S Chand public offer is likely to be launched later this month and following the successful listing of Shankara Building Products earlier this month, the market is looking for more IPOs. As the secondary markets in India are in a strong bull run of their own, risk appetite in the IPO market has also increased. This is visible in the high subscription levels in some SME IPOs. Focus Lighting and Fixtures IPO was subscribed nearly 89 times and Dev Information Technology IPO received 74 times subscription.

S Chand public offer is likely to be launched later this month and following the successful listing of Shankara Building Products earlier this month, the market is looking for more IPOs. As the secondary markets in India are in a strong bull run of their own, risk appetite in the IPO market has also increased. This is visible in the high subscription levels in some SME IPOs. Focus Lighting and Fixtures IPO was subscribed nearly 89 times and Dev Information Technology IPO received 74 times subscription.

While all the points make a case for a well-known name such as S Chand, the success of this upcoming IPO will depend on the pricing. And since pricing will be revealed ahead of the IPO, we would not venture into speculations. However, apart from pricing, there are some key points that investors should know about the company and the IPO. We have compiled a list. Read on.

Two Private Equity investors on board

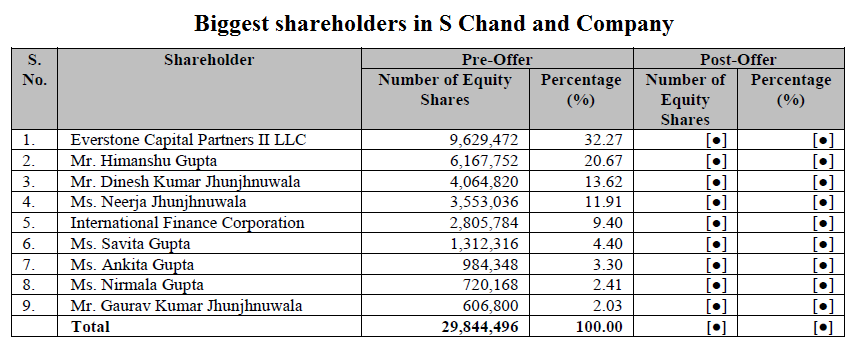

Everstone Capital owns 9,629,472 shares or 32.3% equity stake in the textbook publisher. This makes Everstone the largest investor while also giving a board representation. The private equity firm first invested in S Chand in 2012 and has been putting money in subsequent transactions.

International Finance Corporation (IFC) is another major investor with a 9.4% equity stake. The private lending arm of the World Bank Group is a relatively new entrant in S Chand and made its maiden investment in November 2015.

S Chand public offer = Fresh + OFS

S Chand public offer will be a mix of fresh shares and sale of existing ones by investors. The company plans to raise up to INR300 crore by issuing fresh shares. These funds will be used towards repayment and prepayments of certain loans. These loans include debt it undertook to acquire Kolkata-based publisher Chhaya Prakashani.

The IPO will also include 6,023,236 shares to be sold under the Offer For Sale (OFS) route. The OFS will be primarily led by Everstone which plans to sell 4,814,736 shares. Everstone’s average cost of acquisition works out to be INR270 per share.

While IFC will not be participating in the offer, remaining shares will be offered by promoters and individuals from promoter group. This includes Himanshu Gupta, Dinesh Kumar Jhunjhnuwala, Neerja Jhunjhnuwala, Nirmala Gupta, Savita Gupta, Ankita Gupta and Gaurav Kumar Jhunjhnuwala.

In-house printing operations

S Chand has integrated manufacturing and back-end operations to a great extent and thus has low dependence on third-party vendors. According to its draft prospectus, 85% of its printing requirements in FY2016 were met by facilities in Sahibabad and Rudrapur. In the last two years, S Chand has made capital expenditure of over INR45.3 crore in setting up the printing facility in Sahibabad. As a result, the company’s total printing capacity was enhanced from 15 tons of paper per day in FY2014 to 55 tons of paper per day in FY2016. The two printing facilities have a capacity to print up to 64.24 million pages per day.

Read Also: How the INR10,000 crore NSE offer stacks up against biggest IPOs in India since 2010

Robust sales and distribution network

Like its integrated printing operations, the company has a solid distribution and sales network. As of June 30, 2016, its network consisted of 4,907 distributors and dealers, and the company had an in-house sales team of 697 professionals working from 58 branches and marketing offices across India. Chhaya acquisition has expanded its presence in Eastern India to include an additional 746 distributors and dealers as of 1 December 2016. Similarly, S Chand’s network comprises of 42 warehouses located in 19 states to allow coverage across India. It also has gained access to two warehouses in West Bengal as a result of acquiring Chhaya Prakashani.

Read Also: Here is why you should consider opening a Free Demat Account

Spectacular revenue growth

A highlight in S Chand IPO is the impressive revenue growth the company has achieved in recent years. Topline has been increasing regularly for the last four years and jumped from INR174.6 crore in FY2012 to INR540.6 crore for the year ended March 2016. This translates into a compounded average growth rate of 32.6%.

Much of this growth came from acquisitions in recent years, facilitated by private equity investments. Apart from the acquisition of Chhaya Prakashani mentioned above, S Chand acquired a majority stake in Delhi-based publisher New Saraswati House in 2014.

S Chand’s consolidated financial performance (in INR crore) | ||||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | 3M FY2017 | |

| Total revenue | 174.6 | 281.5 | 370.9 | 478.5 | 540.6 | 34.9 |

| Total expenses | 147.5 | 221.7 | 291.2 | 374.5 | 412.4 | 63.7 |

| Profit after tax | 14.7 | 32.0 | 42.6 | 32.8 | 46.6 | -29.0 |

| Profit margin (%) | 8.4 | 11.4 | 11.5 | 6.9 | 8.6 | -83.1 |

Source: S Chand draft prospectus

Uneven profits

Notwithstanding the superb growth in revenues, the company has registered uneven profits in these years. Starting from INR14.7 crore of profit in FY2012, S Chand’s earning improved to INR46.6 crore in FY2016. While this is 33.5% CAGR, profits dropped in FY2015. In these years, its net margin went from 8.4% to 11.5% but dropped to 8.6% in the latest year.

S Chand’s financial performance in the latest quarter is not promising as the company posted a loss of INR29 crore. First quarter of a fiscal year is typically a lean period for education-focused publishers so this poor performance is understandable.

No dividends for now

This bit of information is going to disappoint dividend chasers. S Chand used to pay dividends earlier at the rate of 250% on face value but has discontinued the same. In the last two years, the company has not paid any dividend. The company has not mentioned any reason for this move but understandably, it is to preserve cash and deploy the same in further acquisitions.

We will come up with our analysis and review of S Chand public offer once the company reveals more details. For now, feel free to check the page about S Chand IPO Discussion.