Oncology chain HealthCare Global Enterprises (HCG) is coming with its IPO that will open on 16 March. The IPO, aimed at mobilizing INR649.6 crore, will close for subscription on 18 March. Priced in the range of INR205-218 per share, HCG IPO comprises of fresh issue of up 1.16 crore shares while existing shareholders will sell 1.82 crore shares through OFS. In our review, we try to find out if the IPO makes sense for your hard-earned money.

The issue will be managed by Kotak Mahindra Capital Company Limited, Edelweiss Financial Services Limited, Goldman Sachs (India) Securities Private Limited, IDFC Securities Limited, IIFL Holdings Limited and Yes Bank Limited who are the Book Running Lead Managers.

HCG IPO details

| IPO dates | 16-18 March 2016 |

| Price Band | INR205-218 per share |

| Issue Size | INR610.9 – 649.6 crore |

| Fresh Shares | 1.16 crore shares |

| Offer for Sale | 1.82 crore shares |

| Minimum Bid | 65 shares |

| Retail allocation | 10% |

Read more about HCG IPO here: HealthCare Global Enterprises IPO cleared by SEBI

Objects of HCG IPO

Since the company will not get any funds from the OFS, its proceeds will be restricted to INR252.8 crore. Like most other IPOs these days, debt reduction finds a prominent place in HCG IPO. The company plans to use INR147 crore towards pre-payment of debt. INR42.2 crore will be spent towards purchase of medical equipment and INR30.2 crore are proposed to be invested in IT software, services and hardware. Remaining funds, amounting to nearly INR33.5 crore, will be used for general corporate purpose.

Private Equity to exit

This Bangalore-based company has a number of Private Equity (PE) players as investors. PIOF, an investment vehicle of Azim Premji’s PremjiInvest, owns 1.53 crore shares or 20.93% equity stake in HCG. This will reduce to 14.02% following the IPO as PIOF aims to sell 34.5 lakh shares. PremjiInvest put its money in the company in 2008, followed by infusion of nearly INR140 crore by Singapore’s Temasek Holdings through V-Sciences in 2013. V-Sciences also aims to sell 34.5 lakh shares and reduce its shareholding to 83.2 lakh shares.

The biggest chunk of selling will come from education and healthcare focused India Build-Out Fund which currently owns 1.25 crore shares but plan to reduce it to just 30.2 lakh shares.

Several doctors will also be participating in the OFS, although the number of shares offered by them will be very small. Selling shareholders here are Dr. BS Ajai Kumar, Dr. G Kilara, Dr. K Harish jointly with Shubha Harish, Dr. Nalini Kilara, Ganga Ramaiah, Gangadhara Ganapati, Rajesh Ramaiah, Shubha Harish jointly with Dr. K Harish.

Read Also: Upcoming IPOs in 2016: IPOs worth at least INR13,500 crores in pipeline

Cancer, Fertility and ‘Hub and Spoke’

HCG is primarily a cancer treatment specialty hospital chain with 14 comprehensive cancer centers as on 31 December 2015. But thanks to the acquisition of a majority stake in BACC Healthcare in March 2013, it is now present in fertility business and operates four fertility centres under the ‘Milann’ name. This business is becoming more important and will start counting for 10% of total revenues in a few years.

Coming back to the main business, HCG operates on a ‘hub and spoke’ model which basically means it sets up joint venture companies and limited liability partnerships with other hospitals or gets into revenue or profit sharing arrangements with these entities. This naturally allows a faster ramp up of network without having to setup or invest in the physical infrastructure. The faster ramp up’s reality can be checked as HCG is currently setting up 12 Cancer Centres in cities including Jaipur, Kanpur, Baroda, New Delhi and Kolkata. Out of the 14 cancer centres HCG counts in its network, only four are owned and controlled by HCG while others are on joint venture or profit sharing basis.

The strategy of collaborating with partners to ramp up its network is a double-edged sword and may cause heartburn to investors. Without doubt, it facilitates a faster roll out but questions remain regarding its ability to effectively control qualitative aspects. To be fair with the company, HCG claims to own the equipment used for the delivery of cancer care at such centres.

Fantastic revenue growth but where are the margins?

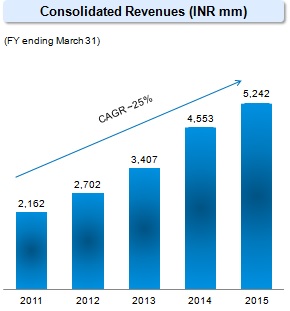

We like it when odd business strategies lead to actual revenues which is the probably the best indicator of a given approach’s effectiveness. This is the case with HCG which has achieved a compounded average growth rate (CAGR) of 25% in the last five years for revenues. From just INR216.2 crore in FY2011, the company was able to more than double revenues to INR524.2 crore in the last year.

