The highly anticipated Initial Public Offering (IPO) of NTPC Green Energy Limited (NGEL) is generating significant buzz, especially among investors interested in sustainable energy. As a wholly-owned subsidiary of NTPC Limited, one of India’s largest power companies, NGEL is poised to play a crucial role in India’s clean energy transition. We discuss NTPC Green Energy IPO in detail and cover the most important points you should know.

#1 NTPC Green Energy IPO: Largest Renewable Energy Public Sector Enterprise (Excluding Hydro)

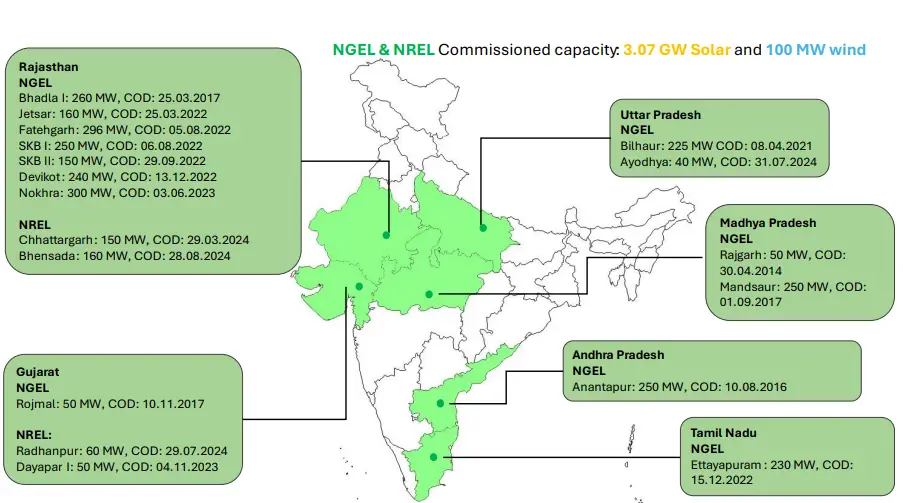

NTPC Green Energy is India’s largest renewable energy public sector enterprise (excluding hydroelectric power) in terms of operational capacity and power generation. As of 30 June 2024, NTPC Green Energy had an operating capacity of 3,071 MW in solar projects and 100 MW in wind projects across six Indian states. Its robust growth has made it a cornerstone of India’s clean energy transition efforts. Fiscal 2024 data revealed that NGEL’s renewable energy portfolio dominated power generation compared to similar public enterprises, reaffirming its leadership position.

#2 NTPC Green Energy IPO: A Parent Company with Clout

NTPC Green Energy benefits significantly from its parent company, NTPC Limited, a “Maharatna” central public-sector enterprise. NTPC is India’s largest power company, with an installed capacity of 72.3 GW and an ambitious goal to achieve 60 GW renewable energy capacity by 2032. NTPC’s backing provides NGEL with financial stability, operational expertise, and a strong brand presence, making the subsidiary an attractive investment in renewable energy.

#3 NTPC Green Energy IPO: Offer Details

NTPC Green Energy IPO is purely a fresh issue of INR 10,000 crores. The retail investors are to be allotted 10% of the shares. The IPO will be listed on both BSE and NSE. In addition, there is a reservation for shareholders of NTPC Limited.

#4 NTPC Green Energy IPO: Diversified Portfolio with Low Risk

The company’s renewable energy portfolio spans both solar and wind assets across multiple locations in more than six states, including states Rajasthan, Gujarat, Uttar Pradesh, Madhya Pradesh, Andhra Pradesh, and Tamil Nadu. This geographical diversification helps mitigate risks related to location-specific generation variability, such as changes in sunlight availability or wind speeds. NGEL’s portfolio, as of 30 June 2024, included 14,696 MW, of which 2,925 MW are operational, while 11,771 MW are contracted or awarded projects.

NGEL’s financials reflect strong growth in the renewable energy sector. In FY 2024, 96.17% of NGEL’s revenue came from renewable energy sales, a slight dip from 96.94% in FY 2023.

#5 NTPC Green Energy IPO: Strong Pipeline for Future Growth

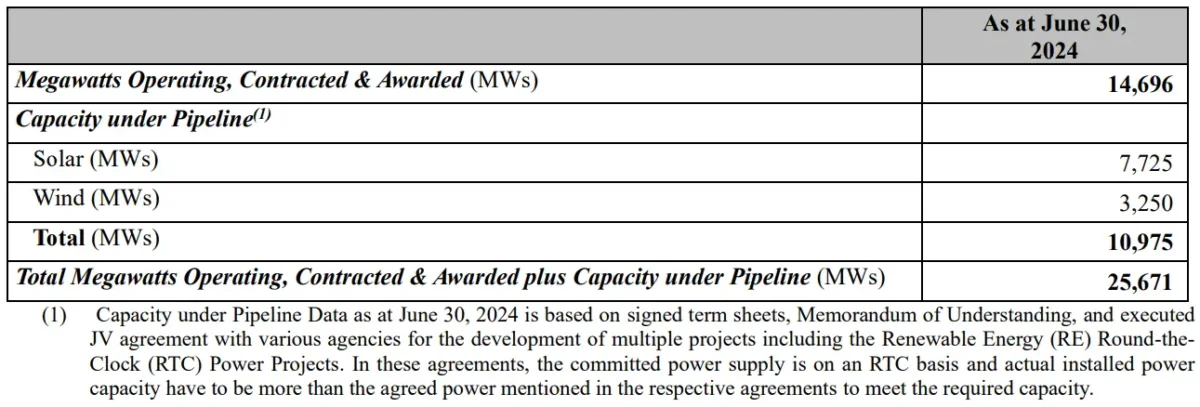

NGEL has an impressive pipeline of 10,975 MW worth of projects under development or in negotiation stages. This, combined with their current portfolio, brings their total pipeline to an astounding 25,671 MW. With India’s push toward renewable energy and ambitious targets of net-zero emissions by 2070, the company’s strong project pipeline positions it for future growth and long-term revenue generation.

