Last Updated on December 13, 2025 by Rajat Bhati

What is Pre-open Market in India?

The pre-open market session is used to determine the ideal price for a stock for the upcoming trading session on a market day. The pre-open market session lasts from 9:00 AM to 9:15 AM. The NSE and BSE trading sessions begin after 9:15 AM. The purpose of the pre-open market session is to mitigate the volatility caused by major overnight events such as company announcements, mergers and acquisitions, political news, changes in management, and company restructuring, all of which have a significant impact on investors and the stock price itself.

The BSE and NSE pre-open market sessions neutralize this volatility by determining the demand and supply of the shares to be traded. The price at which demand and supply are determined is called equilibrium price. This helps in bringing stability in stock as prices are not determined by trends or events.

Pre-Open Market Timings in India: Break Up

1- Order Entry Session

Time: 9 AM – 9:08 AM

- Buying & selling orders are placed in this session. It could be limit or market orders.

- Orders can be modified in this session, that is one can edit, cancel and replace the order.

- After 8 minutes, no orders are accepted.

2- Order Matching Session

Time: 9:08 AM – 9:12 AM

- Order confirmation and order matching of all buy & sell orders.

- Determining the opening price for the normal session that begins after 9:15 AM.

- In this session, no buying, selling or modification of an order takes place.

3- Buffer Session

Time: 9:12 AM – 9:15 AM

- This session allows the transition of the pre-open market to a regular market session.

- This session handles any issues or discrepancies that arise in previous sessions.

Read Also: REIT Investing in India: Meaning, Examples, Best REIT Stocks in 2022

How is Stock Price Determined in Pre-opening Session?

During the pre-open market session, the call auction will take all buying and selling orders and attempt to match them against an equilibrium price. In economics, the price at which demand, and supply meet is referred to as the equilibrium price. In trading, the equilibrium price is the price at which the maximum number of stocks can be traded based on the quantity of demand and supply and the price at which they are traded.

Let’s understand case-wise how equilibrium price is determined in pre-open market.

Consider Reliance previous day closing was INR2,050.

Read Also: Top 10 Most Expensive Stocks in India

Case 1 (Maximum traded quantity corresponds to one price)

In the order entry session of pre-open market, following was the scenario

| Stock Price | Demand Qty | Supply Qty | Maximum Tradable Quantity | Unmatched orders |

| 2100 | 4000 | 1000 | 1000 | 3000 |

| 2150 | 30000 | 26000 | 26000 | 4000 |

| 2200 | 8000 | 8500 | 8000 | -500 |

| 1950 | 5500 | 8000 | 5500 | -2500 |

| 1900 | 20000 | 30000 | 20000 | -10000 |

- The maximum traded quantity corresponds to price INR2150, so equilibrium price would be INR 2150

Case 2 (Maximum traded quantity corresponds to two prices)

| Stock Price | Demand Qty | Supply Qty | Maximum Tradable Quantity | Unmatched orders |

| 2100 | 4000 | 1000 | 1000 | 3000 |

| 2150 | 32000 | 26000 | 26000 | 6000 |

| 2200 | 8000 | 8500 | 8000 | -500 |

| 1950 | 5500 | 8000 | 5500 | -2500 |

| 1900 | 26000 | 30000 | 26000 | -4000 |

- In this case, the maximum traded quantity that corresponds to the minimum unmatched order would be considered as equilibrium price.

- INR 1900 would be identified as the equilibrium price. (Price 1900 has 4000 unmatched orders, while price 2150 has 6000 unmatched orders)

Case 3 (Maximum traded quantity and unmatched orders are same at both prices)

| Stock Price | Demand Qty | Supply Qty | Maximum Tradable Quantity | Unmatched orders |

| 2100 | 4000 | 1000 | 1000 | 3000 |

| 2150 | 30000 | 26000 | 26000 | 4000 |

| 2200 | 8000 | 8500 | 8000 | -500 |

| 1950 | 5500 | 8000 | 5500 | -2500 |

| 1900 | 26000 | 30000 | 26000 | -4000 |

- Both prices 1900 and 2150 correspond to the same maximum tradable quantity and unmatched orders in this case.

- The price that is closest to the previous day’s closing price, INR 2050, will be considered the equilibrium price.

- INR 2150 would be identified as the equilibrium price.

Case 4 (Maximum traded quantity and unmatched orders are the same and equidistant from the closing price at both stock prices)

| Stock Price | Demand Qty | Supply Qty | Maximum Tradable Quantity | Unmatched orders |

| 2100 | 4000 | 1000 | 1000 | 3000 |

| 2150 | 30000 | 26000 | 26000 | 4000 |

| 2200 | 8000 | 8500 | 8000 | -500 |

| 1950 | 5500 | 8000 | 5500 | -2500 |

| 1950 | 26000 | 30000 | 26000 | -4000 |

- Both prices INR1950 and INR2150 are equidistant from closing price.

- In this case, the previous day closing price is equilibrium price.

- INR 2050 is the equilibrium price.

The orders that stand unmatched in pre-open market session are carried forwarded to normal market session and opening price in that case would be

- Limit orders that are unmatched during the pre-open market session will be carried over to the regular market session at the same price at which they were placed.

- Market orders that are unmatched during the pre-open market session will be carried over to the regular market session at the opening price.

- In case, no opening price is discovered during the pre-open market session then the market order will be shifted to the normal market session at the previous day’s closing price.

How to Trade in Pre open Market Session?

- Anyone can trade in a stock market pre-opening but ideally, new traders should restrain from doing so if they have limited trading knowledge as it could lead to heavy losses in their trading account in case of a large price fluctuation.

- Institutional investors generally have a trading edge in pre–open market sessions.

- This feature needs to be activated in your account through your respective broker.

Sensex & Nifty Pre open Market

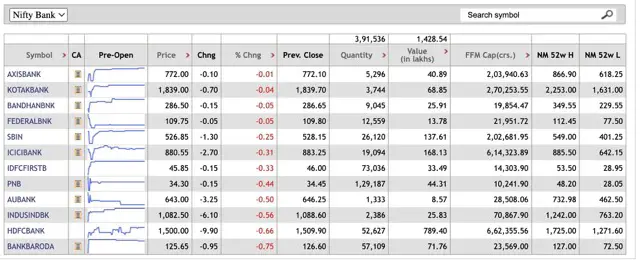

Stocks in Nifty 50, Bank Nifty index and Sensex 30 are enabled for trading in pre-opening market sessions by exchanges. The timings for the Nifty pre open market and Sensex pre-opening market are the same.

In conclusion, we can say that the pre open market session in Indian stock exchanges (BSE and NSE) is reserved for big traders and seasoned investors. Even though there is nothing stopping a rookie to trade in the session, it is best avoided by beginners for the above mentioned reasons.