NSE Emerge, launched by the National Stock Exchange (NSE) in 2012, serves as a dedicated platform for small and medium-sized enterprises (SMEs) and startups in India to access capital markets. NSE Emerge platform allows SMEs to raise funds through public offerings without the complexities associated with traditional Initial Public Offerings (IPOs).

Key Features of NSE Emerge Platform

- Accessibility: NSE Emerge allows SMEs to list their shares with reduced compliance requirements compared to mainboard IPOs. Companies can secure funding by obtaining approval from the NSE board rather than going through the Securities and Exchange Board of India (SEBI).

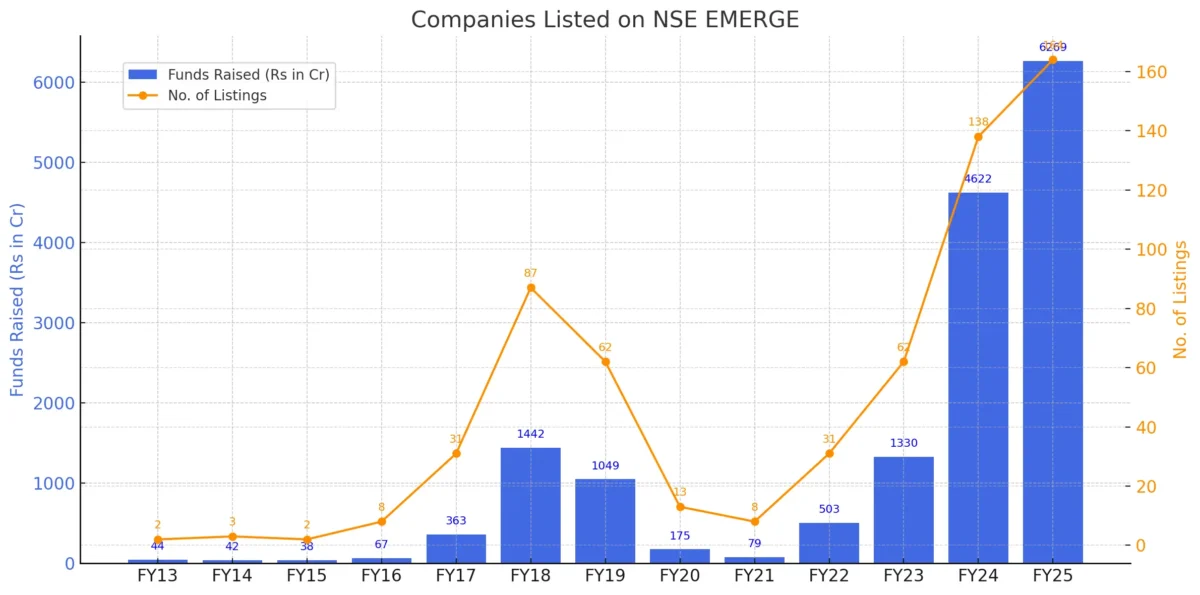

- Funding Opportunities: Since its inception, NSE Emerge has seen significant participation from SMEs. As of 16 June 2025, 655 companies have listed on this platform, raising approximately INR 18,682 crore collectively. This demonstrates the platform’s effectiveness in connecting businesses with potential investors.

- Market Capitalization Growth: The market capitalization of companies listed on NSE EMERGE crossed INR 1,45,385 crore in March 2024, highlighting the growing confidence in India’s SME sector. The Nifty SME EMERGE Index, which includes 420 companies from various sectors, has shown a remarkable compound annual growth rate (CAGR) of 37.16% since its launch in 2017.

NSE Emerge Index

The NSE Emerge Index is designed to represent the performance of a portfolio of eligible small and medium enterprises (SMEs) listed on the NSE Emerge platform. The constituents of this index are weighted according to their free-float market capitalization.

Highlights

- Base Date and Value: The index has a base date of 1 December 2016, with a base value set at 1000.

- Eligibility Criteria: To be included in the NSE Emerge Index, stocks must meet the following requirements:

- They must be listed on the NSE Emerge platform.

- During the quarterly review, they should have traded for at least 25% of the trading days, with a minimum of 10 trading days in the preceding three months.

- Minimum Constituents: The index requires a minimum of 20 constituents.

- Reconstitution Frequency: The index is reconstituted quarterly to ensure it accurately reflects the performance of eligible SMEs.

Interested in NSE? More Articles For You

- NSE IPO News

- NSE IPO Update

- NSE Emerge Platform: All You Need to Know

- NSE IPO Timeline: 1 IPO, 5 SEBI Chiefs, 10 Years

- NSE Unlisted Share Price

- Is NSE Undervalued or BSE Overvalued? NSE IPO May Be the Reset Trigger!

