The anticipation surrounding the Swiggy IPO is palpable as it prepares to enter the public market. This article will delve into the Swiggy IPO SWOT Analysis, exploring its strengths, weaknesses, opportunities, and threats based on factual data and RHP sources. As one of India’s leading food delivery platforms, Swiggy aims to raise approximately INR 11,327.43 crores through this IPO, which will be pivotal for its future growth and stability.

Swiggy IPO SWOT Analysis: A Comprehensive Overview

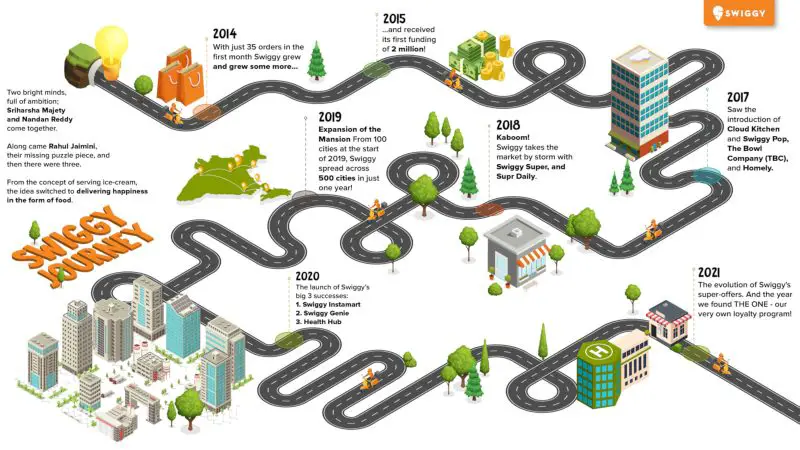

Founded in 2014, Swiggy has rapidly evolved from a small food delivery service in Bangalore to a major player in the Indian food-tech sector, boasting a pre-IPO valuation of around USD 11.2 billion. The company has expanded its offerings beyond food delivery to include grocery services through Instamart and express delivery options. Despite its impressive growth trajectory, Swiggy faces significant challenges that investors must consider.

In addition to serving consumers, Swiggy provides business enablement solutions to restaurant partners, grocery merchants, and brand partners. These solutions include analytics-driven tools to enhance their online presence and customer base, supply chain fulfillment services, and an extended delivery network. As of 30 June 2024, Swiggy had reached a milestone of 11.27 crore transacting users and employed 5,401 staff members.

Swiggy IPO Strengths

- Strong Brand Recognition: Swiggy has successfully positioned itself as a leading food delivery platform in India. Its brand is synonymous with quality and reliability, which has fostered customer loyalty. According to a report, Swiggy’s extensive marketing campaigns and consistent service quality have made it one of the most recognized brands in the Indian food-tech sector.

- Extensive Network of Restaurants: One of Swiggy’s key strengths is its vast network of partnerships with over 3,00,000 restaurants across more than 500 cities in India. This extensive collaboration allows Swiggy to offer a wide variety of cuisines and dining options to its customers, catering to diverse tastes and preferences. Such a broad restaurant network enhances customer choice and convenience, which is crucial in the competitive food delivery market.

- Advanced Technology Infrastructure: Swiggy has heavily invested in technology to optimize its operations. The company employs sophisticated algorithms for efficient routing and real-time order tracking, which significantly enhances the user experience. This technological edge not only improves delivery times but also helps in managing logistics more effectively. The application of artificial intelligence (AI) for personalized customer recommendations further solidifies Swiggy’s competitive advantage.

- Quick Commerce Expansion: The launch of Instamart, Swiggy’s quick commerce platform for grocery delivery, marks a significant diversification in its service offerings. This expansion into quick commerce has allowed Swiggy to tap into new revenue streams and meet the growing demand for fast grocery deliveries.

- Growing User Base: Swiggy has witnessed a steady increase in its user base over the years. The company reported substantial growth in active users, driven by its user-friendly app and consistent service quality. The growing number of users not only boosts revenue but also enhances network effects, making the platform more attractive to both customers and restaurant partners.

- Financial Backing: Swiggy has secured significant funding from reputable investors such as Tencent and Accel India, which provides it with the financial resources necessary for expansion and innovation. This backing not only supports current operations but also positions the company well for future growth initiatives. In Swiggy SWOT analysis, this is one of the most important strengths.

