PSP Projects IPO will be the eighth mainboard IPO in India this year when it opens for subscription on 17 May. The upcoming IPO has some big shoes to fill as it comes right after HUDCO public offer which got oversubscribed more than 79 times. PSP Projects IPO, priced in the range of INR205 – 210 per share, will raise a total of INR211.7 crore (INR2.11 billion) at the upper end of the price band by selling 10,080,000 shares. Investors have time till 19 May to place their bids which need to be in multiples of 200 shares.

The IPO will be managed by Karvy Investor Services Limited while Karvy Computershare Private Limited has been appointed the registrar. Before going deep into the PSP Projects IPO review to figure out if it is worth applying or not, here are some vital details about the upcoming IPO.

PSP Projects IPO details | |

| Subscription Dates | 17 – 19 May 2017 |

| Price Band | INR205-210 per share |

| Fresh issue | 7,200,000 shares (INR151.2 crore at upper band) |

| Offer For Sale | 2,880,000 shares (INR60.5 crore at upper band) |

| Total IPO size | 10,080,000 shares (IN211.7 crore at upper band) |

| Minimum bid (lot size) | 70 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

PSP Projects IPO Review: Fresh + OFS

As we mentioned earlier, the public offer will mobilize a total of INI211.7 crore. This will be split into INR151.2 crore by issuing 7,200,000 fresh shares and INR60.5 crore from existing shareholders which plan to sell 2,880,000 shares through an Offer For Sale (OFS).

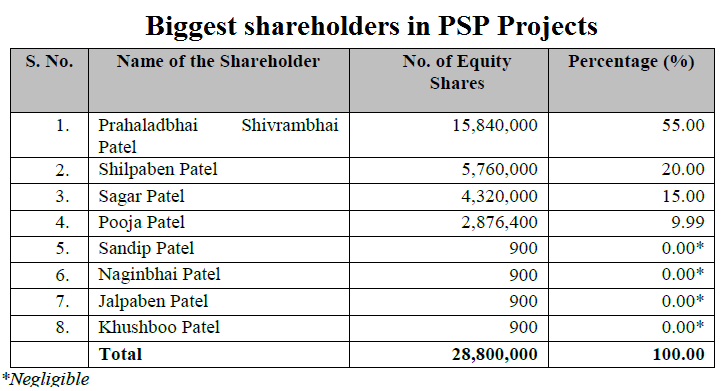

The company will not get any proceeds from the OFS. Among the existing shareholders participating in the OFS are Prahaladbhai Shivrambhai Patel (1,584,000 shares), Shilpaben Patel (576,000 shares), Pooja Patel (288,000 shares), and Sagar Patel (432,000 shares). It is noteworthy that all selling shareholders are either promoter or belong to promoter group. It is not surprising since the company has no external investor and is completely owned by the Patel family.

Source: PSP Projects’ Red Herring Prospectus

Also, worth highlighting is that the cost of acquisition for Prahaladbhai Shivrambhai Patel is INR0.28 per share while the same for Shilpaben Patel is INR0.01 per share.

Read Also: Here is why you should consider opening a Free Demat Account

PSP Projects IPO Review: Use of IPO proceeds

- Funding working capital requirements of our Company – INR63 crore

- Funding capital expenditure requirements of our Company – INR52 crore

- General corporate purposes – amount remaining after issue expenses

PSP Projects IPO Review: Construction all the way

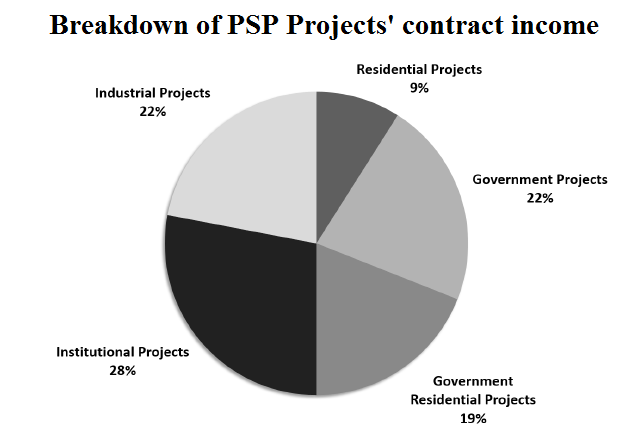

PSP Projects is a construction company that primarily offers turnkey solution across industrial, institutional, government, government residential and residential projects. The company has historically operated in the state of Gujarat, although it has diversified in Karnataka and Rajasthan more recently. A deeper analysis of PSP Projects’ prospectus shows that Institutional projects account for 28% of its standalone contract income while Industrial and Government projects made up 22% each. Government and Private residential projects accounted for 19% and 9%, respectively of the contract income.