The table below outlines the the company’s capacity – Operating, Contracted & Awarded – along with the Total Megawatts Operating, Contracted & Awarded, and Capacity under Pipeline as of 30 June 2024. The Capacity under Pipeline indicates future development opportunities for the company.

#6 NTPC Green Energy IPO: Revenue Stability through Long-Term Power Purchase Agreements

One of NGEL’s strongest selling points is its stable revenue stream. As of 30 June 2024, the company had 15 off-takers across 37 solar projects and 9 wind projects. All these off-takers are government agencies and public utilities, with long-term Power Purchase Agreements (PPAs) averaging 25 years. This reduces the volatility associated with market-based power sales and ensures predictable cash flows, which is a key consideration for long-term investors.

#7 NTPC Green IPO Review: Strong Revenue Growth and Profitability

NGEL has demonstrated impressive revenue and profit growth. The company’s revenue from operations grew at a CAGR of 46.82%, from INR 910.42 crore in FY 2022 to INR 1,962.60 crore in FY 2024. Similarly, operating EBITDA increased by a CAGR of 48.23% over the same period, reaching INR 1,746.47 crore in FY 2024.

| FY 2023 | FY 2024 | Q1 FY 2025 | |

| Revenue | 169.69 | 1,962.60 | 578.44 |

| Expenses | 118.09 | 1,549.46 | 423.98 |

| Net income | 171.23 | 344.72 | 138.61 |

| Margin (%) | 100.91 | 17.56 | 23.96 |

The Profit After Tax (PAT) has also grown at a remarkable CAGR of 90.75%, from INR 94.74 crore in FY 2022 to INR 344.72 crore in FY 2024. NGEL’s operating EBITDA margin stood at an impressive 88.68% for the three months ending 30 June 2024, signaling strong operational efficiency. As of June 2024, NGEL had total borrowings of INR 15,276.98 crore, with a net debt-to-equity ratio of 2.32 times. Its interest coverage ratio stood at a healthy 2.96 times, demonstrating the company’s ability to service its debt.

| FY 2023 | FY 2024 | |

| EPS | 4.66 | 0.73 |

| RONW (%) | 3.50 | 5.53 |

| NAV | 10.36 | 10.90 |

| EBITDA (%) | – | 89.39 |

| Debt/Equity | 2.05 | 2.40 |

#8 NTPC Green Energy IPO: Key Role in India’s Clean Energy Ambitions

NTPC Green Energy is set to play a critical role in India’s journey toward a more sustainable energy mix. According to CRISIL, India ranks fourth globally in total renewable energy installations, with a renewable capacity of 191 GW (including hydro) as of March 2024. Solar energy, in particular, has grown from 0.09 GW in 2012 to an impressive 82 GW by March 2024. With India aiming for 50% of its total power capacity from non-fossil fuel sources by 2030, NGEL is strategically positioned to capture this market growth.

#9 NTPC Green Energy IPO Analysis: Key Partnerships and Joint Ventures

NTPC Green Energy has strategically aligned itself with major public-sector undertakings (PSUs) and private corporations through joint ventures. Notable partners include Indian Oil Corporation Limited, along with MOUs and term sheets signed with other PSUs and private corporates. These partnerships are designed to support the development of renewable power projects, providing NGEL with additional revenue streams and strategic opportunities to scale its operations.

#10 NTPC Green Energy IPO Review: Risk Factors

- In Fiscal 2024, over 87% of the company’s revenue came from its top five power purchasers, with one contributing 50%. Losing these customers or their financial decline could harm the business and its financial health.

- The company’s profitability depends on the availability and cost of solar modules, wind turbines, and other key materials. Reliance on third-party suppliers means any supply disruptions or price volatility could harm the business and its financial performance.

- The company’s renewable energy projects are concentrated in Rajasthan, making them vulnerable to social, political, economic, or natural disruptions in the region, which could harm its business and financial performance.

- The company faces stiff competition from both traditional and renewable energy firms. The inability to adapt to market changes could harm its business and financial health.

NTPC Green Energy IPO Analysis: Conclusion

The NTPC Green Energy IPO represents a compelling opportunity for investors looking to gain exposure to India’s rapidly growing renewable energy sector. CRISIL expects solar energy to grow at a CAGR of 24.8%, while wind energy additions are projected to rise by 34-36 GW over the next five years in India.

With a strong parent company in NTPC Limited, a diversified portfolio of renewable assets, long-term PPAs that ensure revenue stability, and a substantial project pipeline, NGEL is well-positioned for future growth. The company’s use of advanced technologies for operations and maintenance, along with its strong financial performance, makes it an attractive bet for those seeking to invest in India’s clean energy transition.

Given the significant tailwinds from government policies and global climate goals, NTPC Green Energy is not only an investment in a growing sector but also a commitment to a more sustainable future. Investors with a long-term horizon may find this IPO to be a pivotal addition to their portfolio, offering growth, stability, and alignment with ESG (Environmental, Social, and Governance) principles.