The Indian construction industry is bustling with opportunities as cities grow, infrastructure projects expand, and the real estate market remains resilient. Amidst this growth, Garuda Construction and Engineering is making a significant stride with its upcoming Initial Public Offering (IPO). In this Garuda Construction IPO Review, we cover the 10 most important points every investor should know about the company.

#1 Garuda Construction IPO Review: Unique Business Model and Industry Expertise

Historically, Garuda Construction has focused on providing in-house construction services to its promoter group PKH Ventures and related entities. However, the company is now transitioning towards securing contracts directly from third-party developers. This marks a significant shift, as Garuda is leveraging its vast industry expertise to bid for external projects. It also aims to expand into a larger role as a developer, a move that could generate substantial new revenue streams and diversify its operations.

#2 Garuda Construction IPO Review: Diverse Project Portfolio

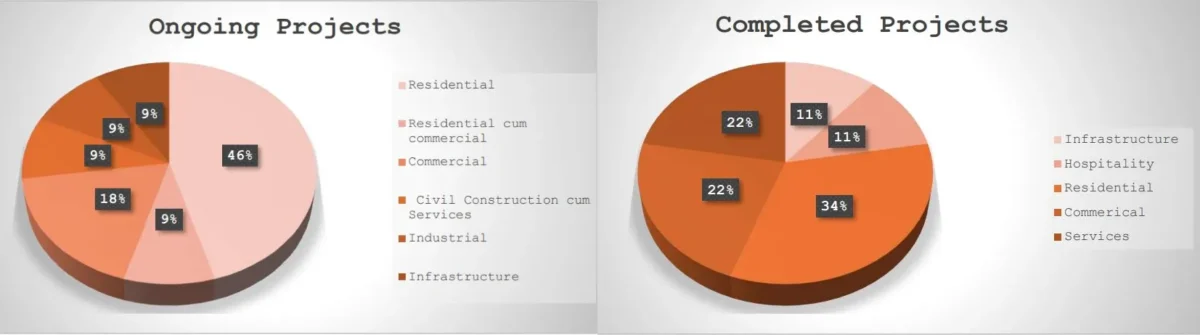

The company offers a broad range of civil construction services, including residential, commercial, industrial, and infrastructure projects. It provides end-to-end solutions, starting from surveys and design to final project handover. Some of Garuda’s notable projects include the Golden Chariot Vasai Hotel & Spa, completed in 2014, and the prestigious Delhi Police Headquarters, a 17-story twin-tower building covering 89,140.53 square meters, completed in 2021.

Its ongoing projects include six residential, two commercial, one industrial projects, and one Infrastructure, showcasing its ability to handle complex, large-scale developments. Some of the Ongoing / Upcoming projects include:

A. Trinity Oasis (Residential cum commercial) – Area of 2,20,000 square feet

B. Garuda Shatrunjay (Residential) – Area of 2,87,400 square feet

C. SRA Project (Residential) – Area of 4,91,800 square feet

D. Options World (Commercial) – Area of 4,00,804.54 square feet

E. Office building at BKC (Commercial) – INR 55 crore

F. Residential Building at Amritsar (Residential) – Area of 3,68,869 square feet

G. Hydro Power Project (Infrastructure) – INR 106.50 crore

H. Agro Processing Cluster (Industrial) – INR 36.39 crore

I. Residential Project – Area of 8,45,000 square feet

J. Residential Project – Area of 1,75,000 square feet

#3 Garuda Construction IPO Review: Strong Order Book

A healthy order book is a positive indicator of future growth for construction companies, and Garuda Construction’s figures are particularly impressive. As of September 2024, Garuda’s order book stands at INR 1,408.27 crore, reflecting a broad pipeline of projects across various sectors. Notably, projects valued at over INR 100 crore each contribute significantly to this figure. The ongoing and upcoming projects span residential, commercial, industrial, and infrastructure development across key regions such as the Mumbai Metropolitan Region (MMR), Karnataka, Uttar Pradesh, Arunachal Pradesh, Punjab, and Rajasthan.

Read Also: Latest IPO Approvals: SEBI Okays 5 High-Profile IPOs including Swiggy, Hyundai, Vishal Mega Mart

#4 Garuda Construction IPO Review: Offer Details

Garuda Construction IPO is scheduled for 8 to 10 October 2024, and shares are scheduled to make a debut on Tuesday, 15 October 2024. The public issue consists of an Offer for Sale (OFS) of 95,00,000 shares and a Fresh Issue amounting to INR 173.85 crore. The minimum bid size is 157 shares, priced at INR 14,915, and retail investors will be allotted 35% of the shares. The IPO will be listed on both BSE and NSE.

#5 Garuda Construction IPO Review: Entry into a Major Greenfield Township Development

One of the standout projects that Garuda Construction is currently engaged in is the Rapti Nagar Extension Township & Sports City in Gorakhpur, Uttar Pradesh. The project covers 207.47 acres, of which 177.47 acres are dedicated to a state-of-the-art township, while 30 acres will feature a Greenfield Sports City. This project includes residential and commercial plots, educational and health facilities, and sports amenities. This venture is a major milestone for Garuda, signaling its growing involvement in large-scale urban development projects.

