This week, Indian investors have a choice of two IPOs. While Newgen Software IPO opens on 16 January, the public offer of Amber Enterprises will open on the next day. The Gurgaon-based contract manufacturer has priced its IPO in the range of INR855 – 859 per share and plans to raise as much as INR600 crore (INR6 billion) by issuing new shares while promoters will also sell some shares. Our regular readers will find Amber Enterprises quite similar to Dixon Technologies which was among the best performers last year. Through Amber Enterprises IPO Review, we try to find out if investors can make similar outsized returns with the latest public offer.

|

Amber Enterprises IPO details |

|

| Subscription Dates | 17 – 19 January 2018 |

| Price Band | INR855 – 859 per share |

| Fresh issue | INR475 crore |

| Offer For Sale | INR125 crore |

| Total IPO size | INR600 crore |

| Minimum bid (lot size) | 17 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Amber Enterprises IPO Review: Promoters to offload, company to reduce debt

The company plans to raise INR475 crore by issuing new shares. Up to INR400 crore are proposed be used for prepayment or repayment of certain borrowings while the remaining amount will be used for general corporate purposes.

Amber Enterprises IPO will also involve an offer for sale (OFS) of up to INR125 crore and these funds will not be available to the company. Among the sellers are promoters Jasbir Singh and Daljit Singh who plan to cash out up to INR62.5 crore each.

Read Also: Upcoming IPOs in 2018: A quick look at India’s IPO pipeline

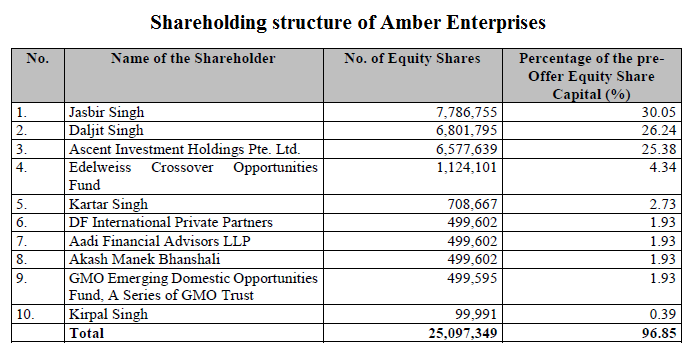

As the table below mentions, there are a number of external investors in the company. Important among these are ADV Partners’ Ascent Investment Holdings (25.38%), Edelweiss Crossover Opportunities Fund (4.34%), and DF International Private Partners (1.93%). None of these investors is selling shares in the IPO and we see it as a sign of confidence in the company’s business model.

Amber Enterprises IPO Review: Room Air Conditioners

As mentioned above, Amber Enterprises is a contract manufacturer like Dixon Technologies but there are differences in the two companies’ business model. While Dixon is into a variety of products like LED TVs, washing machines, LED bulbs and tubelights, and mobile phones, Amber Enterprises is focused on Room Air Conditioner (RAC). This narrow focus on a single product has allowed the company to win OEM/ODM market share of 55.4% in India during FY2017. This surprisingly high figure starts making sense when we consider that leading RAC brands such as Daikin, Hitachi, LG, Panasonic, Voltas and Whirlpool are among the clients of Amber Enterprises.

Read also: Here is why you should consider opening a Free Demat Account

Incorporated in 1990, the company employed 1,152 full-time employees as on 30 November 2017. It started with a single facility in Rajpura, Punjab in 1994 but has now expanded manufacturing operations to 11 factories. As of 31 March 2017, its total annual installed capacity stood at 1.59 million outdoor units (ODUs), 1.37 million indoor units (IDUs) and 0.59 million window air conditioners (WACs). It also makes RAC components such as heat exchangers, motors, inverter and non-inverter printed circuit boards. This means pretty much everything except compressors.

Amber Enterprises IPO Review: Cooling effect

The company has managed to put up a good show in terms of financial performance. It posted a top line of INR882.3 crore in FY2013 and nearly doubled the figure in FY2017. In the first six months of the current FY, it has already posted revenues of INR941.6 crore. With soaring top line, the company has managed to grow its profits every year except in FY2016 when revenues were also down. In all, profitability kept a healthy pace in all these years but tapered off in FY2017 and declined to 1.7% due to high cost of materials consumed. Nevertheless, margins improved to 2.9% in the latest six months to 2.9%.

Apart from other factors, credit for improving profitability needs to go to an improving balance sheet. In the last three financial years, its debt equity ratio has dropped from 1.4 to 1 and this ratio is going to decline further following the IPO.

|

Amber Enterprises’ financial performance (in INR crore) |

||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | H1 FY2018 | |

| Total revenues | 882.3 | 979.7 | 1,236.5 | 1,092.1 | 1,652.3 | 941.6 |

| Total expenses | 853.2 | 949.2 | 1,196.1 | 1,059.4 | 1,613.9 | 904.0 |

| Profit after tax | 19.5 | 21.6 | 28.8 | 24.1 | 27.9 | 27.3 |

| Net margin (%) | 2.2 | 2.2 | 2.3 | 2.2 | 1.7 | 2.9 |

Amber Enterprises IPO Review: Should you invest?

Looking at the company’s performance so far, Amber Enterprises emerges as a winner with a robust product lineup, a well-developed client base and improving financial performance. It is no wonder that the company’s continued success has attracted private investors and at one point of time, it counted Reliance Alternative Investments Fund (AIF) among investors. Reliance AIF exited in December 2016 by selling its stake to Ascent. Edelweiss Crossover Opportunities Fund, DF International Private Partners, and GMO Emerging Domestic Opportunities Fund are relatively new investors and came on board in December 2017. As we mentioned earlier, it is good to see investors’ confidence in the business.

Given the limited number of AC brands in the market, Amber Enterprises has high dependence on few clients. Top 5 customers contributed 74.77% of revenues in FY2017 and the figure for the 10 biggest customers is 92.52%. These numbers indicate very high dependence and loss of a key client may bring the company under pressure but this is a systemic issue with every business that doesn’t cater to retail customers. Most B2B (business to business) firms have this risk in small or large amounts.

Looking at the company’s financial performance, one cannot neglect the low margin of 1.7% in FY2017. As mentioned above, this depression was caused by high raw material costs and does not indicate a trend. On the contrary, an improving balance sheet and better handle on costs has resulted in net margin of 2.9% in the latest six months.

Coming to valuations, the company’s Earnings Per Share (EPS) of INR12.8 in FY2017 translates into Price/Earnings (P/E) ratio of 66.79 – 67.10. Without a doubt, this appears stretched and the Return on Net Worth (RONW) of 8.33% doesn’t things better either. However, FY2017 wouldn’t be a good indicator for benchmarking the performance of the company and we get much better figures by annualizing the six month performance. The PE ratio range drops dramatically to 38.58 – 38.76 by taking the latest results into consideration. This may still appear high but let’s not forget that the stock market is a forward-looking machine. In the last two years, we have seen ample examples of high-growth companies getting rewarded by the market!

Overall, Amber Enterprises IPO Review tells us that the company is suitably positioned to take advantage of the expected increase in AC demand. With bigger scale and the associated benefits kicking in, it appears headed for better times.