Last Updated on August 5, 2018 by Krishna Bagra

Another microlender CreditAccess Grameen, better known as Grameen Koota, is preparing to tap the primary market with its IPO scheduled to open for subscription on 8 August. Investors can place their applications for minimum 35 shares. The IPO is priced at INR418 – 422 per share and retail investors will not get any discount. As the performance of the last few microfinance IPOs like Ujjivan Financial Services, Equitas Holdings, and AU Small Finance Bank was good, it is not surprising that investors have hopes from Grameen Koota IPO. Through CreditAccess Grameen IPO, we try to find out if investors should be as bullish on this as the previous ones.

CreditAccess Grameen IPO details | |

| Subscription Dates | 8 – 10 August 2018 |

| Price Band | INR418 – 422 per share |

| Fresh issue | INR630 crore |

| Offer For Sale | 11,876,485 shares (INR496.44 – 501.19 crore) |

| Total IPO size | INR1,126.44 – 1,131.19 crore |

| Minimum bid (lot size) | 35 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

CreditAccess Grameen IPO Review: Olympus Capital, ADB, CEI on board and selling

Grameen Koota IPO will involve a fresh issue of INR630 crore (INR6.3 billion) while 11,876,485 shares will be sold by existing shareholders through Offer For Sale (OFS) route. Proceeds from the fresh issue will be used to boost the company’s capital base for future capital requirements.

The company counts private equity firm Olympus Capital Asia and Asian Development Bank (ADB) among its investors. While Olympus Capital owns 17% equity stake in CreditAccess Asia NV (CAA), Conferenza Episcopale Italiana (CEI) and ADB hold nearly 10% and 9%, respectively. CAA, in turn, owns 99% of CreditAccess Grameen. Through the OFS, CAA plans to offload 11,876,485 shares amounting to as much as INR501.19 crore at the upper end of the price band. In total, CreditAccess Grameen IPO is expected to mobilize as much as INR1,131.19 crore.

CreditAccess Grameen IPO Review: Focus on Karnataka and Maharashtra

As we mentioned in this earlier report, the company is a microlender with a clear focus on rural customers whose access to the formal banking sector is limited. Within this space, the company provides loans to women having an annual household income of INR100,000 or less. These loans, provided under the joint liability group (JLG) model, are essentially income generation loans to its customers. As of 31 March 2018, average ticket size stood at INR19,671.

Majority of its operations are in Karnataka, Maharashtra, Tamil Nadu, Chhattisgarh and Madhya Pradesh, although the company has some presence in Odisha, Kerala, Goa and Puducherry too. Of these states, Karnataka and Maharashtra accounted for nearly 65% of its branch network and the states’ share in the company’s AUM (Assets Under Management) stood at a staggering 85%. The company’s operations are spread across 516 branches covering 132 districts in the eight states and one union territory. As of 31 March 2018, the company had 4,544 loan officers.

Its customer base increased from 0.50 million active customers as of 31 March 2014 to 1.85 million at the end of FY2018. It had a high active customer retention rate of 84% for the 12 months ended 31 March 2018, which marks an improvement from 82% as of 31 March 2014. At the same time, this metric is higher than the median active customer retention rate of 78% for the leading 15 microfinance players. Its gross AUM stood at INR4,975 crores as of 31 March 2018 and income generating loans accounted for 87% of the total AUM.

CreditAccess Grameen IPO Review: Financially strong

A quick glance at CreditAccess Grameen’s key operating metrics reveals that the company is on a strong wicket, financially speaking. Its revenues grew almost 10-fold from INR89.2 crore in FY2013 to INR875.2 crore in FY2018. This is in line with a CAGR of 57.45% in Gross AUM between FY2014 and FY2018. Accordingly, profits followed suit and jumped multifold to INR124.6 crore in FY2018. Net profit margin has also improved to 14.2% in the latest year, although it is still down from the peak of 17.8% in FY2016.

The performance in the last couple of years has been impacted by currency demonetization which hampered fundraising activities, disbursements as well as recoveries. Nevertheless, it is good to see the improvement in profitability in the aftermath of demonetization.

CreditAccess Grameen’s financial performance (in INR crore) | ||||||

| FY2013 | FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | |

| Total revenues | 89.2 | 147.8 | 281.4 | 466.7 | 709.3 | 875.2 |

| Total expenses | 81.7 | 123.0 | 206.5 | 337.2 | 585.0 | 682.3 |

| Profit after tax | 7.9 | 16.6 | 48.7 | 83.2 | 80.3 | 124.6 |

| Net margin (%) | 8.9 | 11.2 | 17.3 | 17.8 | 11.3 | 14.2 |

CreditAccess Grameen IPO Review: Another microlender, why should I care?