Source: PSP Projects’ Red Herring Prospectus

Source: PSP Projects’ Red Herring Prospectus

PSP Projects notable deliveries include GCS Medical College, Hospital and Research Centre and Zydus Hospital at Ahmedabad. Since its incorporation, it has executed 14 projects for Cadila Healthcare Limited and its affiliates, six projects for Torrent Pharmaceuticals Limited and its affiliates and four projects for Nirma Limited and its affiliates.

Read Also: Upcoming IPOs in 2017 to keep an eye on

PSP Projects IPO Review: Financial performance

According to the red herring prospectus, PSP Projects has posted strong revenue growth in recent years, and except the decline in FY2014, its top line has grown consistently. All in all, revenues grew from INR180.7 crore in FY2012 to INR467.7 crore in FY2016. Nevertheless, the business is cyclical and FY2017 appears to be becoming a casualty of downturn with nine month revenues standing at only INR249.4 crore.

Thankfully, profits have demonstrated better trend, growing from INR8.3 crore in FY2012 to INR24.9 crore in FY2016. This means net margins improved from 4.6% to 5.3% in the same period. While revenues in the latest nine months show slippage, net margin has improved to 8.6%.

PSP Projects’ standalone financial performance (in INR crore) | ||||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | 9M FY2017 | |

| Total revenue | 180.7 | 260.9 | 214.8 | 286.9 | 467.7 | 249.4 |

| Total expenses | 168.3 | 242.7 | 199.4 | 265.7 | 429.1 | 217.6 |

| Profit after tax | 8.3 | 12.2 | 10.0 | 14.0 | 24.9 | 21.4 |

| Profit margin (%) | 4.6 | 4.7 | 4.7 | 4.9 | 5.3 | 8.6 |

Source: PSP Projects’ Red Herring Prospectus

Another key parameter in the construction business is the order book and PSP Projects is growing at a healthy rate on this front. The company’s total order book as of 31 March 2017, stood at INR729.1 crore, comprising of 17 institutional projects, four industrial projects, four government projects and two government residential projects. In addition, the order book of its subsidiary and joint venture was at INR107.4 crore as of 31 March 2017. These are healthy figures.

PSP Projects IPO Review: Should you invest?

While profitable, PSP Projects isn’t a big name and this warrants close scrutiny on the part of prospective investors. The company has done well in these years but its business has a very high dependence on Gujarat. Even after expanding operations in other states, more than 70% of the company’s order book includes projects to be based in Gujarat.

Read Also: How to identify good IPOs

On the basis of valuations, the company’s Earnings per share (EPS) of INR7.86 translates into P/E ratio of 26.1 – 26.7. This is less than Ahluwalia Contracts which trades at a P/E ratio of 30. However, PSP Projects needs to be valued at a discount against its much bigger competitor which has a market capitalization of INR2600 crore. It is also to be noted that PSP Projects IPO will lead to earnings dilution and the company’s performance in the latest nine months has not been very good. It doesn’t appear the promoters are leaving money on the table.

A quick glance at related party transactions and remuneration section threw a number of red flags. Compensation for chairman and managing director Prahaladbhai S. Patel was at INR1.9 crore in FY2016 and if sounds too high, it helps to know that he was paid INR15.1 crore in FY2015. This is even higher than the net profit the company made in the year. As we noted in the case of Precision Camshafts and Power Mech Projects, companies promoted by first-generation entrepreneurs are especially susceptible to excessive promoter payouts. Proper executive compensation is a widely accepted tool for managerial effectiveness in the industry but this is simply too much pay. Although PSP Projects has now capped compensation, the example of what happened in the past isn’t confidence inspiring.

Overall, in PSP Projects IPO Review, we don’t find the offer appealing and while we understand it may still find takers in the bull market, this should not be a reason for one to rush. There are likely to be better opportunities for investors going ahead. Meanwhile, feel free to visit our discussion page on PSP Projects IPO to keep yourself updated about the sentiment around this IPO.