ICICI Lombard General Insurance IPO opens tomorrow for subscription in what will be the biggest IPO this year. Priced in the range of INR651 – 661 per share, the IPO will seek to mobilize as much as INR5,700.9 crore by selling 86,247,187 shares. All the shares will be sold by the existing shareholders and the company will not get any funds (it doesn’t need as we will see). Through ICICI Lombard IPO Review, we try to find out if the large public offer is something good for your portfolio.

ICICI Lombard IPO details | |

| Subscription Dates | 15 – 19 September 2017 |

| Price Band | INR651 – 661 per share |

| Fresh issue | Nil |

| Offer For Sale | 86,247,187 shares (INR5,614.7 – 5,700.9 crore) |

| Total IPO size | 86,247,187 shares (INR5,614.7 – 5,700.9 crore) |

| Minimum bid (lot size) | 22 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

ICICI Lombard IPO Review: Full OFS

All the shares offered in the IPO will be sold by existing shareholders which means the company will not get any funds. We usually prefer IPOs which involve some funds going to the company in question. However, this is not a deal breaker as ICICI Lombard is a cash rich company and has all the means to raise low cost capital when required. The other positive of Offer For Sale (OFS) issues is no dilution of earnings as total shares of the company remains the same.

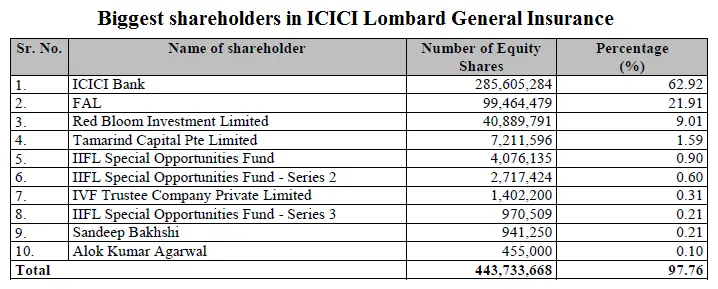

A total of 86,247,187 shares will be offered through the IPO, raising as much as INR5,700.9 crore. Out of these, 31,761,478 shares will be offered by ICICI Bank while 54,485,709 shares will be sold by FAL Corporation, an affiliate of Fairfax Financial Holdings. Following the sale, Fairfax’s shareholding will drop below 10%. Since Fairfax is planning another insurance venture (with former Allianz executive Kamesh Goyal) in India, it needs to bring down its shareholding in ICICI Lombard below 10%. Earlier, it sold 12% stake to three entities including Red Bloom Investment, an affiliate of Warburg Pincus, in May. The other firms were Tamarind Capital, a company owned by the Clermont Group of Singapore and IIFL Special Opportunities Fund, managed by the IndiaInfoline group.

ICICI Lombard IPO Review: First among equals

Undoubtedly, ICICI Lombard has a first-mover advantage among private players. Incorporated in 2000 and commenced operations in 2002, ICICI Lombard became the largest player in India’s private-sector non-life insurance industry. In FY2017, it issued 17.7 million policies, leading to a market share of 8.4% among all non-life insurers in India and 18% among private-sector non-life insurers in India. For the first quarter ended June 2017, these figures stood at 10% and 20.2%, respectively.

The company reaches its customers in 618 out of 716 districts across India through a variety of distribution networks. These include direct sales, individual agents, bank partners, other corporate agents, brokers, and online. It claims to have maintained a leadership position among private sector non-life insurer in India across motor (own damage and third party liability), health and personal accident, crop/weather, fire, engineering and marine insurance, since FY2015. Parentage of ICICI Bank – a well-known brand – has played an important role in this success.

