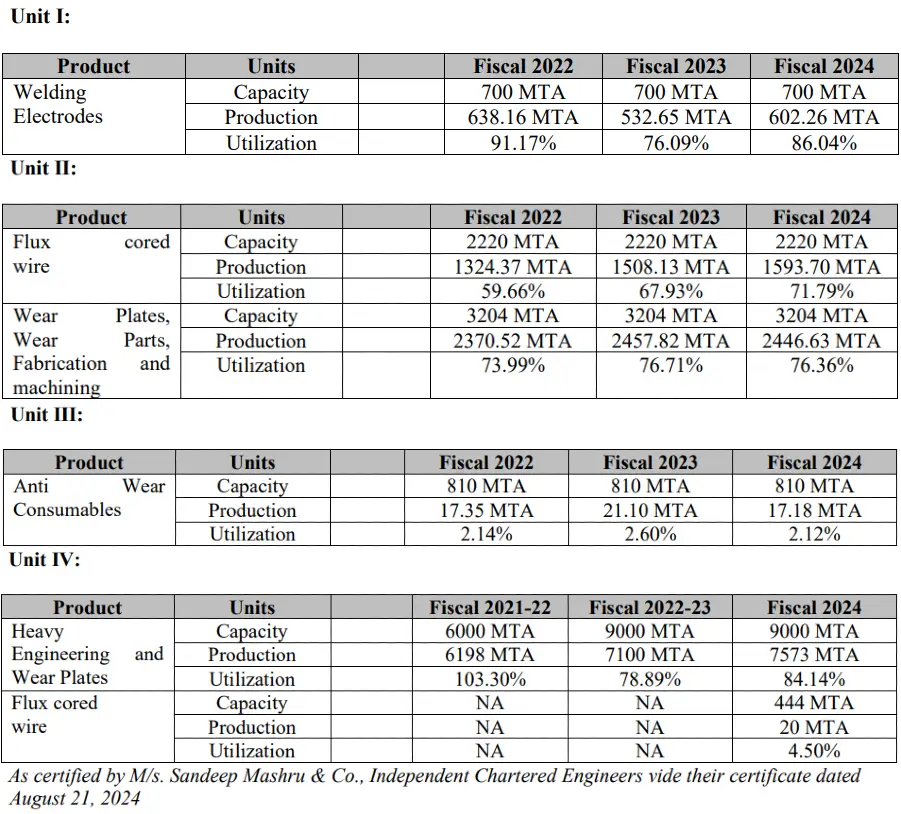

Each unit is specialized—Unit I focuses on special-purpose welding electrodes, Unit II produces flux-cored wires and wear plates, Unit III is dedicated to coatings, and Unit IV manufactures heavy engineering machinery. The specialization of these units ensures operational efficiency and enhances quality control across all product lines. The table below provides specific details regarding the capacity utilization of the Units, which is calculated by comparing the total installed production capacity with the actual production figures for the periods specified.

#6 Diffusion Engineers IPO Analysis: Robust Export Business

Diffusion Engineers has a growing international footprint, exporting products to over 25 countries, including Singapore, the United Arab Emirates, the United States, and Germany. The company’s overseas subsidiaries in Singapore, Turkey, and the Philippines, along with joint ventures in the United Kingdom and Malaysia, provide it with a diversified revenue stream and reduce dependence on the domestic market.

This expansion into global markets is key for long-term growth, especially as developing nations increase their demand for industrial products and infrastructure. In FY 2024, its exporet sales accounted for 10.2% of total revenues.

#7 Diffusion Engineers IPO Review: Valuation

| FY 2022 | FY 2023 | FY 2024 | |

| EPS | 6.09 | 7.91 | 8.24 |

| PE Ratio | – | – | 19.31 – 20.40 |

| RONW (%) | 15.10 | 16.86 | 18.52 |

| NAV | 43.09 | 50.71 | 68.11 |

| ROCE (%) | 17.30 | 18.46 | 20.63 |

| EBITDA (%) | 13.45 | 13.65 | 17.04 |

| Debt/Equity | 0.20 | 0.34 | 0.18 |

#8 Diffusion Engineers IPO Analysis: Focus on Research and Development

The company places a strong emphasis on research and development (R&D), with a dedicated, government-approved facility at Unit I in Nagpur. The R&D center is equipped with advanced testing and developmental tools and is accredited by the National Accreditation Board for Testing and Calibration Laboratories (NABL). Diffusion Engineers also adhere to stringent quality standards, holding ISO certifications for quality, environmental management, and occupational health and safety.

This focus on innovation and quality ensures that the company remains competitive in developing specialized, high-performance products for its clients, further solidifying its market position.

#9 Diffusion Engineers IPO Review: Clientele and Long-Standing Relationships

With over four decades of experience, Diffusion Engineers has built long-standing relationships with both OEMs (Original Equipment Manufacturers) and direct customers in key industries. In FY 2024, the company served 503 clients, demonstrating its ability to retain customers and attract new ones. Out of the total, 233 clients were associated with the company for over 5 years.

Major industrial players rely on Diffusion Engineers’ products and services to ensure the longevity and optimal performance of their heavy machinery, underscoring the company’s vital role in the supply chain.

#10 Diffusion Engineers IPO Review: Risk Factors

- The company experienced negative cash flows during certain fiscal years, affecting its operating, investing, and financing activities.

- All of the company’s manufacturing operations are based in Nagpur, Maharashtra, across four facilities. Any localized social unrest, natural disaster, service disruption, or production halt in Nagpur could severely impact the company’s operations and financial health.

Diffusion Engineers IPO Analysis: Conclusion

In conclusion, Diffusion Engineers offers a compelling investment opportunity. With its strong market position, innovative forward integration strategy, and consistent financial performance, the company is well-equipped to benefit from growing industrial demand in India and abroad. However, as with any IPO, potential investors should carefully evaluate the risks and benefits before making a decision. There is also a strong premium in grey market on Diffusion Engineers IPO.