Chennai-based Syrma SGS is ending the IPO draught on the Dalal Street with its public offer opening on 12 August 2022. The company plans to raise INR766 crore by issuing new shares while shares worth as much as INR74.13 crore will be offered through the Offer For Sale (OFS) route. Syrma SGS IPO Review is aimed to bringing readers up to the speed with regards to the company’s business, strengths and IPO valuation.

Syrma SGS IPO – Overview

The company is a technological-based electronic manufacturing service (EMS) firm and has filed a red herring prospectus (RHP) to raise INR840.13 crore that would be a mix of fresh issue of equity shares worth INR766 Crore and an OFS component of INR74.13 crore. Company promoter Veena Kumari Tandon – who holds 3.45% stake in the company – plans to pare her stake by nearly 69% and sell 3,369,360 shares.

Investors can place orders for minimum 68 shares and in multiples thereafter.

| IPO Issue Opening Date | 12 Aug 2022 |

| IPO Issue Closing Date | 18 Aug 2022 |

| IPO Issue Price | INR209 – 220 per share |

| Document Links | DRHP, RHP |

| IPO Listing At | NSE, BSE |

| Offer for Sale | 3,369,360 Shares |

| Fresh Issue | INR766 Crore |

| OFS | 3,369,360 shares (INR70.42 – 74.13 crore) |

| Total IPO Size | INR836.42 – 840.13 crore |

Syrma SGS IPO Review – Company Background

Syrma SGS is a leading design and electronic manufacturing services company with a wide portfolio of product offerings including PCBA, RFID, Electromagnetic and electromechanical parts, motherboards and many that are used in products manufactured in the automotive, industrial appliances, consumer appliances and healthcare industries.

With 11 manufacturing facilities spread across five states (Tamil Nadu, Karnataka, Himachal Pradesh, Haryana, and Uttar Pradesh), 697 permanent employees, and 3,361 contract workers, Syrma SGS meets domestic and international demand across countries like USA, Germany, Austria, and the UK. It has a strong supplier network in India and abroad, with suppliers in over 19 countries, including the United States, Singapore, and China.

Syrma SGS’s major customers are TVS Motor Company Limited, A. O. Smith India Water Products, Robert Bosch Engineering and Business Solution, Atomberg Technologies Private Limited and Total Power Europe B.V.

Syrma SGS IPO Analysis – Industry Outlook

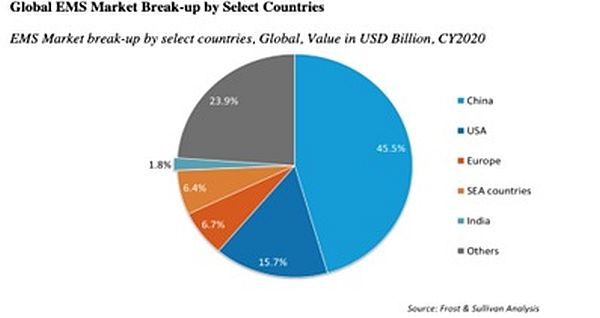

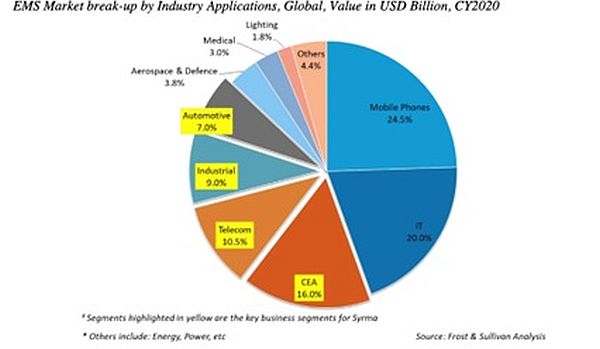

The total electronics market in India was valued at USD91 billion in FY2021, which is expected to grow at a CAGR of 25.5% to reach USD 282 Billion in FY2026. Global EMS industry is likely to accelerate at a CAGR of 15% by 2025, following the Covid 19 pandemic. Additionally, global companies are seen shifting their manufacturing and sourcing bases away from China in a bid to reduce dependence on a single country. Low-cost advantage and availability of high-quality manufacturing base in developing countries like India is likely to offer massive tailwinds to the industry.

The government is driving necessary efforts to help India move among the top 5 countries in electronics production and among the top 3 in electronics consumption. Syrma SGS has also established 3 R&D units for finding low-cost alternatives to the manufacturing of the EMS existing products and increasing exports.

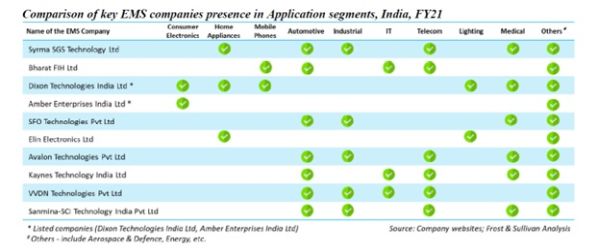

Established players like Dixon Technologies and Amber Enterprises have demonstrated that there is a great deal of confidence in the industry’s potential.

