What is a Growth Mutual Fund?

A growth mutual fund makes the majority of its investments in equities or stocks of emerging companies with the potential to grow through capital appreciation. A growth mutual fund portfolio is made up of companies that register fast-paced progress and can deliver higher returns to investors. These are funds with a high beta which indicates high volatility, a high alpha which indicates a high return relative to peers, a high expense ratio, and almost negligible dividend payout.

We have shortlisted some of the best growth mutual funds in India, and these funds have been divided into further categories: –

- Thematic Funds

- Sector based Funds

- Tax saver funds

- Focused funds

Best Growth Mutual Funds in India: Thematic Funds

Thematic funds are equity mutual funds and they invest in stocks linked to a theme. They are well diversified and may invest in several sectors around a particular opportunity.

Tata Ethical Fund – Growth

Fund allocation: The fund has 96.36% investment in domestic equities of which 50.36% is in Large Cap stocks, 23.27% is in Mid Cap stocks, and 15.24% is in Small Cap stocks. Further, 31% of funds are allocated to IT, 8% to pharmaceuticals, 8% to capital goods and the rest to miscellaneous.

Returns: The three-year and five-year trailing CAGRs are 23.45 % and 13.41 % compared to category returns of 19.5 % and 10%. This performance ensures its entry among the best growth mutual funds in India.

Fund Size: Tata Ethical Fund had Assets under Management worth INR 1,199.36 crore and the NAV of INR 278.56 as on 8th August 2022.

Suitable For: High-risk appetiteinvestors who have advanced knowledge of macro trends and want portfolio diversification across sectors.

Expense ratio: Comparatively moderate ratio of 1% against peers.

Mirae Asset Great Consumer Fund – Growth

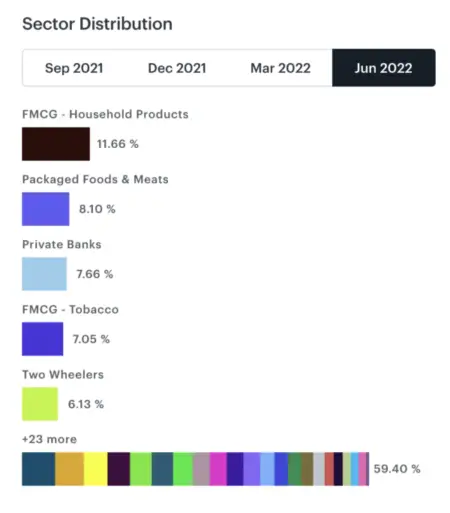

Fund allocation: The fund has the majority of its holdings allocated as 11.6% in FMCG households, 8.10% in FMCG packed food, and the rest in other FMCG verticals. Mirae Asset Great Consumer Fund has 98.69% investment in domestic equities of which 56.42% is in Large Cap stocks, 15.75% is in Mid Cap stocks, 8.82% in Small Cap stock

Returns: The three-year and five-year trailing CAGRs are 23.44 % and 16.05% compared to category returns of 19.5 % and 10%.

Fund Size: Assets under Management worth INR 1,649 crore and NAV of INR 66.024 as on 8th August 2022.

Suitable For: Investors seeking to diversify their portfolio within the FMCG sector.

Expense ratio: Comparatively low ratio of 0.58% against peers. Apart from past returns, expense ratio is also an important consideration while picking up the best growth mutual funds in India.

Best Growth Mutual Funds in India: Sector-Based Funds

Sectoral mutual funds invest in a specific industry, such as technology, metals, energy, or infrastructure. Growth sectoral MF invests more than 80% of AUM in equities ranging from small to mid to large-cap companies.

ICICI Prudential Technology Fund – Growth

Fund allocation: ICICI Prudential Technology Fund has majority of its holdings allocated to the IT and telecom sector which constitutes more than 80% of AUM. It is one of the emerging MFs with substantially-strong returns in past few years. The fund has 89.01% investment in domestic equities of which 74.35% is in Large Cap stocks, 5.66% is in Mid Cap stocks, and 6.41% in Small Cap stocks. The fund has 0.35% investment in Debt, primarily in Government securities.

Returns: The three-year and five-year trailing CAGRs are 34 % and 29% compared to category returns of 19% and 11.2%. Currently, it is the no 1 ranked mutual fund in the technology sector.

Fund Size: Assets under Management worth INR 8,508.13 crore and the NAV of INR 137.68 as on 8th August 2022.

Suitable For: Investors seeking to maximize return from emerging companies in the technology sector.

Expense ratio: Comparatively high ratio of 0.79% against peers.

Quant Infrastructure Fund – Growth

Fund allocation: As the name suggests, Quant Infrastructure Fund invests in the infrastructure sector which includes a diverse range of companies engaged in infrastructure-related activities. The fund has majority of its holdings allocated as 21.09% in Construction & Engineering, 15.01% in Logistics and 8% in public banks. It is one of the classic MFs among high-return funds. The fund has 98.84% investment in domestic equities of which 52.75% is in Large Cap stocks, 16.07% is in Mid Cap stocks, and 27.47% in Small Cap stocks.

Returns: The three-year and five-year trailing CAGRs are 40% and 24.04% compared to category returns of 20% and 12.5%. These are exceptionally strong performances over long timeframes owing to sectoral tailwinds. Nevertheless, the infrastructure sector is deeply cyclic. In order to pick best growth mutual funds in India in this sector, investors need some broad timing skills and patience.