- ASBA e Forms – Download IPO Application Form, BSE & NSE IPO Forms 2026

- Difference Between NSE and BSE – Accurate Comparison

- NSE IFSC: Important Points About Investing in US Stocks

- How Many Companies are Listed in NSE and What are NSE Series?

- NSCCL: 7 Most Important Points about NSE Clearing

- Stock Market Holidays 2026 – BSE, NSE trading holidays

Recent Developments

The NSE and SEBI have introduced critical reforms to strengthen SME listings and improve investor protection:

1. Tighter NSE Listing Norms (Effective September 2024)

- Positive Free Cash Flow to Equity (FCFE): SMEs must show positive FCFE in at least 2 of the last 3 financial years to be eligible for listing on NSE Emerge. This ensures only financially sound companies can access public markets.

- IPO Opening Price Cap: The NSE has capped opening price movement at 90% above the issue price to reduce excessive speculation and manipulation during listings.

2. SEBI ICDR Amendments for SME IPOs (Effective 3 March 2025)

In March 2025, SEBI implemented new SME IPO rules under the ICDR regulations:

- Minimum IPO Application Size: Increased from INR 1 lakh to 2 lakh.

- Minimum Public Shareholders in IPO: Raised from 50 to 200.

- Operating Profit Threshold: Companies must report INR 1 crore profit in 2 of the last 3 years.

- Use of IPO Proceeds: Cannot be used to repay promoter or related-party loans.

- Offer for Sale (OFS) Limit: Max 20% of issue size, and selling shareholders may offload no more than 50% of their holdings.

- Promoter Lock-In:

- Minimum 20% promoter shareholding locked for 3 years

- Additional promoter holdings locked for 2 years (50%) and 1 year (remaining 50%)

- Public DRHP Comment Window: A 21-day period has been mandated for public comments on DRHPs.

- Mandatory Monitoring Agency: Required for IPOs above INR 50 crore.

3. New NSE Mainboard Migration Norms (Effective 1 May 2025)

For SMEs aiming to migrate from NSE Emerge to the Main Board:

- Minimum Revenue: INR 100 crore in the last financial year

- Market Cap: INR 100 crore (average over the last 3 months)

- Operating Profit: Positive in 2 of the last 3 years

- Paid-Up Capital: At least INR 10 crore

- Minimum Public Shareholders: 500 (reduced from 1,000)

- Promoter Holding: Minimum 20% stake with at least 50% retained post-listing

- Net Worth Requirement: INR 75 crore

- Must be listed on NSE Emerge for at least 3 years

NSE Emerge Listing Eligibility Criterion

To list on NSE Emerge, companies must meet the following conditions:

| Parameter | Criterion |

|---|---|

| Incorporation | Incorporated under Companies Act, 1956 or 2013 |

| Post-Issue Paid-Up Capital | Not exceeding INR 25 crore |

| Operational Track Record | Minimum 3 years of operations by the company or promoters |

| Profitability | Positive operating profit in at least 2 of the last 3 years |

| Free Cash Flow (FCFE) | Positive FCFE in at least 2 of the last 3 financial years |

| Financial Health | Positive net worth; no winding-up or insolvency proceedings |

| Regulatory Compliance | No material regulatory action in the past 3 years |

| Disclosure Obligations | Must disclose regulatory actions or defaults from the last 3 years |

| Cooling-Off for Rejections | Not rejected by the Exchange in the past 6 months |

Additional Notes:

- Monitoring Requirements: IPOs over INR 50 crore require a monitoring agency report on fund usage.

- Promoter Qualifications: At least 3 years’ experience in the business line and must hold ≥ 20% of post-issue equity.

Also Read: Nifty 50 Stock List in 2024

Regulatory Framework: Emerge vs. Main Board

| Particulars | Emerge | Main Board |

|---|---|---|

| Post-Issue Paid-Up Capital (Face Value) | Less than INR 25 crore | Not less than INR 10 crore |

| Minimum Number of Allottees in the IPO | 50 | 1,000 |

| Observations on DRHP | By the Exchange | By SEBI |

| IPO Application Size | Not less than INR 1,00,000 | INR 10,000 – 15,000 |

| Post-Issue Reporting Requirements (Financial Accounts) | Half-yearly | Quarterly |

| Market Making | Mandatory | Non-mandatory |

Trading Lot Sizes for NSE Emerge

Standardized lot size for Initial Public Offer proposing to list on EMERGE and for the secondary market trading:

