Central Depository Services Limited (CDSL) – one of the most anticipated IPOs this year – is likely to open for subscription later this month. The company is one of the two depositories in India which naturally makes it a sought-after upcoming IPO. CDSL’s parent BSE earlier came with its IPO and as we analyzed and predicted, it went on to reward investors very well, although allotment was on the lower side as the issue got subscribed over 51 times. Investors haven’t missed the bus though as several quality names including CDSL IPO have potential to generate excellent returns in 2017 (DMart IPO is another promising avenue, read more about it here). As pricing details for CDSL IPO are not finalized yet, it would be futile on our part to speculate on this part. However, we dived into the draft prospectus and found out some important details for the company.

Central Depository Services Limited (CDSL) – one of the most anticipated IPOs this year – is likely to open for subscription later this month. The company is one of the two depositories in India which naturally makes it a sought-after upcoming IPO. CDSL’s parent BSE earlier came with its IPO and as we analyzed and predicted, it went on to reward investors very well, although allotment was on the lower side as the issue got subscribed over 51 times. Investors haven’t missed the bus though as several quality names including CDSL IPO have potential to generate excellent returns in 2017 (DMart IPO is another promising avenue, read more about it here). As pricing details for CDSL IPO are not finalized yet, it would be futile on our part to speculate on this part. However, we dived into the draft prospectus and found out some important details for the company.

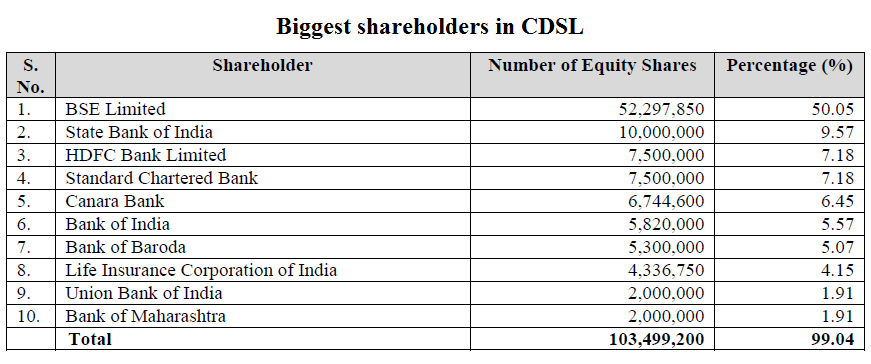

BSE as promoter – CDSL was established by BSE in 1997 and its operations were flagged off by the then Finance Minister Yashwant Sinha in 1999. According to the draft prospectus BSE holds 52,297,850 shares or 50.05% equity stake in the depository subsidiary. This parentage has certainly helped CDSL in growing business and limited competition also made things easier for it (NSE’s NSDL is the only competitor for CDSL). As we mentioned in our review of BSE IPO, the stock exchange has been losing to rival NSE. However, it is not true for CDSL which we will illustrate further in this article. Just like BSE was the first stock exchange to list in India, CDSL will be the first depository to be quoted in the country’s stock exchanges.

Several prominent names on board too – Apart from BSE, CDSL counts several other prominent names among its investors and sponsors. These include State Bank of India (SBI), Standard Chartered Bank, HDFC Bank, Canara Bank, Bank of India, Bank of Baroda, Union Bank of India, and Calcutta Stock Exchange. Presence of these big names as substantial shareholders has helped CDSL immensely in not just creating a sense of trust among users but also in distribution of CDSL’s services and opening of new demat accounts.

All OFS, no fresh shares – Like the recently launched BSE IPO, CDSL IPO will also not involve sale of new shares. All the shares in the offer will be sold by existing shareholders through an Offer for Sale (OFS). BSE’s stake is set to decline to 24% after CDSL IPO which will be in line with the regulatory requirements. In addition; SBI and Bank of Baroda will reduce their shareholding while Calcutta Stock Exchange will sell all the 1,000,000 shares it owns. We are not big fans of OFS issues as they don’t offer funds to the company but the situation is different for players like CDSL where overall business and earnings can continue to grow with proportionately less increase in costs. In these cases, no dilution is a great proposition.

All OFS, no fresh shares – Like the recently launched BSE IPO, CDSL IPO will also not involve sale of new shares. All the shares in the offer will be sold by existing shareholders through an Offer for Sale (OFS). BSE’s stake is set to decline to 24% after CDSL IPO which will be in line with the regulatory requirements. In addition; SBI and Bank of Baroda will reduce their shareholding while Calcutta Stock Exchange will sell all the 1,000,000 shares it owns. We are not big fans of OFS issues as they don’t offer funds to the company but the situation is different for players like CDSL where overall business and earnings can continue to grow with proportionately less increase in costs. In these cases, no dilution is a great proposition.