#6 Garuda Construction IPO Review: Sector-Leading Operating Margins & Impressive Financial Growth

Garuda Construction boasts some of the highest operating margins in the construction industry. For FY 2023, the company’s operating margin stood at a staggering 34.80%, significantly higher than the industry average of 16.90%. Over the last three fiscal years, Garuda’s average operating margin was 30%, double that of its competitors. This level of profitability is a strong indicator of the company’s operational efficiency and cost management, which are critical factors in the competitive construction market.

The company has shown a remarkable upward trend in its revenue. In Fiscal Year 2024, the company reported revenues of INR 154.18 crore, reflecting strong growth from INR 77.02 crore in FY 2022. This results in a CAGR of 41.49%. Additionally, profits have surged from INR 18.78 crore in FY 2022 to INR 36.44 crore in FY 2024, a 39.3% CAGR. As of 30 April 2024, the company had already reported revenue of INR 11.88 crore with a profit after tax of INR 3.50 crore. This financial trajectory paints a positive picture for prospective investors looking for growth potential. Financial performance always plays an important role and it is no different in the case of Garuda Construction IPO review.

| FY 2022 | FY 2023 | FY 2024 | 1M FY 2025 | |

| Revenue | 77.02 | 160.69 | 154.18 | 11.88 |

| Expenses | 52.24 | 105.94 | 104.82 | 7.20 |

| Net income | 18.78 | 40.80 | 36.44 | 3.50 |

| Margin (%) | 24.38 | 25.39 | 23.63 | 29.46 |

#7 Garuda Construction IPO Review: Debt-Free Balance Sheet

Garuda is virtually debt-free, which is a strong positive in the construction industry, where many companies struggle with heavy leverage. With an interest coverage ratio of 146x in FY 2023—compared to the peer average of 28.4x—Garuda stands out for its financial prudence. This low debt burden allows the company more flexibility to take on new projects and scale its operations without being weighed down by financing costs.

| FY 2022 | FY 2023 | FY 2024 | |

| EPS | 2.51 | 5.46 | 3.92 |

| PE Ratio | – | – | 23.48 – 24.25 |

| RONW (%) | 44.94 | 49.38 | 30.62 |

| NAV | 5.59 | 11.06 | 15.93 |

| ROCE (%) | 40.46 | 70.85 | 46.69 |

| EBITDA (%) | 35.27 | 34.85 | 32.49 |

| Debt/Equity | 0.29 | – | – |

Read Also: Vikran Engineering IPO DRHP Filed: Star Investors, Strong Financials Among Highlights

#8 Garuda Construction IPO Analysis: Transition to Independent Projects

Garuda Construction is evolving from being primarily a subcontractor for its promoter group to undertaking third-party projects. This shift not only diversifies its client base but also allows the company to tap into a broader market. By venturing into contracts with unrelated parties, Garuda is positioning itself as a fully-fledged player in the civil construction industry. This transition is expected to drive future revenue growth and provide stability by reducing its reliance on group entities.

#9 Garuda Construction IPO Analysis: Growth Outlook

The future looks bright for Garuda Construction, as its strategic shift towards direct contracts and larger development roles comes at a time of booming infrastructure and real estate sectors in India. The company’s solid order book, high operating margins, virtually debt-free status, and ongoing participation in major projects like the Rapti Nagar Township underscore its growth potential. Moreover, with its proven track record of delivering complex projects on time and within budget, Garuda is well-placed to benefit from India’s growing demand for high-quality construction services.

#10 Garuda Construction IPO Review: Risk Factors

- Garuda Construction and Engineering’s growth is limited by its reliance on related party contracts, which accounted for 100% of its revenue in the stub period ending April 2024. To ensure long-term success, it must diversify its client base and reduce dependency on group projects.

- The construction industry is cyclical and sensitive to economic changes. Downturns or shifts in interest rates can delay or cancel projects, impacting Garuda Construction and Engineering’s operations and financial results.

- The previous IPO filed by the promoter group, PKH Ventures, was not fully subscribed, leading to the withdrawal of the IPO.

- The company’s contracts are mostly of the nature of EPC contracts and it is exposed to inherent risks related to the contractual framework.

Read Also: Diffusion Engineers IPO Listing: GMP Drops to INR 60 Ahead of Debut

Garuda Construction IPO Analysis: Conclusion

Garuda Construction IPO review reveals that investors have a compelling opportunity to invest in a fast-growing company with a unique business model, strong financials, and a promising future. With a shift towards third-party contracts, large-scale projects like the Gorakhpur Township, and sector-leading operating margins, the company is poised for robust growth. Its leadership team, proven track record, and strategic positioning make Garuda a strong candidate for those looking to invest in India’s booming construction industry. Investors should closely watch this IPO although the offer isn’t attracting any premium in the grey market as of now.