| Price Band (in INR) | Lot Size (no. of Shares) |

|---|---|

| Upto 14 | 10,000 |

| More than 14 upto 18 | 8,000 |

| More than 18 upto 25 | 6,000 |

| More than 25 upto 35 | 4,000 |

| More than 35 upto 50 | 3,000 |

| More than 50 upto 70 | 2,000 |

| More than 70 upto 90 | 1,600 |

| More than 90 upto 120 | 1,200 |

| More than 120 upto 150 | 1,000 |

| More than 150 upto 180 | 800 |

| More than 180 upto 250 | 600 |

| More than 250 upto 350 | 400 |

| More than 350 upto 500 | 300 |

| More than 500 upto 600 | 240 |

| More than 600 upto 750 | 200 |

| More than 750 upto 1000 | 160 |

| Above 1000 | 100 |

Price Bands

Price bands for securities are as follows:

- Daily price bands of 20% (either way)

- Price Bands may be changed as per surveillance action from time to time.

- For the Call Auction 1 market, the price bands of 20% are applicable

Circuit Breakers

If the capital market of the main board is closed due to a nationwide index circuit filter or for any other reason, the Emerge platform will also be closed. It will reopen simultaneously when the capital market resumes trading.

Impact on SMEs and Startups

NSE Emerge has proven to be a catalyst for economic growth by providing SMEs with a credible platform for fundraising. The ability to raise capital through public markets empowers these businesses to expand operations, create jobs, and contribute significantly to India’s economic landscape. The trend of migration from the SME platform to the main board is also noteworthy; as of now, 143 NSE SME and 195 BSE SME companies have successfully transitioned, indicating that many SMEs are maturing into larger entities capable of meeting more stringent regulatory requirements.

Read Also: SME to Mainboard Migration – Benefits, Eligibility Criteria and More

Milestones Achieved

- NSE UP Govt. MoU: The Uttar Pradesh government signed an MoU with NSE to help 96 lakh MSMEs raise capital via IPOs on the NSE Emerge platform. Under MSME Policy 2022, eligible enterprises receive INR 5 lakh financial support. Awareness drives, workshops, and handholding support will be provided to facilitate stock market listing.

500th Listing Celebration: On 22 July 2024, Prizor Viztech became the 500th company listed on NSE Emerge, and Thejo Engineering was the first. This milestone reflects an accelerated pace of listings, with the last 100 companies listed within just six months—a stark contrast to the five years it took to reach the first 100 listings. - Significant Fund Mobilization: July 2024 alone saw a record mobilization of INR 11,186.02 crore from 23 listings, showcasing investors’ growing interest in SME IPOs.

Challenges and Regulatory Measures

Despite its successes, NSE Emerge faces challenges related to company quality and market manipulation concerns. Recent regulatory measures aim to address these issues:

- Stricter Listing Norms: The introduction of positive cash flow requirements is expected to filter out companies that may not be financially stable or sustainable.

- Investor Caution: Regulatory bodies have issued warnings regarding potential manipulations in SME stock prices, urging investors to conduct thorough due diligence before investing.

Role of Merchant Bankers in NSE Emerge

Merchant bankers play a crucial role in the NSE Emerge platform by managing the IPO process for SMEs. They assist in due diligence, prepare offering documents, set share prices, and ensure regulatory compliance. Additionally, they facilitate market-making for three years post-listing, enhancing liquidity and investor confidence in these emerging companies.

Roles and Responsibilities of Market Makers

The following are the roles, obligations and responsibilities that are required to be carried out by the Market Maker.

- The Market Maker shall be required to provide a 2-way quote for 75% of the time in a day.

- The minimum depth of the quote shall be INR 1,00,000/-. However, the investors with holdings of value less than INR 1,00,000 shall be allowed to offer their holding to the Market Maker in that scrip provided that he sells his entire holding in that scrip in one lot along with a declaration to the effect of the selling broker.

- Execution of the order at the quoted price and quantity must be guaranteed by the Market Maker, for the quotes given by him.

- There would not be more than five Market Makers per scrip.

- The Market Maker may compete with other Market Makers for better quotes to the investors.

- The Market Maker has to start providing quotes from the day of the listing / the day for the respective scrip and shall be subject to the guidelines laid down for market making by the exchange.

- The Market Maker has to act in that capacity for three years.

Read Also: Latest SEBI IPO Approvals

Conclusion

NSE Emerge represents a vital opportunity for SMEs and startups in India, offering them a pathway to financial growth and market visibility. With ongoing enhancements in listing criteria aimed at maintaining quality and investor confidence, this platform is poised to continue playing an essential role in nurturing India’s vibrant SME ecosystem. As more businesses recognize the benefits of going public through NSE Emerge, we can expect further contributions to economic development and innovation across various sectors.