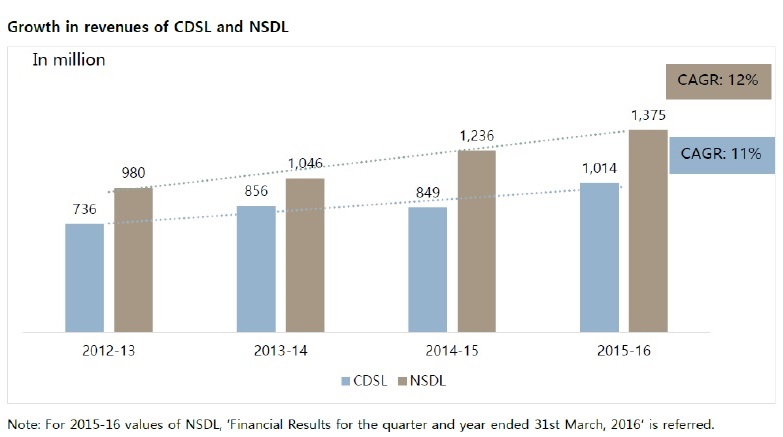

Steady business – Stock trading in India is still considered niche and risky by a large portion of investing public, including people who end up investing in stock markets indirectly through mutual funds. However, the scenario is changing gradually and this is a big positive for players like CDSL. The company has seen its revenues grow over time and even though the top line growth has not been high, it is steady. A graphical illustration of revenue growth for both CDSL and NSDL demonstrates that the ship is steady.

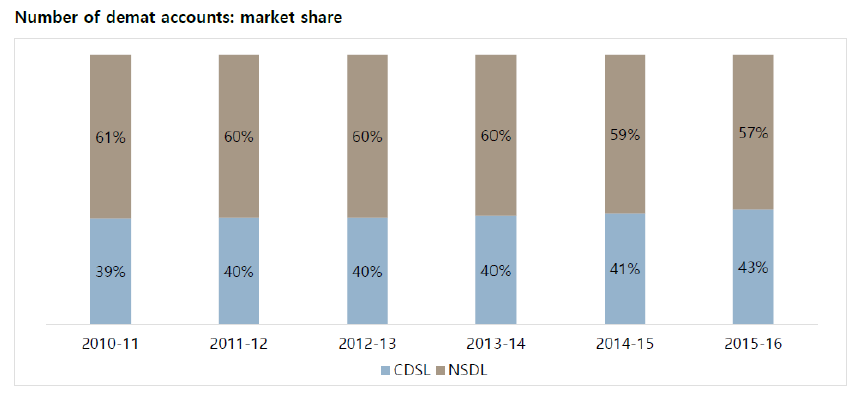

Gaining ground against NSDL – While the above graph shows that CDSL trails its counterpart in revenues, it doesn’t capture what has happened more recently. In the last couple of years, CDSL has opened more demat accounts than NSDL. As a result, its share in terms of demat accounts has increased steadily in the last five years. As of 30 November 2016, CDSL had over 14 million capital market investor records under the KRA (KYC Registration Authority) representing approximately 67% market share. Its subsidiary CDSL Ventures is registered with the SEBI and the Unique Identification Authority of India (UIDAI) as Authorized and KYC user agency. This is valuable data and may generate revenues for CDSL in years to come as more securities are kept in demat form.

Gaining ground against NSDL – While the above graph shows that CDSL trails its counterpart in revenues, it doesn’t capture what has happened more recently. In the last couple of years, CDSL has opened more demat accounts than NSDL. As a result, its share in terms of demat accounts has increased steadily in the last five years. As of 30 November 2016, CDSL had over 14 million capital market investor records under the KRA (KYC Registration Authority) representing approximately 67% market share. Its subsidiary CDSL Ventures is registered with the SEBI and the Unique Identification Authority of India (UIDAI) as Authorized and KYC user agency. This is valuable data and may generate revenues for CDSL in years to come as more securities are kept in demat form.

Solid profitability – With growth in revenues come increase in costs, right? Wrong. Just like its revenues, CDSL has seen an uptick in its earnings in the latest year although profits declined in the previous three years. However, its margins are solid and never went below 34% in the last four years. In the latest year, its profitability was at 53.2%. The company credits this strong profitability to its scalable business model.

Our largely fixed operating costs result in high economies of scale. Our main costs are employee wages and post employee benefits and software development and maintenance costs.

| CDSL’s consolidated financial performance (in INR crore) | |||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 120.7 | 124 | 122.8 | 127.2 | 139.4 |

| Total expenses | 39.8 | 57.6 | 61.2 | 66.2 | 63.5 |

| Profit after tax | 55.3 | 49.9 | 49.3 | 43.7 | 74.1 |

| Net margin (%) | 45.8 | 40.2 | 40.1 | 34.4 | 53.2 |

Source: CDSL draft prospectus

Dividends – Some good news for dividend lovers. CDSL has paid dividends regularly to its shareholders in the last four years and considering that BSE will continue to remain the biggest shareholder, this policy is unlikely to change any time soon. Out of the INR74.1 crore it earned last year, CDSL paid a total of INR31.4 crore in the form of dividends. CDSL paid dividend at the rate of 25% (INR2.5 per share) and this was up from 22% in FY2015. This generous dividend policy makes CDSL a great long term portfolio bet. However, exact dividend yield for IPO investors will depend on how the offer is priced. In the latest deal in October 2016, BSE sold 4.33 million shares to Life Insurance Corporation (LIC) at INR78.93 per share. This price gives some insight as to how the IPO may be priced. Considering the increase in profits since October last year, dividend yield will still be quite attractive if CDSL IPO is priced below INR100 per share.