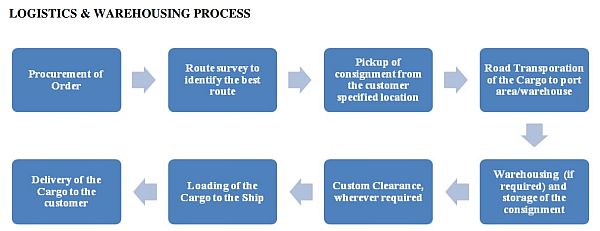

Cargotrans Maritime IPO description – The company is an international logistics solutions provider with core business of providing sea logistics services including ocean freight forwarding (FCL and LCL), transportation, custom clearance, warehousing and other value-added services to the clients. It started the business of freight forwarding in 2012 and has consistently grown its presence, enhanced the scope of services and increased its capabilities and expertise.

In October 2019, the company acquired 100% stake in Cargotrans Maritime Agencies Private Limited (CMAPL) and Cargotrans Maritime Forwarding Private Limited (CMFPL) to enter into the segment of custom house agent service and coastal transportation (i.e. transport of goods through sea within India).

It has a Multi-Modal Transport Operator’s License, which enables it to issue a single negotiable multimodal transport document covering multiple modes of transport. It also undertakes work related to regulatory compliance services such as customs clearance, through CMAPL, which owns a valid Custom House Agent’s License.

The company operates at 4 sea ports of Gujarat i.e. Mundra, Hazira, Kandla and Pipavav. Currently, it operates a fleet of 9 owned commercial trailers for moving containers and apart from this, it also hires third party transport operators to meet the shipping demand of its customers. Its customers operate in various sectors, including food processing, agro-based, commodities, plastics, minerals, ceramics, trading, packaging, textiles etc.

Promoters of Cargotrans Maritime – Edwin Alexander, Manju Edwin, Mathew Jacob and B Chandrashekhar Rao

Cargotrans Maritime IPO Details

| Cargotrans Maritime IPO Dates | 27 – 29 September 2022 |

| Cargotrans Maritime IPO Price | INR 45 per share |

| Fresh issue | 10,80,000 shares (INR 4.86 crore) |

| Offer For Sale | Nil |

| Total IPO size | 10,80,000 shares (INR 4.86 crore) |

| Minimum bid (lot size) | 3,000 shares (INR 135,000) |

| Face Value | INR 10 per share |

| Retail Allocation | 50% |

| Listing On | BSE SME |

Cargotrans Maritime Financial Performance

| FY 2020 | FY 2021 | FY 2022 | |

| Revenue | 2,057.94 | 4,940.77 | 8,954.36 |

| Expenses | 2,020.42 | 4,785.67 | 8,641.70 |

| Net income | 27.56 | 115.01 | 236.28 |

Cargotrans Maritime Offer News

Cargotrans Maritime Valuations & Margins

| FY 2020 | FY 2021 | FY 2022 | |

| EPS | 0.92 | 3.83 | 7.88 |

| PE ratio | – | – | 5.71 |

| RONW (%) | 44.39 | 38.85 | 15.23 |

| NAV | – | – | 17.74 |

| Debt/Equity ratio | 1.39 | 1.13 | 0.43 |

| ROCE (%) | 19.77 | 38.26 | 51.91 |

Cargotrans Maritime IPO GMP Daily Trend

| Date | Consolidated IPO GMP | Kostak | Subject to Sauda |

| 8 Oct 2022 | 15 | – | – |

| 7 Oct 2022 | 10 | – | – |

| 6 Oct 2022 | 10 | – | 42,000 |

| 4 Oct 2022 | 12 | – | 42,000 |

| 3 Oct 2022 | 10 | – | 42,000 |

| 1 Oct 2022 | 10 | – | 40,000 |

| 30 Sep 2022 | 10 | – | 35,000 |

| 29 Sep 2022 | 8 | – | 28,000 |

| 28 Sep 2022 | 8 | – | 25,000 |

| 27 Sep 2022 | 5 | – | 15,000 |

| 26 Sep 2022 | 5 | – | 8,000 |

| 24 Sep 2022 | 5 | – | 8,000 |

| 23 Sep 2022 | 6 | – | 8,000 |

Cargotrans Maritime Offer Subscription – Live Updates

| Category | Non-retail | Retail | Total |

| Shares Offered | 510,000 | 510,000 | 1,020,000 |

| Day 1 | 1.42 | 6.75 | 4.09 |

| Day 2 | 7.36 | 30.69 | 19.03 |

| Day 3 | 129.63 | 166.86 | 148.25 |

| Last updated on 29 Sep 2022 | 06:59:28 PM |

Cargotrans Maritime Offer Lead Manager

HEM SECURITIES LIMITED

904, A Wing, Naman Midtown, Senapati Bapat Marg,

Elphinstone Road, Lower Parel, Mumbai-400013, India

Phone: +91- 022- 49060000

Email: [email protected]

Investor Grievance Email: [email protected]

Website: www.hemsecurities.com

Cargotrans Maritime Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

Office No. S6 – 2, 6th Floor,

Pinnacle Business Park, Next to Ahura Centre,

Mahakali Cave Road, Andheri (East),

Mumbai – 400093, Maharashtra

Phone: 22 6263 8200

E-mail: [email protected]

Website: www.bigshareonline.com

Cargotrans Maritime Contact Details

CARGOTRANS MARITIME LIMITED

DBZ-S-61A, 2nd Floor,

Shyam Paragon, Gandhidham,

Kachchh – 370 201, Gujarat

Phone: +91 90999-35142

E-mail: [email protected]

Website: www.cargotrans.in

Cargotrans Maritime IPO Allotment Status

Cargotrans Maritime IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Cargotrans Maritime IPO Timetable

| Cargotrans Maritime IPO Opening Date | 27 September 2022 |

| Cargotrans Maritime IPO Closing Date | 29 September 2022 |

| Finalisation of Basis of Allotment | 4 October 2022 |

| Initiation of refunds | 6 October 2022 |

| Transfer of shares to demat accounts | 7 October 2022 |

| Cargotrans Maritime IPO Listing Date | 10 October 2022 |

| Opening Price on BSE SME | INR70 per share (up 55.56%) |

| Closing Price on BSE SME | Coming soon |

Cargotrans Maritime IPO FAQs

What is Cargotrans Maritime offer size?

Cargotrans Maritime offer size is INR 4.86 crore.

What is Cargotrans Maritime IPO Price Band?

Cargotrans Maritime public offer price is INR 45 per share.

What is the lot size of Cargotrans Maritime IPO?

Cargotrans Maritime offer lot size is 3,000 shares.

What is Cargotrans Maritime IPO GMP today?

Cargotrans Maritime IPO GMP today is INR 15 per share.

What is Cargotrans Maritime kostak rate today?

Cargotrans Maritime kostak rate today is NA per application.

What is Cargotrans Maritime Subject to Sauda rate today?

Cargotrans Maritime Subject to Sauda rate today is INR NA per application.