Consumer durables firm Dixon Technologies will come up with its IPO on 6 September and the same will remain open for subscription till 8 September 2017. The Noida based company makes products in the consumer durables, lighting and mobile phone segments and counts several big brands among its clients (more on this later). Dixon Technologies IPO, priced in the range of INR1,760 – 1,766 per share, will raise anywhere in the range of INR597.45 crore to INR599.28 crore.

Consumer durables firm Dixon Technologies will come up with its IPO on 6 September and the same will remain open for subscription till 8 September 2017. The Noida based company makes products in the consumer durables, lighting and mobile phone segments and counts several big brands among its clients (more on this later). Dixon Technologies IPO, priced in the range of INR1,760 – 1,766 per share, will raise anywhere in the range of INR597.45 crore to INR599.28 crore.

Through Dixon Technologies IPO review, we try to find out if the offer is worth a serious consideration. Here are some essential details about the IPO.

Dixon Technologies IPO details | |

| Subscription Dates | 6 – 8 September 2017 |

| Price Band | INR1,760 – 1,766 per share |

| Fresh issue | INR60 crore |

| Offer For Sale | 3,053,675 shares (INR537.45 -539.28 crore) |

| Total IPO size | INR597.45 – 599.28 crore |

| Minimum bid (lot size) | 8 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Dixon Technologies IPO Review: Little fresh, more OFS

Dixon Technologies IPO will be a mix of fresh shares and an offer for sale (OFS) by existing shareholders. The company plans to raise INR60 crore by issuing new shares. This money is proposed to be used towards:

- Repayment/pre-payment, in full or in part, of certain borrowings availed by the company – INR22 crore

- Setting up a unit for manufacturing of LED TVs at the Tirupati Facility – 58 crore

- Enhancement of backward integration capabilities in the lighting products vertical at the Dehradun I Facility – 86 crore

- Upgradation of the information technology infrastructure of the company – 63 crore

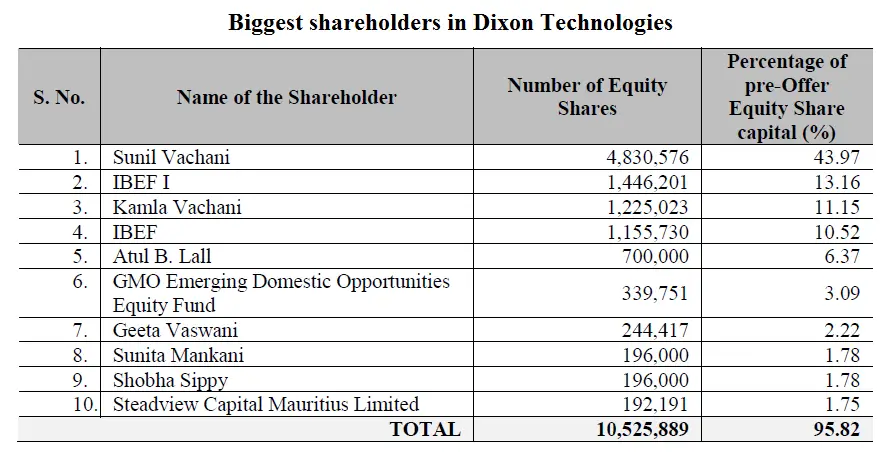

Among the biggest shareholders in the company, besides promoters, is Motilal Oswal Group’s Indian Business Excellence Fund (IBEF) which owns 2,601,931 shares or 23.68% stake through two funds. Motilal Oswal invested in the company in 2008. The private equity arm will sell majority of its investment and will be left with just 660,417 shares following the IPO.

In total, 3,053,675 equity shares are proposed to be sold by existing shareholders. Included among this are 634,368 shares by Sunil Vachani; and 477,793 equity shares collectively by Atul B. Lall, Kamla Vachani, Geeta Vaswani, Sunita Mankani and Shobha Sippy.

Dixon Technologies IPO Review: Design and production capabilities

As mentioned above, Dixon Technologies is into the business of producing a diverse range of consumer electronics items like LED TVs, home appliances like washing machines, lighting products like LED bulbs and tubelights, downlighters and CFL bulbs, and mobile phones. In addition, it offers reverse logistics solutions related to repair and refurbishment services of these products. Several big brand names in these product lines such as Panasonic, Philips, Haier, Gionee, Surya, Intex, and Mitashi are clients of Dixon Technologies.

