Indian pharma firm Alkem Laboratories has set the price band of its IPO between INR1,020 and INR1,050 per share. The IPO will open on 8 December for subscription. At the upper end of the price band, the public offer will mobilize INR13.5 billion. This will make it India’s second largest IPO this year after InterGlobe Aviation that raised INR30 billion in October.

The IPO will see existing shareholders selling some of their shares and thus, no issue proceeds will go to the company. As a result of the sale of 10.75% equity shares, the IPO will value the company at INR125.5 billion.

Alkem Laboratories received capital market regulator SEBI’s approval to bring IPO in October.

Alkem Laboratories received capital market regulator SEBI’s approval to bring IPO in October.

Read Also: Alkem Laboratories gets SEBI approval for IPO

Nomura Financial Advisory and Securities (India), Axis Capital, J P Morgan India and Edelweiss Financial Services will be managing the issue.

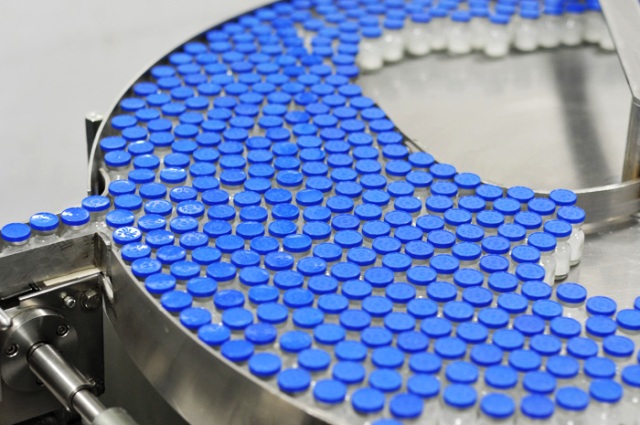

“We have total of 16 manufacturing facilities, of which 14 facilities at five locations in India and two in the US. Five of the facilities are USFDA approved, mainly catering to sales in US markets,” said Alkem Labs joint managing director Sandeep Singh while announcing IPO details.

Humble beginnings

Founder and Chairman Samprada Singh along with his brother B N Singh established Alkem Laboratories in 1973 as a healthcare marketing company and gradually extended operations into the pharmaceutical business. The company deals in active pharmaceutical ingredient (API), branded and generic drugs. Alkem owns 16 manufacturing facilities including two overseas plants and operations spread over 55 countries. Collectively, the promoter group holds 70% stake in the company with Samprada Singh and B N Singh holding a share of 31.75% each.

Alkem Laboratories IPO would be the biggest one in pharmaceutical segment. The only other pharmaceutical company to bring IPO this year is Syngene International Limited with its INR5.5 billion issue. Starting on 8 December, Alkem’s IPO will coincide with the public offering of Dr Lal Path Labs.

Read Also: Dr Lal Path Labs IPO reveals price band, retail investors offered discount

Stay tuned for in-depth review of both IPOs by IPO Central.