Gurugram based Sona BLW Precision Forgings – one of India’s leading mission-critical automotive systems and components manufacturers – is planning to launch its maiden public offer later this month. The company filed its draft red herring prospectus (DRHP) with SEBI in February 2021 and received approval in May 2021. Here are few key points you need to know about the company and its business.

#1 Sona BLW Precision Forgings IPO: Fresh + OFS

Sona BLW Precision Forgings IPO will involve mobilization of INR6,000 crores. The IPO will consist of a fresh issue of equity shares worth INR300 crore and an offer for sale (OFS) amounting to INR5,700 crores by existing shareholders.

The capital raised through fresh issues is proposed to be used for repayment/pre-payment of INR225 crores borrowings availed by the company and general corporate purposes.

#2 Sona BLW Precision Forgings: Capital Structure

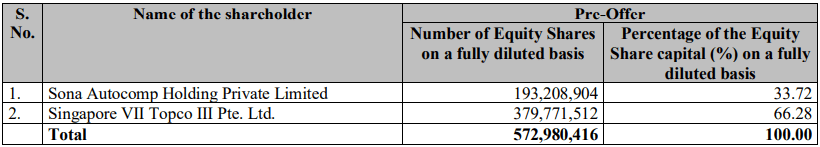

Singapore VII Topco III is the major shareholder in the company with 66.28% equity stake. Singapore VII Topco III is an affiliate of global private equity major Blackstone Group. The remaining stake is held by Sona Autocomp Holding Private Limited. Sona Autocomp is controlled by Sunjay Kapur who has vast experience in the automotive industry and also serves as the chairman of Sona BLW Precision Forgings.

#3 Geographically Diversified Business

Sona BLW is a leading automotive parts manufacturer and supplier to domestic and global automotive players and boasts of diversified operations. It supplies highly-engineered, mission-critical automotive systems and components to auto original equipment manufacturers (OEMs).

It operates a total of 9 manufacturing and assembly facilities out of which 6 are based out of India and one each out of China, Mexico, and the USA respectively. It has 8 warehouses dispersed across India, the USA, Germany, and Belgium. It also supplies automotive parts to Electric Vehicle (EV) markets. For the nine months ended 31 December 2020, Sona Comstar’s biggest market was North America which accounted for 40.2% of its revenues. Europe (25.3%), India (24.6%) and China (5.3%) were other important markets.

Some of the company’s OEM customers include Ashok Leyland, CNH, Daimler, Escorts, Escorts Kubota, Geely, Jaguar Land Rover, John Deere, Mahindra and Mahindra, Mahindra Electric, Maruti Suzuki, Renault Nissan, Revolt Intellicorp, TAFE, Volvo Cars, and Volvo Eicher.

#4 Sparkling Future Growth

The company is dealing in the automotive sector which is a cyclical sector. While past few years haven’t been kind to the sector, demand of automobiles has started picking up in the aftermath of Covid scare. Nevertheless, the impact of the global pandemic has been quite mild on the company’s operations.

This was partly possible because of Sona BLW’s presence in high growth businesses such as EV parts. According to the draft prospectus, the company increased its sales to the EV market at a CAGR of 35.8% between FY2018 and FY2020. The EV business contributed 13.7% to Sona BLW’s revenues for the nine months ended 31 December 2020 and is likely to do well in future as well.

To stay up to the mark, the company spent an average of 3% of the turnover on R&D which is the second-highest among the domestic competitors. The company develops mechanical and electrical hardware systems, components as well as base and application software solutions to meet the evolving demands of customers.

#5 Financial Performance: On a Strong Footing

The company’s financial performance has been quite impressive in recent years. It managed to grow its revenues consistently in these years and profits have also been climbing up, except a dip in the latest nine months when operations were impacted by pandemic.

Between FY2016-20, the company saw its total operating income grow at the CAGR of 10.9%. This is above the average CAGR of 8.1% for the top 10 listed auto-component manufacturers in India by market capitalization. Similarly, its operating EBITA margin, PAT margin, ROCE, and ROE are above the average of top 10 listed players.

Sona BLW’s financial performance (in INR crore)

| FY2018 | FY2019 | FY2020 | 9M FY2021 | |

| Revenue | 625.9 | 702.5 | 1,043.8 | 1,029.6 |

| Expenses | 494.8 | 548.0 | 888.8 | 818.6 |

| Comprehensive income | 55.2 | 173.8 | 331.7 | 154.3 |

| Margin (%) | 8.8 | 24.7 | 31.8 | 15.0 |

Considering these positives, Sona BLW Precision Forgings IPO will be closely watched by investors. As always, we will post further updates on our site. Watch this space.