Azad Engineering IPO price band has been fixed in the range of INR 499 – 524 per equity share. The public offer of the precision component maker will open for subscription on 20 December and will close on 22 December. Allocation to anchor investors in Azad Engineering IPO is scheduled on 19 December.

Azad Engineering IPO price, valuation and other details

On a fully-diluted basis, the price-to-earnings (PE) ratio range of the public offer turns out to be 278.77 – 292.74. This compares to industry peer group P/E ratio of 77.43. Its peer group includes companies like MTAR Technologies, Paras Defence and Space Technologies, Dynamatic Technologies, and Triveni Turbine.

Investors can place orders for minimum 28 shares, amounting to INR 14,672 and in multiples thereafter. Since the company meets SEBI’s profitability norms, retail investors are entitled for 35% of the shares offered.

Read Also: White Oil Industry – The Niche Set to Outpace Specialty Oils Market

Raising INR 740 crore through Fresh and OFS

The company aims to raise INR 240 crore by issuing fresh shares which are earmarked to be used towards

1. Funding capital expenditure of the company – INR 60.4 crore

2. Repayment/prepayment, in part or full, of certain of our borrowings availed by the company – INR 138.2 crore

3. General corporate purposes – remaining amount

In addition, there is a sale of shares amounting to INR 500 crore by existing shareholders. This takes the overall IPO size to INR 740 crore. Its investors include Piramal Group and DMI Finance. Among other prominent investors, former cricketer Sachin Tendulkar holds 438,210 shares in the company while PV Sindhu, Saina Nehwal and several other sports personalities are also onboard.

Business Verticals: Aerospace & Defence, Energy, Oil & Gas

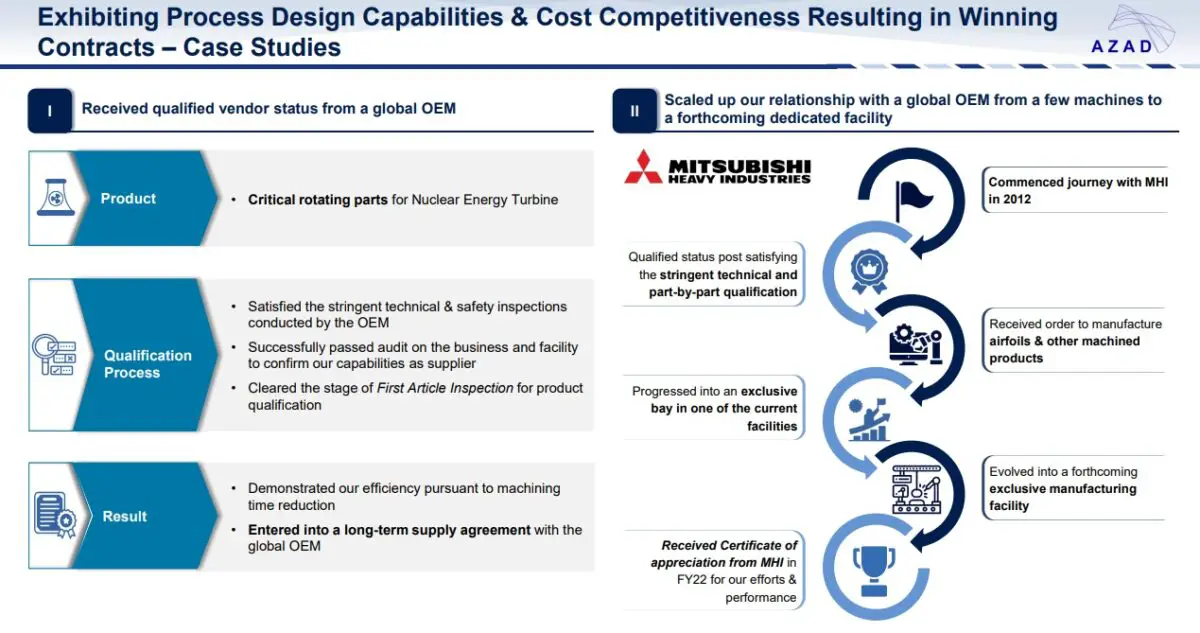

Incorporated in 1983, Azad Engineering has vast experience in its key industries of Aerospace & Defence, Energy, Oil & Gas. As a manufacturer of mission critical and precision components, it has long-term agreements with its key clients some of which include Honeywell, GE, Eaton, Siemens and Mitsubishi Heavy Industries. The industry is characterized by stringent vendor qualifications which can take up to 48 months to meet.

Azad Engineering has posted impressive financial performance in recent years and has managed to more than double its topline in the last three years.

Azad Engineering Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 122.72 | 194.47 | 251.68 | 158.75 |

| Expenses | 108.79 | 159.13 | 248.36 | 137.92 |

| Net income | 11.50 | 29.46 | 8.47 | 26.89 |

| Margin (%) | 9.37 | 15.15 | 3.37 | 16.94 |

Figures in INR Crores unless specified otherwise

Now that Azad Engineering IPO price band and other details are out, it needs to be seen how the grey market receives the offer.