Last Updated on January 12, 2020 by Krishna Bagra

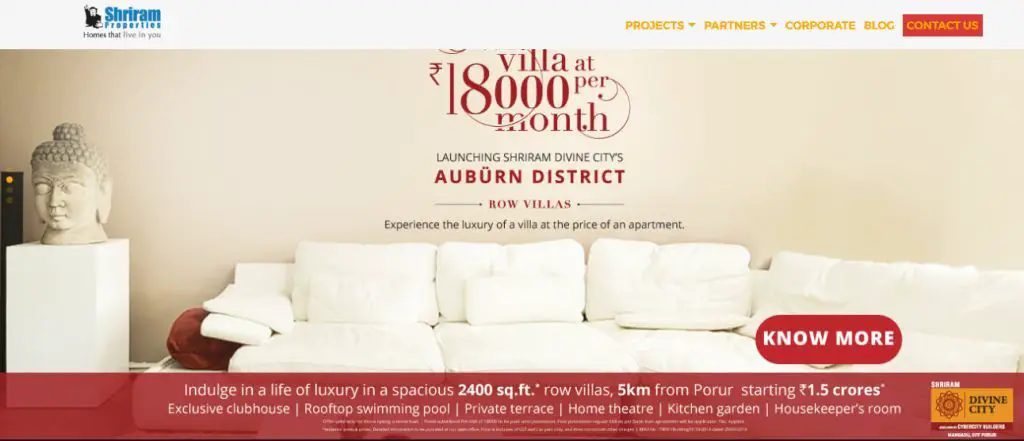

Shriram Properties Limited (SPL) has filed its Draft Red Herring Prospectus (DRHP), seeking SEBI permission to launch its IPO. Shriram Properties is a leading residential real estate development player in South India, primarily catering to the mid-market (INR40-80 lakhs) and affordable housing (INR40 lakhs or less) categories. Like many other upcoming IPOs in India, Shriram Properties IPO will be a mix of fresh issue and sale by existing shareholders.

Shriram Properties Limited (SPL) has filed its Draft Red Herring Prospectus (DRHP), seeking SEBI permission to launch its IPO. Shriram Properties is a leading residential real estate development player in South India, primarily catering to the mid-market (INR40-80 lakhs) and affordable housing (INR40 lakhs or less) categories. Like many other upcoming IPOs in India, Shriram Properties IPO will be a mix of fresh issue and sale by existing shareholders.

Shriram Properties IPO will involve a fresh issue aggregating up to INR250 crore (INR2,500 million) and an offer for sale (OFS) of up to 42,403,271 shares. The company has roped in several high-profile investors which will participate in the OFS. These include Omega TC Sabre Holdings Pte. Limited (11,243,964 shares); Tata Capital Financial Services Limited (1,031,557 shares); TPG Asia SF V Pte. Ltd. (11,398,698 shares); WSI/WSQI V (XXXII) Mauritius Investors Limited (16,502,880 shares); and other selling shareholders (2,226,172 shares).

The property developer counts WSI Mauritius Investors, TPG Asia and Omega TC Sabre Holdings among its major investors holding 23.97%, 16.56% and 16.33% equity stake respectively. Promoter Shriram Properties Holdings has 31.82% equity in the company.

Through the combination of fresh issue and an OFS, the upcoming IPO is expected to mobilize INR1,200-1,500 crore.

Shriram Properties IPO: Use of funds

Out of the INR250 crore the company will get by selling new shares in the upcoming IPO, it plans to use INR200 crores towards repayment and/or pre-payment of certain borrowings availed.

The company calls itself among the top-five players in residential real estate in South India, in terms of number of aggregate units launched in the calendar years 2012 to 2017 and the six months ended 30 June 2018. SPL has majority of its presence in Bengaluru and Chennai although it has also expanded to Kolkata in East India. As of 30 November 2018, it has completed 25 projects, with 20 in Bengaluru and Chennai. Out of the 12.86 million square feet of saleable area it has delivered so far, 81.88% was in the mid-market category and affordable housing categories. The remaining was contributed by commercial and office space and luxury housing categories.

Stock market shunning property developers

Shriram Properties is yet another property developer seeking to raise public funds. However, weak market sentiments around real estate have forced companies to look at other avenues. Mumbai-based Paranjape Schemes dropped IPO plans even after getting SEBI approval in December 2015. Similarly, VBHC Value Homes deferred its public offer due to poor sentiments while Hindustan Construction Company (HCC)-backed Lavasa has been in abeyance for several years now.

The only other real estate player in fray now is Lodha Developers which received regulatory go ahead in July this year. This is Lodha Developers’ second attempt at listing itself after shelving IPO plans in early 2010.

nice info, can i share it?