Fair question, as there are already several microlenders listed on stock exchanges one can select from. At the same time, microfinance business model is full of internal and external risks.

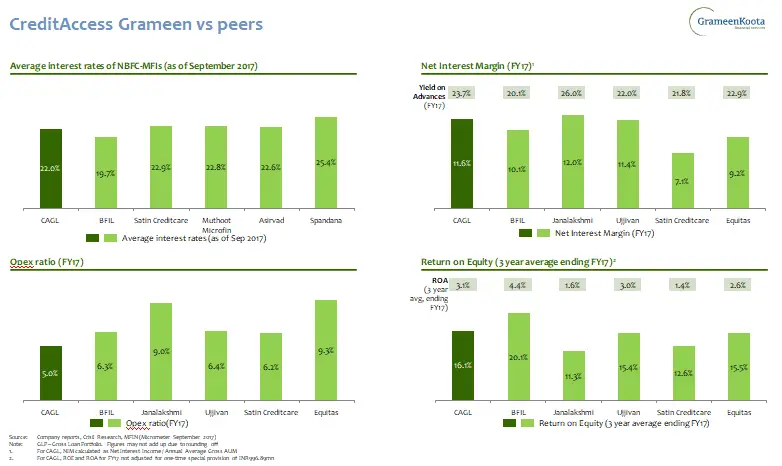

Grameen Koota’s average interest rate is at 22% and even though it is slightly less than its competitors, these are the kind of rates which will continue to attract political attention every now and then. This is precisely what makes microfinance a tricky business and it is not surprising to see that leading players like Bandhan, AU Finance, Equitas and Ujjivan chose to become banks when presented with the opportunity.

Now that we have highlighted the risks with microfinance, it is worth noting that not all is lost in this business and CreditAccess Grameen has some things working in its favor.

To begin with, it is important to note that the company did not apply for a small finance bank (SFB) license and chose to focus on the pure microfinance model. Apart from other considerations, the decision was led by its strong parentage. Its parent company CreditAccess Asia is a multinational company and has similar operations in Indonesia, Philippines, Thailand and Vietnam. This means that GrameenKoota not only benefits from its parent’s deep pockets but also from its deep understanding of similar markets and best practices.

It is probably for this reason that the company’s operating expense ratio was 4.5% of annual average total assets in FY2018 – among the lowest in the industry. Another thing to note here is that this ratio has been decreasing in the last five years.

The company has also done a good job of keeping NPAs under limits. Currency demonetization caused the company’s gross NPA ratio to spike to 1.97% in FY2018 from just 0.08% in FY2017. In light of demonetization, the RBI offered a short-term deferment regarding classification of loan accounts as sub-standard and this has enabled the company to report zero net NPA as of 31 March 2018.

The company has also done a good job of keeping NPAs under limits. Currency demonetization caused the company’s gross NPA ratio to spike to 1.97% in FY2018 from just 0.08% in FY2017. In light of demonetization, the RBI offered a short-term deferment regarding classification of loan accounts as sub-standard and this has enabled the company to report zero net NPA as of 31 March 2018.

Unlike other microfinance players which have exposure to urban markets, our analysis reveals that Grameen Koota is a pure rural play with 82% of its branches catering to rural markets and 81% of customers in rural areas. For example, Ujjivan Financial Services focuses on urban and semi-urban poor while Equitas has a focus on vehicle and SME finance. This can be a positive or a negative, depending on how one looks at it. As rural India still recovers from the impact of demonetization, there is a strong case for further improvement in disbursements and other financial parameters.

Coming to valuations, the company’s Price Band of INR418 – 422 per share and Earnings Per Share (EPS) of INR12.11 translates into Price/Earnings (P/E) ratio in the range of 34.51 – 34.84. This is less than Equitas and Ujjivan and in line with its larger rival Bharat Financial Inclusion. At the same time, other focused plays like Mahindra & Mahindra Financial Services and Shriram Transport Finance are available at lower valuations. Its Return on Net Worth (RONW) of 8.73% doesn’t top the industry but is better than several peers. Bharat Financial Inclusion and AU Small Finance Bank trade at 5.5 times and 8.1 times their book values while that of Grameen Koota is 3.8 times.

Our overall thoughts in CreditAccess Grameen IPO review center around the company’s solid business model, its strong execution capabilities, the fact that demonetization is a thing of past and there are better times ahead. At the same time, valuations do not reflect deep value for IPO investors and unlike Equitas and Ujjivan, there isn’t a lot left on the table. Feel free to head to our discussion page to get more perspectives on this IPO.

Amazing review! Thanks and keep up the good work…

Thanks for your kind words, Ron. Appreciate it.

Review is on exactly my line of thinking.It is a long term bet with some immediate listing gain of 20 to 30 rupees which premium may or may not sustain.

Should we apply for listing gains?