Campus Activewear IPO opens for subscription on 26 April 2022 and is scheduled to close on 28 April 2022. The company is a leading sports and athleisure footwear brand in India. Campus Activewear IPO Review is aimed at bringing readers up to the speed with regards to the company’s business, strengths and valuation.

Campus Activewear IPO Review – Strengths

- India’s largest sports and athleisure footwear brand in terms of value and volume

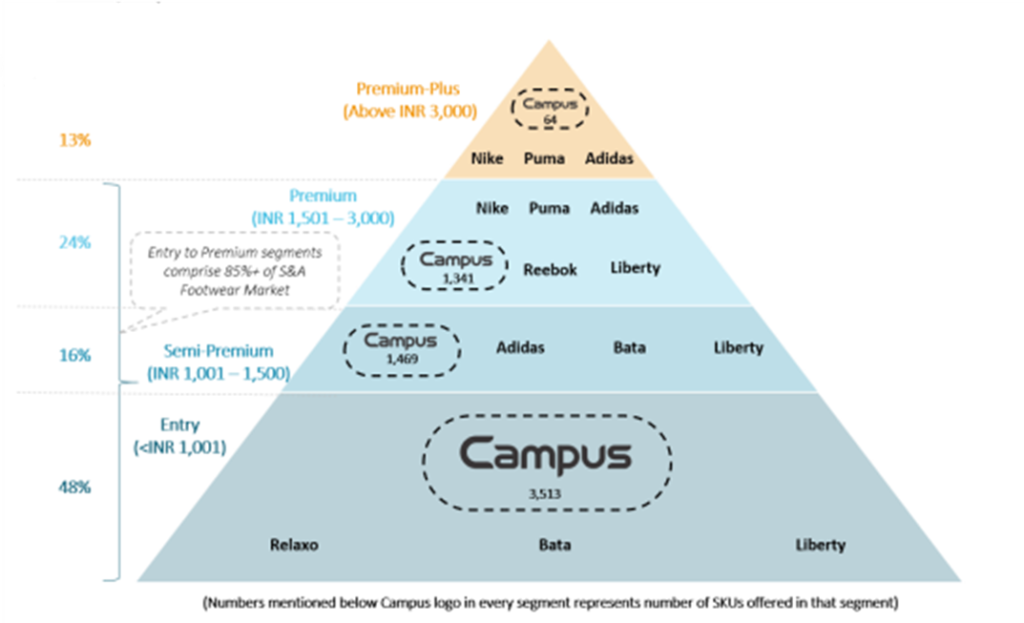

- Robust product portfolio across the demand spectrum covering over 85% of the total addressable market

- Pan India presence with a focus on tier 2 and tier 3 cities

- Growing D2C presence through online and offline channels

- Sustained focus on design and product innovation facilitating access to the latest global trends and styles

- Integrated manufacturing capabilities supported by robust supply chain

- Strong brand recognition, innovative branding and marketing approach

- Experienced management team

Campus Activewear IPO Analysis – Risk Factors

- Highly competitive industry

- Excessive reliance on trade distribution channel for a majority of sales (81.36% in FY2021)

- Dependence on third parties to manufacture slippers

- Limited control over the ultimate retail sales by distributors and retailers

- Seasonal nature of the business (revenues in third and fourth quarters tend to exceed remaining quarters)

- Negative cashflows in recent years

Campus Activewear IPO Analysis – Financial Performance

| FY2019 | FY2020 | FY2021 | 9M FY2022 | |

| Revenue | 596.7 | 734.1 | 715.1 | 843.9 |

| Expenses | 530.4 | 635.4 | 645.1 | 730.0 |

| Net income | 38.6 | 62.4 | 26.9 | 84.8 |

| Net margin (%) | 6.5 | 8.5 | 3.8 | 10.0 |

Campus Activewear Valuations & Margins

| FY2019 | FY2020 | FY2021 | |

| EPS | 1.28 | 2.05 | 0.88 |

| PE ratio | NA | NA | 315.091 – 331.82 |

| RONW (%) | 19.04 | 21.63 | 8.60 |

| ROCE (%) | 21.88 | 21.03 | 18.54 |

| EBITDA (%) | 17.12 | 18.90 | 16.84 |

| Debt/Equity | 0.87 | 0.85 | 0.43 |

| NAV | 6.72 | 9.45 | 10.29 |

Campus Activewear IPO Review – Subscribe or Avoid?

