As the 14th public offer in India, Dilip Buildcon IPO opens for subscription on 1 August and will close on 3 August. Priced in the range of INR214-219 per share, the IPO will raise INR430 crore by issuing fresh shares while 10,227,273 shares will be sold by existing shareholders through an offer for sale (OFS). In total, Dilip Buildcon IPO will mobilize around INR653.97 crore at the upper end of the price band. Retail investors will be offered 35% shares in the offer. Shares of Dilip Buildcon are proposed to be quoted on BSE and NSE on the listing date of 11 August. Lead managers of the IPO are Axis Capital, IIFL Holdings, JM Financial Institutional Securities and PNB Investment Services.

As the 14th public offer in India, Dilip Buildcon IPO opens for subscription on 1 August and will close on 3 August. Priced in the range of INR214-219 per share, the IPO will raise INR430 crore by issuing fresh shares while 10,227,273 shares will be sold by existing shareholders through an offer for sale (OFS). In total, Dilip Buildcon IPO will mobilize around INR653.97 crore at the upper end of the price band. Retail investors will be offered 35% shares in the offer. Shares of Dilip Buildcon are proposed to be quoted on BSE and NSE on the listing date of 11 August. Lead managers of the IPO are Axis Capital, IIFL Holdings, JM Financial Institutional Securities and PNB Investment Services.

Bhopal-based Dilip Buildcon filed its IPO application with the market regulator in March 2015 and got the approval in June 2015. However, the company reduced the IPO fresh issue size from INR650 crore and filed the application again in February. The IPO size has been reduced on account of modest sentiments among FIIs regarding the infrastructure sector. In the last year, MEP Infrastructure Developers, PNC Infratech, and Sadbhav Infrastructure Projects came with their IPOs which offered modest or negative returns to investors. As a result, expectations are not very high with Dilip Buildcon IPO. We try to figure out in this IPO review if the company deserves investors’ hard earned money.

Dilip Buildcon IPO details

| IPO dates | 1 – 3 Aug 2016 |

| Price Band | INR214 – 219 per share |

| Issue Size | INR653.97 crore |

| Fresh Issue | INR430 crore |

| Offer for share (OFS) | 10,227,273 shares (INR223.97 crore) |

| Minimum bid (lot size) | 65 shares |

| Retail allocation | 35% |

Dilip Buildcon IPO Structure

Dilip Buildcon was started by first-generation entrepreneur Dilip Suryavanshi who has 32 years of experience in the construction business. Dilip Suryavanshi, Seema Suryavanshi, Devendra Jain and Suryavanshi Family Trust are the promoters of the company and collectively own 90.25% equity stake. Another prominent party in the shareholding structure is BanyanTree Growth Capital LLC which has the remaining 9.75% stake.

Dilip Suryavanshi and Devendra Jain will be selling 1,136,364 shares in Dilip Buildcon IPO while BanyanTree Growth Capital will sell 7,954,545 shares. Following the IPO, BanyanTree Growth Capital’s stake in the company will fall to 2.95%. BanyanTree Growth Capital made its investment in February and March 2012.

Fun Trivia – Among promoters, the highest cost of acquisition for shares is for Seema Suryavanshi at INR5.41 per share. For BanyanTree Growth Capital, the cost of acquisition works out to INR65.67 per share.

Major shareholders in Dilip Buildcon | ||

| Name of shareholder | Equity Shares | Percentage (%) |

| Dilip Suryavanshi | 56,809,851 | 48.50 |

| Devendra Jain | 36,999,936 | 31.59 |

| Seema Suryavanshi | 11,904,200 | 10.16 |

| BanyanTree Growth Capital LLC | 11,420,969 | 9.75 |

| Suryavanshi Family Trust | 100 | 0.00 |

| Karan Suryavanshi | 3 | 0.00 |

| Suryavanshi Minerals Private Limited | 3 | 0.00 |

| Dilip Suryavanshi HUF | 3 | 0.00 |

| Total | 117,135,065 | 100.00 |

Where is the money going? (aka Use of Proceeds)

