Cancer treatment specialist hospital chain HealthCare Global Enterprises (HCG) has revealed its IPO price band at INR205-218 per share. In its red herring prospectus, the company said its public issue opens on 16 March and closes on 18 March. The IPO comprises of fresh issue of up 1.16 crore shares while 1.82 crore shares will also be sold by existing shareholders under the offer for sale (OFS) route. AT the lower end of the price band, the IPO will mobilize INR610.9 crore while the upper band indicates the IPO size will be INR649.6 crore.

Since the company will not get any proceeds from the OFS, its proceeds will be restricted to INR252.8 crore.

The issue will be managed by Kotak Mahindra Capital Company Limited, Edelweiss Financial Services Limited, Goldman Sachs (India) Securities Private Limited, IDFC Securities Limited, IIFL Holdings Limited and Yes Bank Limited who are the Book Running Lead Managers.

Objects of the IPO

- Purchase of medical equipment – INR42.2 crore

- Investment in IT software, services and hardware – INR30.2 crore

- Pre-payment of debt – INR147 crore

- General corporate purpose – INR33.5 crore

Selling shareholders

PIOF owns 1.53 crore shares or 20.93% in the company. Following the IPO, this will reduce to 14.02%. PIOF is the investment vehicle of Azim Premji’s PremjiInvest. The offloading will be particularly heavy at IL&FS Trust Company’s India Build-Out Fund which currently owns 1.25 crore shares but plan to reduce it to just 30.2 lakh shares. V-Sciences holds 1.17 crore shares and this number will fall to 83.2 lakh shares.

PremjiInvest invested in the company in 2008 and this was followed by a big investment of nearly INR140 crore by Singapore’s state-owned investment company Temasek Holdings through V-Sciences in 2013.

Read Also: Upcoming IPOs in 2016: IPOs worth at least INR13,500 crores in pipeline

What is noteworthy in HCG IPO?

HCG claims to operate one of the biggest chains of hospitals in India. As of 31 December 2015, its network consisted of 14 comprehensive cancer centres, including its centre of excellence in Bengaluru, three freestanding diagnostic centres and day care chemotherapy centre across India and four Milann fertility centres in Bengaluru. HCG is currently setting up 12 Cancer Centres in several cities including Jaipur, Kanpur, Baroda, New Delhi and Kolkata.

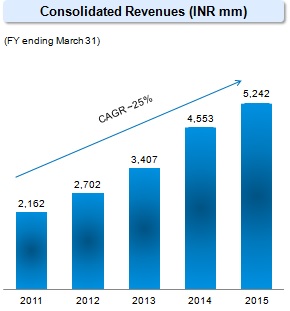

This wide network has allowed the company to register an average growth rate of 25% in the last five years. However, as we mentioned earlier, HCG has a poor track record of profitability. Read more about HealthCare Global Enterprises’ financial performance here.

This wide network has allowed the company to register an average growth rate of 25% in the last five years. However, as we mentioned earlier, HCG has a poor track record of profitability. Read more about HealthCare Global Enterprises’ financial performance here.

In the coming days, we intend to dive deep in the company’s red herring prospectus and do a thorough analysis. Keep coming back to IPO Central or follow us on social networks for latest analysis.