Shyam Metalics and Energy Limited (SMEL) is seeking SEBI approval for launching its maiden public offer. The integrated steel and Ferro alloys producer is looking to raise as much as INR1,107 crore through a mix of fresh equity and offer for sale (OFS). Team IPO Central dived into Shyam Metalics IPO draft prospectus to understand the business strengths and weaknesses. Here are few points worth sharing:

#1 Presence Across Value Chain

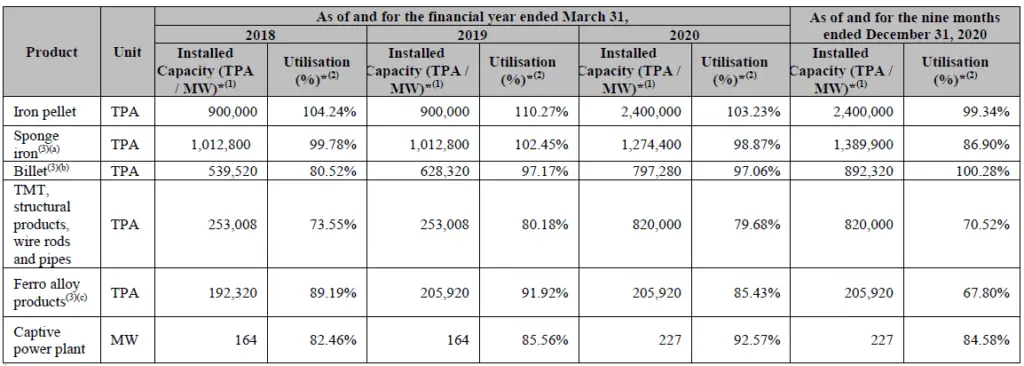

SMEL is present across the steel sector’s value chain- pellets, sponge iron, billets, long steel (structural / TMT), pipe, Ferro alloys, railway siding and captive power plant. SMEL has 3 manufacturing units with aggregate operating capacity of 5.7 MTPA (million tonnes per annum) and also boasts of a 227 MW Captive Power Plant. Its 2 integrated units are located at Sambalpur, Odisha and Jamuria, West Bengal respectively. One other unit is located at Mangalpur, West Bengal. Production capacities of different products:

Iron Pellet: 2.4 MT

Sponge Iron: 1.38 MT

Billets/SMS: 0.89 MT

Long Steel: 0.82 MT

Ferro Alloys: 0.21 MT

Captive Power Plant: 227 MW

Wind power: 5.1 MW

#2 Integrated Operations

As mentioned above, SMEL is present across the steel sector’s entire value chain through different products. This diverse product mix de-risks from demand volatility and cost pressures. Integration ensures better synergies, economies of scale and more effective control of operations. Its manufacturing capacity also allows cross selling of intermediate products apart from captive consumption.

#3 Proximity to Raw Material

The group’s manufacturing units in Odisha and West Bengal are in close proximity to mineral rich belt of iron ore, manganese ore, chrome ore, and coal. SMEL also has long term linkages for coal as well as chrome ore with Mahanadi Coal Field and Odisha Mining Corporation Limited respectively.

#4 Shyam Metalics IPO: Capacity Utilization

Utilization rates are pretty high and didn’t drop much even during Covid-19 (look at FY2020 numbers). Important to note that SMEL expanded capacity in 2019 and 2020.

#5 Captive Power Plant

SMEL houses captive power plant of 227 MW capacity which typically meets 90% of its power requirement and is self-sufficient. While average grid power is estimated to cost INR5-7 per unit at an all India basis, SMEL’s power and fuel cost is significantly lower at INR2.24 per unit as of FY2020. The captive power plant uses waste heat and Dolochar (non-fossil fuel) as the main feed.

#6 Captive Railway Siding

SMEL has captive railway siding at 2 of its integrated manufacturing units which ensures a more optimised freight cost given that nearly three times of raw material is to be transported for every tonne of steel produced. Railway freight is highly cost effective than road for long distances.

#7 New Product Introduction

Following the IPO, Shyam Metalics plans to expand into newer products such as DI Pipe and aluminium foils with the aim of boosting product mix and market penetration. DI pipes demand is expected to witness a robust growth of 8% to 9% led by government’s continuous efforts on increasing the penetration of tap water, improving sewage facilities under various schemes such as AMRUT, Swach Bharat Abhayan, National Clean Ganga Mission.

Meanwhile, a new Aluminium foil rolling mill is being set up at Pakuria in West Bengal with a proposed installed capacity of 0.04 MTPA. Operations at the plant are expected to start in FY2022.

#8 Net debt-free

SMEL has zero long term debt and is a net debt free company and is among the few AA rated steel companies in India. Its Gross Debt to Equity ratio as of 31 December 2020 stood at 0.27.

#9 Rising Revenues and Healthy Margins

| FY2018 | FY2019 | FY2020 | 9M FY2021 | |

| Revenue | 3,920.4 | 4,684.6 | 4,395.3 | 3,995.6 |

| Expenses | 3,405.5 | 3,920.7 | 4,099.9 | 3,489.5 |

| Comprehensive income | 521.9 | 641.8 | 340.8 | 460.2 |

| Margin (%) | 13.3 | 13.7 | 7.8 | 11.5 |

As the above table shows, the company has registered robust growth in recent years. Despite a radical event like Covid-19, Shyam Metalics was able to expand its revenues in the 9 months of FY2021.

Thanks to a lean balance sheet, Shyam Metalics boasts of double digit net profit margins. Such high margins in a commodity product are often indicative of highly refined and optimized back-end operations. As a matter of comparison, corresponding figures for its competitors JSW Steel and Tata Steel during FY2020 were 5.5% and 1.1%, respectively.

#10 High Return on Equity

SMEL’s Return on Net Worth (RONW) or Return on Equity (ROE) in FY2020 stood at 12% which is highest among its peers. Comparable return figures for Shyam Metalics’ listed peers during FY2020 are as follows:

JSW Steels – 10.8%

Tata Steel – 1.5%

SAIL – 5.1%

To read this content on Twitter, please head to this page and don’t forget to follow us for regular updates.

Bumperr stockkk!! Metals on Fire! Shyam playing topp level game in sector with most well balanced product offering aswell as growth trajectory!!