Syrma SGS IPO Analysis – Issue Objectives

Majority of Syrma SGS IPO Proceeds are expected to be utilized in funding capital expenditure requirements for setting up manufacturing facilities and developing R&D facilities, with the remaining funds to support the long-term working capital and corporate needs.

- Setting up a new and expansion of existing manufacturing facility, in Chennai, Hyderabad, Mysore and Tamil Nadu. Research and development laboratory to be developed in Chennai and Hyderabad – INR 571 Crore

- For long-term working capital requirements – INR 131 Crore

- General corporate purposes

Syrma SGS IPO Review – Financial Performance

Revenue from operations has grown from FY2019 to FY2021 at a strong rate and it is noteworthy that revenues didn’t drop in FY2021 when operations were impacted due to Covid-19 pandemic. While profitability suffered in the wake of soft demand, it was on expected lines and the company put up a much better show then several of its competitors.

Syrma IPO Review – Financial Performance

| FY2019 | FY2020 | FY2021 | FY2022 | |

| Revenue | 357.4 | 404.9 | 444.5 | 1,032.4 |

| Expenses | 330.1 | 347.1 | 408.1 | 951.5 |

| Net income | 20.5 | 44.2 | 32.0 | 56.5 |

| Margin (%) | 5.7 | 10.9 | 7.2 | 5.5 |

Its Return on Capital Employed (ROCE) in FY2022 stood at 13.6% and EBITDA at 11.3%, both of which are quite robust figures, albeit lower than comparative figures in previous years. Its profitability and return ratios are yet to recover to pre-covid levels and this recovery will be crucial for the company and its investors in the post-listing era. Thankfully, its debt to equity ratio is quite attractive at 0.33 and this is an important plus point in Syrma IPO Review. This should also go some distance in the expected revival of margins.

Syrma SGS IPO – Strengths & Weaknesses

Strengths

- First company to manufacture RFID products in India and continues to lead the industry

- Manufacturing facilities in Tamil Nadu are placed in SEZs, allowing them to take advantage of specific tax and other incentives in relation to the products manufactured at these facilities.

- Strong R&D Units in 3 cities for exploring alternatives to existing EMS products.

Weaknesses

- Absence of long-term commitments from customers. High raw material import cost at 74.2% of cost of raw materials and components in FY2022.

- Debtor’s turnover ratio is high compared to other peers.

- Uneven profitability.

Syrma SGS IPO Review – Should you invest?

So far in Syrma SGS IPO analysis, we have not found any red flags. This largely indicates that the company’s operations are good. Nevertheless, valuations is where it all starts to falter. Afterall, a good business at a bad price is eventually a bad investment while a bad business purchased at a good price may still reward investors with profits.

The company has priced its IPO at INR209 – 220 per share and it reported earnings per share (EPS) of INR5.17 in FY2022. This translates to a PE ratio of 40.42 – 42.55 which isn’t a screaming buy but turns out an ok multiple when we take a look at the competition. Dixon Technologies currently trades at a PE multiple of 104 while Amber Enterprises is available at 68.7 times its annual earnings.

At sales revenue of just INR1,032 crore, Syrma is quite small compared to its listed peers but boasts of better profitability. Its focus on high mix low volume products is particularly helpful in maintaining its profitability.

One area where Syrma SGS differs from its listed peers is export operations. While Amber Enterprises and Dixon Technologies primarily cater to domestic customers, Syrma SGS gets nearly 43% of its revenue from sales to overseas markets. Without a doubt this is hugely positive for the company. Its strong credentials with global customers also make it a front runner to benefit from the China+1 strategy at several of its global clients. This is an important distinction not just in Syrma SGS IPO review but also post listing.

Since this is manufacturing outsourcing industry, getting repeat business is very important and Syrma SGS shines in this department. In FY2022, it catered to over 200 customers of which 16 customers have been associated for over a period of 10 years. At the same time, it is not overly dependent on its biggest customers. Its top five customers accounted for 41% of revenues in FY20220 and this ratio came down to 29% in FY2022.

Overall, we like the business of Syrma SGS and how it has performed over the last few years. Valuation-wise, it appears to be a reasonable bet for the impressive growth it has achieved in the past and is likely to post in the future. The EMS industry is headed for good times in India and there is a strong chance for incumbents to capitalize on the China+1 strategy. All in all, Syrma SGS IPO review finds Syrma SGS to be nicely placed to capitalize on this trend with an R&D center in Germany and sizeable exports.

Although not a major consideration in Syrma SGS IPO review, it is worth highlighting that the company is commanding a premium of roughly 15% in grey market. Although a small premium, this is positive as broader market sentiments aren’t exactly soaring.