Out of the INR430 crore it will get from Dilip Buildcon IPO, the company plans to spend INR202.38 crore on prepayment/repayment of a portion of term loans while another INR200 crore will be used towards working capital requirement. Practically speaking, almost all of the IPO proceeds will be used to retire debt. This is not at all different from what the other IPO companies did last year and is quite a sensible step for a company whose total consolidated debt jumped from INR737 crore in FY2012 to INR3,825.3 crore in FY2016. However, as one can see, there is not much this IPO is going to do to bring down the bloated net debt equity ratio of 2.2.

| Fresh issue size | INR430 crore |

| Prepayment/repayment of a portion of term loans availed by the company | INR202.38 crore |

| To meet working capital requirement | INR200 crore |

Dilip Buildcon’s business background

So why did Dilip Buildcon need to amass a debt of INR3,825.3 crore on its books? Well, the answer lies in its capital intensive business operations. The company is a road-focused EPC contractor with some interest in irrigation sector and urban development business. All of these operations require enormous amounts of capital and owing all the equipment, as Dilip Buildcon does, further increases capital requirements.

Read Also: Hits and misses in India’s IPO market in H1 2016

Dilip Buildcon has traditionally focused on Madhya Pradesh, Gujarat, Himachal Pradesh, Rajasthan and Maharashtra although it has ongoing projects in Tamil Nadu, Punjab, Chhatisgarh, Jharkhand, Haryana, Telangana, Andhra Pradesh, Karnataka, Goa and Uttar Pradesh. The company claims to operate one of the largest fleets of construction equipment in India. As of 31 March 2016, its fleet included 7,345 vehicles and other construction equipment from Schwing Stettar, Metso, Wirtgen and Vogele. A detailed description of its business segments is available here.

Dilip Buildcon building solid financial performance

Last few years have been very taxing on infrastructure companies and that’s the reason why so many public offers came from the sector last year when sentiments turned positive in the IPO market. Not surprisingly, most of the IPOs had the common agenda of retiring debt through IPO proceeds. In this gloomy scenario, Dilip Buildcon has made good progress with its operations. Top line has grown impressively from INR1,192.8 crore in FY2012 to INR4,348 crore in FY2016 which translates into a CAGR of around 36%. This is commendable as several other players in the sector have struggled in the recent years. At the same time, its order book has grown considerably during the last four years and stood at INR10,778.7 crore as of 31 March 2016, nearly 2.5 times its FY2016 revenues.

Dilip Buildcon’s consolidated financial performance (in INR crore) | |||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 1,192.8 | 1,926.8 | 2,401.5 | 2,768.5 | 4,348.9 |

| Total expenses | 1,028.5 | 1,637.1 | 2,159.8 | 2,635.3 | 4,118.1 |

| Profit after tax | 108.1 | 241.2 | 185.6 | 87.6 | 196.6 |

| Net profit margin (%) | 9.1 | 12.5 | 7.7 | 3.2 | 4.5 |

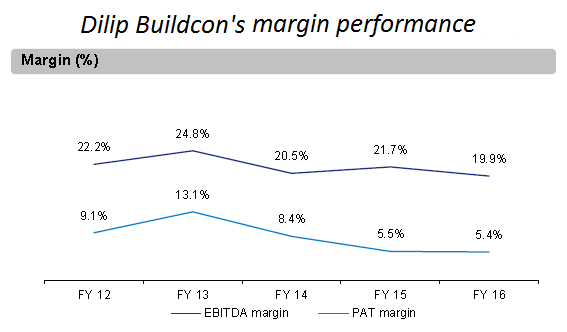

However, the positives end with top line as profitability has been uneven and has dropped considerably in the last two years. This is understandable and one of the culprits here is the high debt on the books. More importantly, its profit margins have come under pressure and have remained at 3.2% and 4.5% in FY 2015 and FY2016 respectively. As displayed in the chart below, margins have come down at EBITDA level as well.

Should you subscribe?