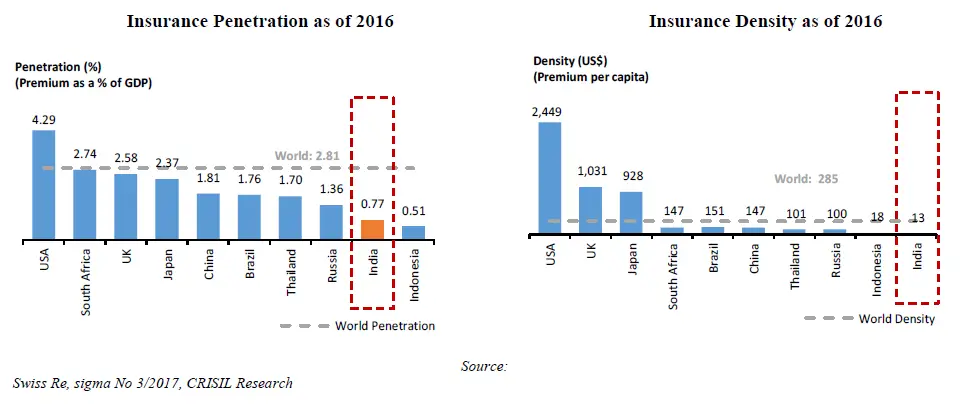

We are not going to go into detail of how underpenetrated the concept of insurance is in India. The chart below does a good job of indicating that we have a lot of catching up to do.

ICICI Lombard IPO Review: Financial performance

As mentioned above, the company has outsmarted most of its rivals in the game and this is reflected in its financial performance. Total revenues increased from INR4,487.4 crore in FY2013 to INR7,180.5 crore in FY2017 and the topline increased every time in the last four years. Profits have expanded at a faster rate as shown in the table below.

ICICI Lombard’s financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | ||

| Total revenue | 4,487.4 | 5,028.4 | 5,044.8 | 5,804.2 | 7,180.5 | |

| Operating income | 302.6 | 412.8 | 558.4 | 482.0 | 667.0 | |

| Profit after tax | 380.1 | 551.5 | 585.8 | 504.1 | 622.1 | |

ICICI Lombard IPO Review: Should you buy?

So far, everything looks good, great in fact! One can’t fault in identifying the under-penetrated nature of general insurance in the country and the fact that regulatory framework will keep driving revenues for insurance players for decades to come. At the same time, newer generations are clearly taking a different approach involving concepts like adequate risk cover, financial independence leading to an increasing channeling of savings into financial assets. With its diversified product offering, ICICI Lombard is simply among the best-suited players in the industry to take advantage of these trends.

Do these fundamentals support valuations?

We don’t think so. Stock markets are mostly forward-looking and during bull market cycles, they develop a tendency of viewing a competitive advantage as a static, never-changing concept. Of course, nothing is permanent and that’s why valuations metrics play even more important role during such phases. ICICI Lombard, selling shares in the range of INR651 – 661 per share, is asking for a Price/Earnings (P/E) ratio range of 47.14 – 47.86. These are evidently high multiples but there is more that investors should know. These multiples will value the company at nearly INR30,000 crore, marking a valuation jump of nearly 48% in just four months. In May, Fairfax sold its stake in the company and the business was valued at just above INR20,000 crore then.

This valuation jack-up is similar to what ICICI Bank did last year while bringing the IPO of the life insurance subsidiary. ICICI Prudential Life Insurance listed at a discount and continued to trade at sub-IPO levels for a long time. The company launched its IPO last year at a P/E ratio of 28.9 and we found it in line with its dominant position. However, the market disagreed and while the stock price has recovered now, it needs to be seen in the context of the rising tide that lifted all boats. The increase in valuation implies one of two things – either Fairfax didn’t pay attention to its numbers (highly doubt that) or IPO investors are being treated as bag-holders at a time when Fairfax needs to shed its shareholding.

Drawing parallels from micro-finance world, Ujjivan Financial Services and Equitas Holdings launched their IPOs last year to meet similar requirements and kept valuations at attractive levels. We get that ICICI Lombard is an established player and has a much robust base but we still don’t get how the valuation has jumped 48% when one of the investors is clearly in need to reduce its shareholding! As we mentioned earlier through example of micro-finance IPOs, valuations are kept moderate in such cases but ICICI Lombard is looking the other way – another sign of bull market euphoria.

Read Also: Capacit’e Infraprojects IPO Review: Big and beautiful

For these high valuations, investors don’t even get the cushion of dividend yield. At the upper end of the price band, the dividend yield will be just 0.52% going by what the company paid last year.

Overall, ICICI Lombard IPO review tells the story of a great insurance play marred by high pricing. Like its previous adventure in the primary market, ICICI Bank is clearly targeting the IPO for high-risk investors by leaving nothing on the table.

WHAT SHOULD WRITE IF ALLOTMENT GOT VERY LUCK