We like it when odd business strategies lead to actual revenues which is the probably the best indicator of a given approach’s effectiveness. This is the case with HCG which has achieved a compounded average growth rate (CAGR) of 25% in the last five years for revenues. From just INR216.2 crore in FY2011, the company was able to more than double revenues to INR524.2 crore in the last year.

However, its expenses have also risen at an almost identical rate. Net result is slim profit margins in years when there were positive earnings. Other years went without profits. In three out of the last five years, HCG has booked net losses. In fact, its profit stood at just INR54.6 lakh in the latest fiscal year. Over the last five years, its EBITDA margins have also declined from 18% to 15.5%. HCG’s financial performance for the six months ended September 2015 does not offer any hope either as the company incurred a loss of INR75 lakh, although the top line continued to grow.

If this does not inspire confidence, you are not alone in thinking on these lines. We also don’t like the fact that the growth is coming without economies usually associated with bigger scale. Going by this rate, the setting up of new centres in coming years may play havoc to HCG’s profit and loss statements.

HealthCare Global Enterprises’ consolidated financial performance (figures in INR crore) | |||||

| FY2011 | FY2012 | FY2013 | FY2014 | FY2015 | |

| Total revenue | 216.2 | 270.2 | 340.7 | 455.3 | 524.2 |

| Total expense | 208.2 | 273.1 | 350.8 | 481.5 | 517.2 |

| Profit/(loss) after tax | 6.3 | (3.3) | (10.5) | (35.5) | 0.55 |

Investment decision

‘Hub and Spoke’ works well in diagnostics but treatment space is yet to see successful role models employing this technique. The ‘Hub and Spoke’ business model is the proverbial rabbit hole that needs to be discovered, there may be value in this. HCG may emerge the champion of this model but its poor financial performance ensures it is nowhere close to being this poster boy anytime soon.

Given the vast demand-supply mismatch in investible healthcare sector, Dr Lal Path Labs IPO was lapped up by investors. Considering the limited investment options available in the healthcare space, HCG may catch the fancy of investors but its poor profitability record makes Narayana Hrudayalaya’s single-digit net margin as a much better deal.

While price by earnings (P/E) ratio does not work for evaluating such companies, EV/EBITDA is an accurate metric. Enterprise Value (EV) is an indicator of a company’s value and is the sum of market capitalisation and net indebtedness. On this parameter, HCG scores better with a demand of 17 times on the basis of FY2017 earnings. Its listed peers Narayana Hrudayalaya and Apollo Hospitals are currently trading at corresponding EV/EBITDA multiples of 23 and 21, respectively.

HealthCare Global probably deserves this discount as a risky bet when compared to its listed peers as it exercises a lower degree of control over its network. Unlike Narayana Hrudayalaya’s Devi Shetty, HCG has no celebrity doctor whose name it can use as anchor. These factors will be amply highlighted when grey market activity in HCG IPO starts in coming days.

Despite all the shortcomings, HCG IPO may sail through as the company is offering only 10% to retail investors and the IPO subscription will be guided by QIB and HNI categories.

In our analysis, HCG IPO is a solid play in India’s underpenetrated market and it is good that it has got ambitions to replicate the model in Africa. The IPO is designed to reduce the chances of undersubscription because of fickle retail category which puts applications on the last day. It may turn out to be a good long term bet but the markets’ cliffhanger position means that 10-15% downside can easily wipe out notional profits. If this selling pressure coincides with the listing of HCG IPO, investors may be staring at losses instead of some profits.

HCG has a proven management background, a very niche segment of operations and strong expansion plans. Hence, I suggest subscribing to this IPO.

You can read more here: http://www.slideshare.net/Ketandhad/icici-direct-ipo-note-on-healthcare-global-enterprises

HCG has plans to expand the cancer care network as well as upgrade and strengthen the information technology infrastructure. I suggest go for the IPO.

You can read more here: http://www.slideshare.net/Pooja_Singh1732/monarch-networth-capital-ipo-note-on-healthcare-global-enterprises

Where is Anil Singh, look at the listing of HCG. It has been a disaster for investors.

Very weak listing. It even beats quick heal which had nrgative surprises at listing.

Krishna Bagra Ji

that brilliant explanation.

Excellent blog for sharing valuable information. Thanks for sharing, Appreciate your work.

fantastic blog