Fund Size: Assets under Management worth INR 539.75 crore and the NAV of INR 23.02 as on 8th August 2022.

Suitable For: Investors seeking to maximize the return from emerging companies in the infrastructure sector with a high-risk appetite, owing to sector volatility.

Expense ratio: Comparatively low ratio of 0.64% against peers.

Read Also: All About REIT Investing in India

Tax saver funds

Tax-saving mutual funds come under the EEE (Exempt-Exempt-Exempt) regime where investments, returns and withdrawals are tax-free. To get these benefits, investors need to lock-in their investments for 3 years, unlike other normal mutual funds.

Quant Tax Plan – Growth

Fund allocation: The Quant Tax Plan Direct-Growth scheme has delivered consistently higher returns than most funds in its category. It has a high ability to control losses in a falling market. The fund has the majority of its holdings allocated as 11.38% in Construction & Engineering, 9.33% in public banks and 8.5% in logistics. The fund has 99.34% investment in domestic equities of which 57.88% is in Large Cap stocks, 18.61% is in Mid Cap stocks, and 12.42% in Small Cap stocks.

Returns: The three-year and five-year trailing CAGRs are 41 % and 23.51% compared to category returns of 21.5 % and 11.5%. In its category, Quant Tax Plan has managed highest returns for the last 3 years, easily placing it among the best growth mutual funds in India.

Fund Size: Assets under Management worth INR 1,370.2 crore and the NAV of INR 229.75 as on 8th August 2022.

Suitable For: Investors who plan to invest for at least three years and seek additional benefits such as income tax savings in addition to higher expected returns.

Expense ratio: Comparatively low ratio of 0.57% against peers.

Mirae Asset Tax Saver Fund

Fund allocation: The Mirae Asset Tax Saver Fund Direct – Growth is one of the oldest fund houses and has majority of its holdings allocated as 19.24% in Private Banks, 12.54% in IT services and consulting and 7.63% in oil and gas. The fund has 99.11% investment in domestic equities of which 58.49% is in Large Cap stocks, 11.52% is in Mid Cap stocks, 7.1% in Small Cap stocks.

Returns: The three-year and five-year trailing CAGRs are 24.23 % and 14% compared to category returns of 21.5 % and 11.5%.

Fund Size: Assets under Management worth INR 11,494.4 crore and the NAV of INR 30.723 as on 8th August 2022.

Suitable For: Investors who plan to invest for at least three years and seek additional benefits such as income tax savings in addition to higher expected returns.

Expense ratio: Comparatively low ratio of 0.56% against peers.

Focused funds

Focused mutual funds invest in companies based on their market capitalization, which can range from small to medium to large. These funds are appropriate for investors who want to stabilize their overall portfolio by investing in one of these funds.

Axis Small Cap Fund

Fund allocation: The Axis Small Cap Fund scheme has been a pioneer in small-cap mutual funds. It has a high ability to minimize losses in the downside market. The fund has the majority of its holdings allocated as 20.75% in Investment Banking & Brokerage, 10.39 % in Diversified Chemicals and 8.5% in IT. The fund has 79.37% investment in domestic equities of which 0.34% is in Large Cap stocks, 4.43% is in Mid Cap stocks, and 58.4% in Small Cap stocks.

Returns: The three-year and five-year trailing CAGRs are 29.67% and 18.95% compared to category returns of 30.55 % and 12.77%. It is among the top small cap funds and has delivered impressive performance in the category.

Fund Size: Assets under Management worth INR 8,955.5 crore and the NAV of INR 61.14 as on 8th August 2022.

Suitable For: Investors who want to invest for at least 3 to 4 years and expect high returns with high volatility or beta.

Expense ratio: Comparatively low ratio of 0.49% against peers.

Quant Mid Cap Growth Fund

Fund allocation: The Quant mid-cap fund scheme has been aggressive in mid-cap mutual funds. The fund has the majority of its holdings allocated in public banks, logistics and hotels. The fund has 98.6% investment in domestic equities of which 30.27% is in Large Cap stocks, 42.97% is in Mid Cap stocks, and 8.65% in Small Cap stocks.

Returns: The three-year and five-year trailing CAGRs are 38.81 % and 21.40% compared to category returns of 25.23 % and 12.35%. It is the top mid-cap fund and has given highest returns in the category for the last 3 years.

Fund Size: Assets under Management worth INR 534.94 crore and the NAV of INR 124.6 as on 8th August 2022.

Suitable For: Investors who want to invest for at least 3 to 4 years and expect very high returns with moderate volatility or beta.

Expense ratio: Comparatively moderate ratio of 0.49% against peers.

Summary

| MF Scheme | Category | Sharpe Ratio | Expense Ratio (%) | 3-year CAGR (%) |

| Tata Ethical Fund | Thematic | 0.6 | 1.00 | 23.49 |

| Mirae Asset Great Consumer Fund | Thematic | 0.7 | 0.58 | 23.44 |

| ICICI Prudential Technology Fund | Sectoral | 0.67 | 0.79 | 34 |

| Quant Infrastructure Fund | Sectoral | 0.79 | 0.64 | 40 |

| Quant Tax Saver Plan | Tax Saver | 0.39 | 0.57 | 41 |

| Mirae Asset Tax Saver | Tax saver | 0.16 | 0.56 | 24.23 |

| Axis Small Cap | Focused | 0.49 | 0.49 | 29.67 |

| Quant Mid Cap Growth | Focused | 0.6 | 0.49 | 38.81 |