Last Updated on January 6, 2025 by Anil Sharma

Private equity (PE) investor Actis Advisers is planning to exit auto components manufacturer Endurance Technologies through an IPO of the latter. The Aurangabad-based company has finalized Axis Capital and Citigroup Global Markets as the bankers for the upcoming IPO, according to sources close to the matter. However, the company is yet to file a prospectus with SEBI.

Private equity (PE) investor Actis Advisers is planning to exit auto components manufacturer Endurance Technologies through an IPO of the latter. The Aurangabad-based company has finalized Axis Capital and Citigroup Global Markets as the bankers for the upcoming IPO, according to sources close to the matter. However, the company is yet to file a prospectus with SEBI.

The UK-based PE firm holds 13.7% equity stake and is looking to shed some shares through Endurance Technologies IPO which will likely be around INR1,000 crore (INR10 billion). “It is going to be part-OFS (offer for sale) and part primary. Overall, it will be a deal of around INR1,000 crore, depending on how much holding Actis decides to sell. It has not been finalised yet. The work is on and the prospectus will be filed over the next month or so,” one of the persons said.

Actis bought out Standard Chartered PE in Endurance Technologies in December 2011 in a deal worth USD71 million (INR372.5 crore). The investment by Standard Chartered PE turned out to be a profitable one as it doubled its money in five years. At that time too, Endurance had filed IPO application with market regulator SEBI but the offer was put on hold following the investment by Actis.

Endurance Technologies – Big player but still unlisted

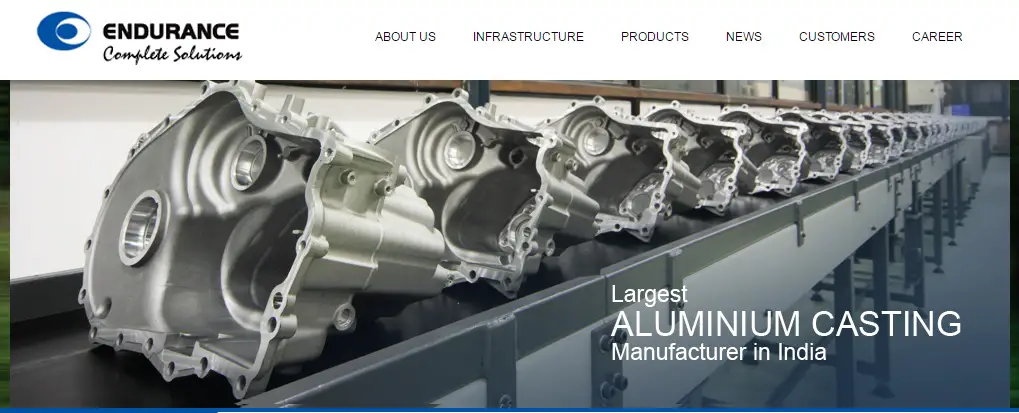

Endurance makes aluminium die castings, suspensions, transmissions and brakes, and supplies OEMs like Bajaj Auto, Mahindra & Mahindra, Eicher, Royal Enfield, Harley Davidson and Tata Motors through its 24 manufacturing locations across the world.

Established in 1985, Endurance Technologies is one of the largest players in the components industry but still remains unquoted on the stock exchanges. According to regulatory documents, the company posted consolidated revenue of INR4,955.7 crore in FY14/15, marking a jump of 16.7% from INR4,245 crore posted in the previous year. A sharper jump of 22% was registered in its net profits to INR253 crore.

So far in 2016, 10 companies have come up with their IPOs and have raised about INR6,700 crore. Successful IPOs this year include a sector play Precision Camshafts which was the first public offer this year.