Campus Activewear is the largest sports and athleisure footwear brand in India and offers a diverse and versatile product portfolio in the footwear segment. It offers multiple choices across style, color palates, price points and an attractive product value proposition. The company is also the fastest-growing scaled sports and athleisure footwear brand in India and serves over 85% total addressable market for sports and athleisure footwear in India as of FY2021.

As seen in the above image, Campus has presence across segments from entry-level to premium plus. Campus competes with highly recognized brands such as Nike, Puma, Adidas, Reebok, Bata, Relaxo and so on. Campus has the highest number of SKUs (3,513) in entry-level segment. As of FY2021, Campus had 17% market share in the sports and athleisure footwear industry in India by value.

Market Overview – Huge scope

The Indian footwear industry is quite versatile and is expected to grow at a CAGR of 21.6% from FY2021 to FY2025. It is one of the fastest-growing discretionary categories from Fiscal 2021 to Fiscal 2025. In this footwear industry, the particular segment of sports and athleisure footwear is highly underpenetrated. That is evidenced by the extremely low footwear penetration per capita as compared to developed economies and as a result, this segment is expected to expand at a CAGR of 25% from FY2021 to FY2025.

Campus Shoes IPO Review – The road ahead

Among its most prominent strengths are strong brand recognition and pan-India sales and distribution network. Both these points are likely to aid its strategy to expand in premium category.

Despite its integrated operations, Campus Activewear outsources a significant portion of its raw materials like soles and uppers, although assembly is 100% in-house. With recent capital investments in its facilities, the company aims to reduce its dependence on external vendors.

Are Campus Activewear’s valuations attractive?

It is noteworthy that the company has witnessed declining return ratios such as ROCE. Although FY2021 was an aberration due to Covid-19, it needs to be noted that profitability and return ratios took a beating despite a sharp reduction in debt equity ratio. The company’s financial performance has been quite strong in the nine months ended 31 December 2021 as the pent-up demand found way in the market.

Its nine-month EPS of INR2.82 translates to annualized figure of INR3.76 which puts the price band of INR278 – 292 per share to a PE ratio range of 73.94 – 77.66. Even after adjusting for all the growth promises, these figures appear to be on the higher side.

If we take a different approach and value the company on the basis of sales revenues, its EV/Sales ratio for FY2021 stands at 12.7 which is slightly higher than 11.8 for market leader Relaxo Footwears, although lower than 14.4 for Bata India. Campus Activewear’s EV/EBITDA is also quite high at 78.1 compared to 56.4 for Relaxo and 58.6 for Bata India. Quite clearly, the IPO appears to be priced on the higher side.

An important distinction here is Campus Activewear’s dependence on tier II and tier III cities. These cities contributed 78.25% to the company’s total revenue in FY2021. Affordability is a key issue in tier II and tier III cities and increasing Average Selling Price (ASP) from current levels might be a challenge for the company.

The fact that this upcoming public offer has got no fresh component and is purely an offering to allow exit to private equity investors TPG and QRG is a further dampener.

Overall, Campus Shoes IPO review reveals that the company is a solid growth story that appears to have been priced to perfection. Although there is a decent premium in the grey market, investors should be careful and shouldn’t be dependent to this single criterion.

Campus Shoes IPO Review – Broker Calls

Angel One – Neutral

Arihant Capital –

Ashika Research – Subscribe

Asit C Mehta –

BP Wealth – Subscribe

Canara Bank Securities – Subscribe

Choice Broking – Subscribe with caution

Elite Wealth – Subscribe

GEPL Capital –

Hem Securities – Subscribe

ICICIdirect – Subscribe

KR Choksey – Subscribe

Marwadi Financial Services –

Motilal Oswal –

Nirmal Bang – Subscribe for long term

Religare Broking –

Samco Securities – Subscribe for long term

Share India Securities –

SMC Global – 2.5/5

Systematix –

Ventura Securities – Subscribe