Chennai-based Aptus Value Housing Finance (AVHF) has filed draft papers with capital market regulator SEBI to launch its maiden public offer. Aptus Value Housing Finance IPO papers are filed at a time when several other players have approached the regulator (here is the full list of companies having filed prospectus). Here are a few points you need to know about the company and its business:

#1 Aptus Value Housing Finance IPO: Fresh + OFS

According to market sources, Aptus Value Housing Finance IPO is expected to mobilize around INR2,600 – 3,000 crore (INR26 – 30 billion). This will be a combination of fresh equity raise as well as sale by existing shareholders. A total of INR500 crore are proposed to be raised through fresh issue of equity shares. These funds will be used towards augmenting the lender’s capital base to meet its future capital requirements.

In addition, 6.46 crore equity shares will be offered by AVHF’s shareholders and promoters.

#2 Aptus Value Housing Finance Capital Structure

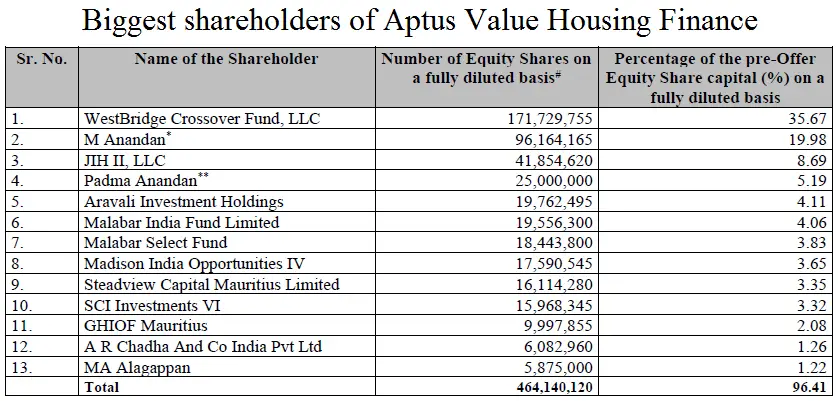

Westbridge Capital is the biggest shareholder in the company with nearly 36% equity stake. Other prominent investors include Sequoia Capital, Steadview Capital and Malabar Investment Advisors. Together, these investors own nearly 55% equity stake in the company.

Read Also: Shyam Metalics IPO: 10 points you need to know

#3 Retail Focused Business Model

The company offers housing loans, serving low and middle income self-employed customers in the rural and semi-urban areas. However, a unique aspect in its business model is that AVHF is entirely foused on retail customers and does not offer any loans to builders or for commercial real estate.

It is one of the largest housing finance companies in South India in terms of asset under management and has the largest network of 181 branches.

As of 31 December 2020, AVHF’s AUM stood at INR3,790.9 crore, representing a split of 72.5% and 27.5% between self-employed and salaried individuals, respectively. It had 56,430 active loan accounts across 75 districts in Tamil Nadu, Andhra Pradesh, Karnataka, Telangana and the Union Territory of Puducherry.

#4 Aptus Value Housing: Pristine Asset Quality

Aptus Value Housing Finance boasts of solid asset quality, represented through net NPA (Non-Performing Asset) of just 0.57% and Collection Efficiency at 99.2% as of 31 December 2020. Similarly, its RoA (Return on Assets) and RoE (Return on Equity) stood at 6.3% and 17.5% as of 31 March 2020.

#5 Financial Performance: On a strong footing

The company’s financial performance has been quite impressive in recent years. Revenue growth has been consistent through the years as a clear indication of a secular trend. At the same time, the company boasts of a strong control on costs so growth in profits has also been consistently high. AVHF has one of the lowest cost to income ratio at 26.4% as compared with peers in the Industry.

| FY2018 | FY2019 | FY2020 | 9M FY2021 | |

| Revenue | 199.2 | 323.9 | 500.3 | 461.2 |

| Expenses | 101.1 | 184.3 | 276.4 | 226.2 |

| Comprehensive income | 66.5 | 111.5 | 210.9 | 191.3 |

| Margin (%) | 33.4 | 34.4 | 42.2 | 41.5 |

#6 Strategy: Same segment, new geographies

In the coming years, AVHF plans to continue to focus on low and middle income self-employed customers in rural and semi-urban markets. This means that the company will continue to disburse loans with an average ticket size in the range of INR5 lakh to INR15 lakh.

However, the company aims to expand its operations beyond the current geographies to include Maharashtra, Odisha and Chhattisgarh.

Given all these positives in its business model, Aptus Value Housing Finance IPO will be closely watched. As always, a lot will depend on pricing but if valuations are right, this offer could be a portfolio stock for IPO investors.

yes it is a valuable information