The chemical industry is a vital part of the Indian economy by contributing 7% of total GDP. The Indian chemical industry is the 6th largest in the world and third largest in Asia. Since chemicals are mostly intermediate products used in several finished goods across industries, the chemicals industry has emerged as a secular growth story. This growth is likely to continue as the chemical industry is expected to be worth USD 304 billion by 2025 growing at a CAGR of 9% annually. Operating in the chemical industry, Chemplast Sanmar has launched its IPO today. Through Chemplast Sanmar IPO review, we aim to weigh positive and negative aspects of the company.

Chemplast Sanmar IPO Review – Business background

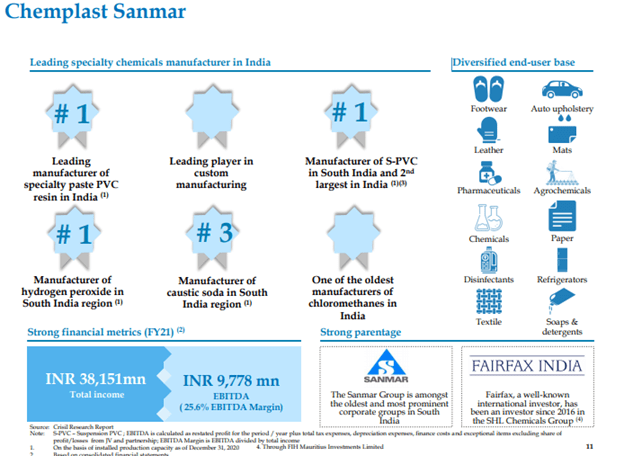

Chemplast Sanmar is a chemical-based company founded in 1967. Its parent company is Sanmar Holdings Ltd. The Chairman of the company is Mr. Vijay Sankar and management includes professionals like Ramakumar Shankar, Krishna Kumar. The majority of the top management of Chemplast Sanmar is well experienced, having spent over 30 years in the industry.

The main focus of the company is on specialty paste PVC and custom manufacturing of starting materials and intermediates for pharmaceutical, agrochemical, and fine chemicals sectors.

The company has four major manufacturing units out of which three are situated in Tamil Nadu and another one Puducherry. The company is dealing in various products and its main products are as follows-

- PVC resin

- Custom manufacturing of starting materials and intermediates

- Caustic Soda

- Hydrogen Peroxide

- Chloromethanes

NOTE- In 2012, Chemplast Sanmar was delisted from the stock market at the price of INR15 per share. More on this later.

Chemplast Sanmar IPO Details

The company is looking to collect INR3,850 crores through the IPO priced in the range of INR530 to INR541 per share.

| IPO opening date | 10th August |

| IPO closing date | 12th August |

| Price Band | INR530 – 541 per share |

| Fresh Issue | INR1,300 crore |

| Offer for sale | INR2,550 crore |

| Total IPO size | INR3,850 crore |

| Minimum Bid (Lot size) | 27 |

| Face Value | INR5 per share |

| Retail Allocation | 10% |

| Listing on | 24th August |

Chemplast Sanmar IPO – Issue Objectives

The company stands to raise INR1,300 crore by issuing new shares to investors. Out of this, the majority of the proceeds, to the tune of INR1,238.3 crore, are scheduled to go towards early redemption of NCDs. These NCDs attract an interest rate of 17.5% per year and thus, redemption will help in reducing interest outgo.

Chemplast Sanmar IPO Review – Financial Performance

The company’s financial performance in recent years has been marked with higher revenues; however, this was largely driven by acquisition of Chemplast Cuddalore Vinyls Limited (CCVL) in 2021. The acquisition of suspension PVC resin business has boosted the top line as well as the bottomline of the company.

Following the repayment of NCDs, the company’s balance sheet is likely to strengthen. As of 31 May 2021, the company’s indebtedness stood at INR3,288.2 crore on a consolidated basis.

Chemplast Sanmar Financial Performance (in INR crore)

| FY2019 | FY2020 | FY2021 | ||

| Revenue | 1,266.8 | 1,265.5 | 3,815.1 | |

| Expenses | 1,038.0 | 1,128.2 | 3,401.6 | |

| Net income | 118.5 | 46.1 | 410.2 | |

| Margin (%) | 9.4 | 3.6 | 10.8 |

Chemplast Sanmar IPO Analysis – Conclusion

So far, we have seen that the company has been able to generate revenue growth in recent years, most notably through the acquisition of CCVL.

The company’s IPO has generated buzz on social media, mainly because of its delisting in 2012. This was done at a level of INR15 per share and now the IPO at higher levels is seen in a negative light. However, it needs to be analyzed objectively. The company back then was a loss making entity while it has become profitable now and a few developments have aided this transformation. During these years, custom manufacturing business has been added to the company’s operations. Similarly, CCVL has been a fresh addition.

This isn’t a clean chit to the company, just stating the fact that a lot changes in nearly a decade and should be seen in the right perspective. Fairfax’s presence as an investor is also assuring.

Regarding the company’s core operations, it appears to be on a solid footing with two major products in its arsenal. These products – specialty paste PVC resin (82% market share in domestic production) and suspension PVC (20% market share in domestic production) – have limited competition and high barriers to entry. With most global chemical buyers following “China+1” strategy now, Indian manufacturers are clear winners. This offers a runway of at least next 2-3 years before fresh capacity comes on board.

In the case of specialty paste PVC resin, there is a supply deficit of nearly 45% and this demand is currently met by imports. The situation in suspension PVC is also not different and large quantities are imported from Japan, Taiwan, South Korea, and China.

Operationally, the company has made few changes helping it in better self-reliance. One such change is better integration in supply chain. For example, internal manufacturing of EDC, VCM and chlorine, the intermediates required for the manufacturing of its products has resulted in in-house raw material consumption increasing from 14% in FY2019 to 44% in FY2021.

In terms of valuations, the company is offering its shares at P/E ratio range of 17.32 – 17.68 which is quite reasonable and attractive when compared to its peers.

Overall, Chemplast Sanmar comes across as a turnaround story with good potential but a decision to invest or not should be taken by investors according to their risk appetite.