Swiggy IPO Weaknesses

- High Operational Costs: Swiggy faces significant operational expenses that impact its profitability. The company allocates around 25% of its total costs to outsourcing support, which includes delivery logistics and customer service. Additionally, employee benefits account for a similar percentage, further straining financial resources. In FY24, Swiggy reported total expenses of INR 13,947.38 crore, highlighting the substantial financial burden it carries.

- Dependence on Third-Party Restaurants: Swiggy’s business model heavily relies on partnerships with third-party restaurants. This dependency can lead to challenges in maintaining service quality and pricing control. If restaurant partners face operational issues or choose to exit the platform, it could adversely affect Swiggy’s revenue and customer satisfaction.

- Intense Competition: The food delivery sector in India is highly competitive, with major players like Zomato and newer entrants such as Blinkit and Zepto vying for market share. Swiggy’s inability to effectively compete against these rivals could result in a decline in market position and profitability. Zomato reported revenues of INR 12,114 crore in FY 2024, illustrating the competitive landscape Swiggy must navigate.

- Market Saturation: As the food delivery market matures, growth rates may slow down significantly compared to earlier years when the market was expanding rapidly. The saturation of major urban markets means that capturing new customers will become increasingly challenging for Swiggy.

Swiggy IPO Opportunities for Growth

- Market Expansion: The online food delivery market in India is expected to grow significantly, providing ample opportunities for established players like Swiggy to capture new customers in tier 2 and tier 3 cities.

- Product Diversification: Expanding into new product lines such as meal kits or grocery delivery can enhance revenue streams further.

- Strategic Partnerships: Collaborations with cloud kitchens or local eateries can increase market penetration and operational efficiency.

- Sustainability Initiatives: By adopting environmentally friendly practices, Swiggy can attract consumers who prioritize sustainability in their purchasing decisions.

Swiggy IPO Threats

- Intense Competition: The food delivery market in India is highly competitive, with major players like Zomato, Dunzo, and Blinkit vying for market share. Swiggy’s closest rival, Zomato, has successfully navigated the IPO landscape and continues to pose a substantial threat.

- Regulatory Challenges: Swiggy operates in a sector subject to various regulations that could impact its business model. Changes in food delivery regulations, such as commission caps and labor laws, could affect operational costs and service pricing. Additionally, compliance with data privacy regulations is crucial given the vast amount of consumer data Swiggy handles.

- Technological Disruptions: The rapid pace of technological advancement means that new business models or competitors could emerge at any time. Innovations in logistics or changes in consumer behavior driven by technology could disrupt Swiggy’s current operational framework.

- High Attrition Rates: Swiggy has reported a high attrition rate among its delivery personnel, with figures reaching 53.74% in fiscal 2024. High turnover can lead to increased training costs and operational inefficiencies, ultimately affecting service quality and customer satisfaction.

Swiggy IPO SWOT Analysis: Financial Performance Overview

Swiggy’s financial performance has shown encouraging performance leading up to the IPO:

- For FY 2024, the company reported revenues of INR 11,247 crores while incurring losses of INR 2,350 crores. Both parameters demonstrated a marked improvement from previous year.

- Similar improvement was seen in other financial metrics such as EBITDA margin.

| FY 2022 | FY 2023 | FY 2024 | Q1 FY 2025 | |

| Revenue | 5,704.90 | 8,264.60 | 11,247.39 | 3,222.22 |

| Expenses | 9,574.45 | 12,884.40 | 13,947.38 | 3,907.96 |

| Net income | (3,628.90) | (4,179.30) | (2,350.24) | (611.01) |

| Margin (%) | (63.61) | (50.57) | (20.90) | (18.96) |

Swiggy SWOT Analysis: Conclusion

The Swiggy IPO SWOT Analysis highlights a company poised at a critical juncture in its growth journey. While it boasts significant strengths such as brand recognition and technological innovation, it also faces challenges related to profitability, competition and potential regulatory changes.

However, India’s growing market and the ability to tap into smaller cities is a big opportunity for Swiggy. At the same time, growing topline is generally seen to be aiding profitability as it happened in the case of Zomato.

In summary, the upcoming IPO represents not just an investment opportunity but also a test of how well Swiggy can adapt to the challenges ahead while leveraging its strengths effectively in an increasingly competitive environment.