With its annuity focused portfolio, Dilip Buildcon gets assured annual payments that minimize dependence on traffic volume. The company has also moved into other businesses and geographies to diversify key risks. In fact, the share of orders outside of Madhya Pradesh reduced from 33.8% in FY2012 to 60.5% in FY2016. Another positive for the company (and the entire sector) is Modi government’s seriousness about removing bottlenecks in road construction business and invest more. For FY2017, the government plans to award 25,000 km of road projects, up from 10,000 km in FY2016. This may be a good opportunity for Dilip Buildcon which has built a reputation of executing on time.

Despite its slightly differentiated business model and the efforts to diversify, there shouldn’t be any doubt that it remains an infrastructure play after all and comes with most of the negatives that the industry is well known for. Debt is one, land acquisition is another and then there are delays, even though reducing, in the regulatory corridors. The company understands these challenges and has indicated it may sell some of its BOT projects.

In terms of valuations, Dilip Buildcon had consolidated EPS of INR16.79 in FY2016, which values the business a price earnings (PE) ratio of nearly 13 at the upper price band of INR214-219 per share. This may look attractive but let’s not forget its EPS was only INR8.19 in FY2015 which results in a PE multiple of 26.7 times on FY2015 earnings. For FY2016, Dilip Buildcon’s Return on Net Worth (RONW) was 19.64% which is highest among its peer group but several competitor are available at comparable or better PE multiples. IRB Infrastructure and IL&FS Transportation Networks, both bigger than Dilip Buildcon, are available at lower PE ratios.

Finally, a word about management. Not much information is available about Dilip Suryavanshi or Devendra Jain in public domain except their performance at Dilip Buildcon which is no inferior achievement, going by how the company’s operations have grown. Promoters and senior executives are often rewarded handsomely for the efforts and risks they undertake and Dilip Buildcon is no different in this game. Dilip Suryavanshi and Devendra Jain received compensation of INR8.5 crore each in FY2016 while Seema Suryavanshi earned INR1.8 crore in the year. We understand that promoters are members of highly paid species but these are fairly high figures and have only grown over the last four years. Although these payments are less than the exorbitant compensation Precision Camshafts paid to its promoters in FY2015, these are easily among the top bracket considering the saner payouts to Thyrocare’s A Velumani.

Overall, Dilip Buildcon IPO comes across as a decent play in a sector that is likely to see more action in coming years. However, there is no novelty value attached to it and investors may wonder why to invest in this company when comparable or better options are available in the market. Since there is positivity around IPOs this time and grey market premiums (GMP) are generally high, Dilip Buildcon IPO may end up giving some listing gains but these are unlikely to be substantial. Investors may look at the competing IPO of SP Apparels which is going to open for subscription on 2 August. We will come up with an IPO analysis for this issue in the coming days.

Mr Bagra i have been reading your analyses for nearly half a year now and i must say this. Your analysis has gotten sharper and prescient with every piece. Thank you for all these insights.

Thank you raj, I’m glad the analysis is helpful. I’ve noticed you are a regular commentator on IPO discussions. Kudos to you, this platform is vibrant because of users like you.

Keep posting your thoughts 🙂

Hi,

I am a newbie to this forum.

But at the outset must congratulate the detailed and incisive dissection aimed at retail investors. Retail investors are currently going through herd mentality while applying for IPOs, further aided by listing gains of the last couple of issues.

It has been rightly pointed out that there isn’t much of novelty in both Dilip and SP apparel IPOs.

At this point of time, the response to the IPO has also been lukewarm, which again might mean hardly worthwhile listing gains.

Retail investors may end up getting allotment, and as usually happens when we get allotment it would most likely be dud issues.

One may consider applying on the last day and looking at the subscription levels for excitement and subscribing to the Olympic motto: Participation!!

Sometimes fortune favours the brave like Infibeam, Parag, Manpasand IPOs which did not have great subscriptions levels but ended up giving good returns to investors with a risk appetite.

Thanks Prakash, it is positive feedback from readers like you which keep us going. You are right in pointing out that retail investors largely follow the herd mentality but things are changing for good. We had several IPOs last year where retail investors stayed away.Hopefully, better sense will prevail.

Thanks again for writing in. Keep reading and sharing!!