Burger King IPO is scheduled to open on 2 December, leading the pack of IPO hopefuls for the next month. Priced in the range of INR59 – 60 per share, the offer has already sparked interest in the grey market with healthy margins. Through Burger King IPO review, we try to understand if the stock should be part of investors’ portfolio.

Burger King India IPO details

| Subscription Dates | 2 – 4 December 2020 |

| Price Band | INR59 – 60 per share |

| Fresh issue | INR450 crore |

| Offer For Sale | 60,000,000 shares (INR354 – 360 crore) |

| Total IPO size | INR804 – 810 crore |

| Minimum bid (lot size) | 250 shares |

| Face Value | INR10 per share |

| Retail Allocation | 10% |

| Listing On | NSE, BSE |

Burger King IPO Review: A strong and growing brand

Through a multi-layered structure, private equity firm Everstone Capital owns the majority stake in Burger King India. The company’s direct promoter is QSR Asia Pte Ltd. which holds 94.34% of the issued, subscribed and paid-up equity share capital while Amansa Investments Limited owns another 5.12% through its pre-IPO investment.

F&B Singapore owns 87.64% of equity capital in QSR Asia Pte Ltd. F&B Singapore is a 100% subsidiary of F&B Asia Ventures Ltd in which Everstone Capital Partners II LLC holds 45.7% of the Class A shares.

Burger King IPO Analysis: A strong and growing brand

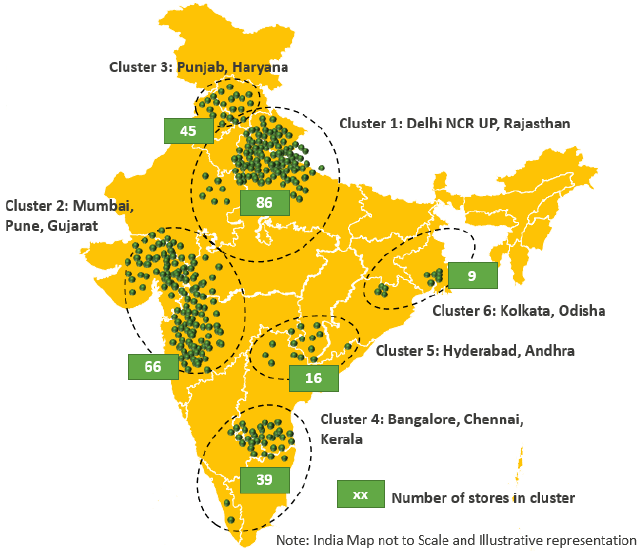

After opening its first restaurant in November 2014, Burger King has come a long way in India. The chain’s outlet reach stood at 261 restaurants, including eight sub-franchised restaurants as of 30 September 2020. These outlets were spread across 17 states and union territories and 57 cities across India. By the end of calendar year 2021, the company plans to expand its network to 300 outlets.

Burger King is a globally known brand and enjoys strong brand recall value among millennials – its target customers – in India as well.

Read Also: Laxmi Organics files DRHP for INR800 crore IPO

Burger King IPO Review: Financial performance on a slippery slope

As is the case with most companies in growth phase, Burger King has registered higher revenues in each of the last 3 years. However, this streak appears to be coming to an end in FY2021 due to the pandemic.

The company has not been profitable in these years and the impact of Covid-19 is clearly visible in its profits during the latest six months.

Burger King’s financial performance (in INR crore)

| FY2018 | FY2019 | FY2020 | H1 FY2021 | |

| Revenue | 388.7 | 644.1 | 846.8 | 151.7 |

| Expenses | 471.0 | 682.4 | 919.0 | 268.5 |

| Net income | -81.4 | -38.6 | -77.6 | -119.0 |

| Net margin (%) | -20.9 | -6.0 | -9.2 | -78.4 |

Burger King IPO Analysis: Should you invest?

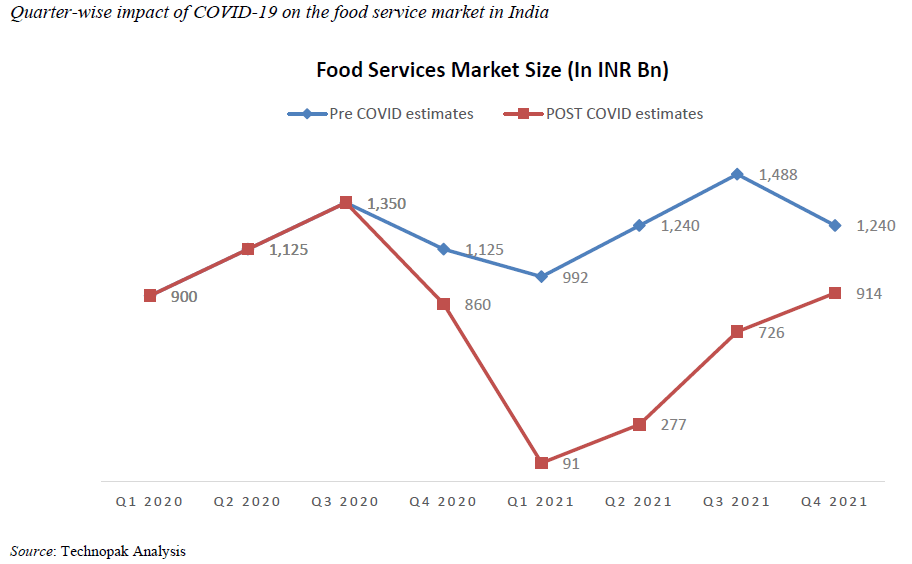

Investors would be kidding themselves if they wanted to base their investment decision on past financial performance. In terms of hardcore numbers, there isn’t much to talk about. On the contrary, the company’s performance has further deteriorated in the latest six months due to Covid-19. It is anyone’s guess that it will take quite some time before the demand recovers to pre-covid levels but it is really hard to imagine that people will go out in droves to QSR outlets for the next 12 months even after vaccines are made available in this timeframe.

This leads us to the second point, an investment decision has to be forward looking and there are plenty of reasons to think that there are better days ahead for Burger King. No one can really deny the tailwinds for QSR industry – a young population that is quick at adopting new trends, a growing middle class, and increasing nuclearization of families. When combined these factors with the fact that India has one of the lowest per capita spend on eating out, it is a no brainer that players like Burger King stand to gain more traction in the coming years.

Given that packaged food and food services are likely to remain under pressure, it is unlikely that Burger King will run away post listing. In the event of markets tanking from here, it is also possible to see better price points in Burger King post-listing. As such, it is a question if investors are willing to hold the stock for longer timeframe after listing.

Looking at the longer term and its valuations, it may not be a bad idea to hold the shares for long term. Burger King has priced its offer at market cap to sales ratio of 3.5 which is lower than 4.5 for Westlife Development and 8.5 for Jubilant FoodWorks. Similarly, market cap by EBITDA metric shows Burger King is priced attractively at a discount to its listed peers.

Overall, Burger King IPO analysis reveals that the brand with a solid market standing has a long runway of growth but immediate gains post listing may be capped.

I prefer to wait and watch as the demand is not so great, so maybe we will be able to get the shares in the secondary market below it’s listing price

During still uncertain times ahead and its dismal performance even during earlier non-covid times its better to invest post IPO when it settles at a fair value in the market.

I know its international company

good company