An interesting fact about the company is that it is not merely a contract manufacturer but also has design capabilities to offer to clients. Dixon Technologies is a leading Original Design Manufacturer (ODM) of lighting products, LED TVs and semi-automatic washing machines in India. This means it develops and designs its own products and supplies the same to well-known companies for sales under different brand names. This essentially makes the company a fully-integrated player.

With 34.4% of the total revenues in FY2017, Consumer electronics is the largest business vertical, followed by Mobile phones which contributed 33%. Lighting products at 22.4% is another important business line, followed by Home appliances (7.6%) and Reverse logistics (2.5%).

Read Also: Dixon Technologies IPO priced at INR1,760-1,766, issue opens on 6 Sep

Dixon Technologies IPO Review: Financial performance

Dixon Technologies has had an impressive performance in terms of expanding business in recent years. Its revenues have grown at a staggering average rate of 33.78% in the last year, expanding from INR768 crore in FY2013 to INR2,458.3 crore in FY2017. Thanks to this awesome growth in revenues, profits have also increased substantially in the timeframe. From merely INR5 crore in FY2013, net profit exploded 10X to INR50.4 crore in the latest year.

Dixon Technologies’ financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | ||

| Total revenue | 768.0 | 1,097.1 | 1,203.1 | 1,391.2 | 2,458.3 | |

| Total expenses | 763.0 | 1,084.3 | 1,185.9 | 1,352.3 | 2,389.4 | |

| Profit after tax | 5.0 | 13.5 | 11.9 | 42.6 | 50.4 | |

| Net margin (%) | 0.7 | 1.2 | 1.0 | 3.1 | 2.1 | |

Beyond the fantastic numbers, couple of factors has caught our attention. It is worth noting that the ODM business, closely associated with the often neglected research & development (R&D), is not a drag on the company’s overall operations. In fact, the ODM business contributed 14.72%, 26.88% and 21.88% to its revenue from operations in FY 2015, 2016 and 2017, respectively.

Another important factor is about the quality of earnings. Despite such strong growth in business, the company has managed to keep its balance sheet clean and it has a long-term debt/equity ratio of just 0.07. This has helped immensely in keeping costs down and in posted better profit margins. On a parameter like Return on Capital Employed (ROCE), the company has progressively posted better figures with FY2017 performance at 36.53%.

Dixon Technologies IPO Review: Invest/Avoid?

Finally, we are back to the most important question. Frankly, there is nothing on the face of it that we can dislike about this company. They were smart enough to attract private equity early on and have posted strong business performances in these years. Profits have improved and as we highlighted earlier, there are other positive factors to look forward to.

On the concerns front, there are not many except the fact that the company has excessive dependence on few clients. Top five customers accounted for nearly 83% of its revenues in FY2017. Panasonic alone accounted for 38.5% while Philips Lighting also had a high figure of 20.2%. Although these companies have been Dixon’s clients for 4 and 8 years respectively, this high concentration is still a matter of concern. Nevertheless, it is not an uncommon phenomenon with small and upcoming businesses.

Read Also: Barbeque Nation files draft prospectus for IPO

As a result, it boils down to valuations. The price band of INR1,760 – 1,766 per share and earnings per share (EPS) of INR46.22 means that the company is asking for price by earnings (P/E) ratio of 38.1 – 38.2. Although this valuation is not a screaming buy, it appears to be in line with the company’s strong fundamentals and improving profitability. There are no listed peers with similar credentials so benchmarking is not possible but a strong balance sheet, low debt, and a return on net worth (RONW) of 25.48% are further indicators of the company’s robust position.

We are not fans of low margin businesses but Dixon has a scalable business model with a positive outlook. With almost all its products falling into the category defined by the intersection of high utility and decent price points, consumption uptick in India is going to translate into better capacity utilization at Dixon’s plants.

An important distinction to be made here is that despite its successful ODM business, Dixon is largely a contract manufacturer and this need not be seen as a shortcoming. Maintaining a consumer-oriented brand has its own costs and the fate of several leading brands (Nokia, BPL, Onida being the obvious ones) in the rapidly-changing industry indicates the huge downside of a failure. In contrast, contract manufacturing is a much simpler machine to operate. Investors wouldn’t get the moon but wouldn’t lose the earth either.

Overall, Dixon Technologies IPO review tells us that the fast-growing company is in a strong position, has decent valuations with promise of even better profitability in the years to come. Check out our IPO grey market and discussion pages to get the latest trends about this IPO.

Its high price because. Led. Buisness is very big competition

Very expensive

it is most expensive and profit margin also very less so dont expect much from it ,if expectation are low its bettar to avoid dis…