Equitas Small Finance Bank IPO (ESFB IPO) is scheduled to open on 20 October 2020, marking yet another public offer from the newly created banking licensees. The Chennai based company started as a microfinance player and was granted SFB license in 2016 by the RBI. The bank is now among the leading players in its category (more on this later). Equitas Bank IPO is priced in the range of INR32 – 33 per share and investors can also take advantage of shareholder reservation apart from investing in the retail category. Through Equitas Bank IPO review, we try to assess the positives and negatives associated with the company.

Equitas Small Finance Bank IPO details

| Subscription Dates | 20 -22 October 2020 |

| Price Band | INR32 – 33 per share |

| Fresh issue | INR280 crore |

| Offer For Sale | 72,000,000 shares (INR230.4 – 237.6 crore) |

| Total IPO size | INR510.4 – 517.6 crore |

| Minimum bid (lot size) | 450 shares |

| Face Value | INR10 per share |

| Retail Allocation | 35% |

| Listing On | NSE, BSE |

Equitas Bank IPO Review: Fresh + OFS

The offer has been pared down from the earlier expectations, considering the precarious market conditions. In total, INR280 crore will be raised by issuing fresh shares and the proceeds will be used to augment the bank’s tier I capital base and meet its future capital requirements.

There is also an offer for sale (OFS) by promoter Equitas Holdings Limited which is planning to sell 72 million shares.

ESFB IPO Review: From microfinance to banking

The company was incorporated as V.A.P. Finance Private Limited on 21 June 1993. In subsequent years, it expanded operations to include housing finance, vehicle finance besides microfinance. In these years, the company has successfully diversified its loan portfolio and significantly reduced its dependence on the microfinance business.

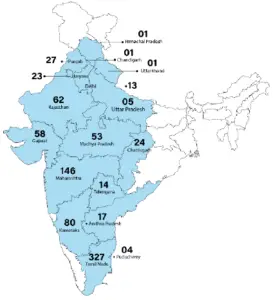

As of 31 March 2019, ESFB was the largest small finance bank in India in terms of number of banking outlets, and the second largest SFB in India in terms of Assets under Management (AUM) and total deposits in Fiscal 2019. As of 30 June 2020, its network comprised of 856 banking outlets and 322 ATMs across 17 states and union territories.

The bank offers a range of banking products and services to customers with a focus on serving the financially unserved and underserved customer segments in India. Its asset products include small business loans comprising LAPs, housing loans, and agriculture loans to micro-entrepreneurs, microfinance to JLGs (Joint Liability Groups), used and new commercial vehicle loans to drivers and micro-entrepreneurs. Similarly, it offers current accounts, salary accounts, savings accounts, and a variety of deposit accounts on the liability side.

Equitas SFB IPO Review: Financial performance

The table below very well captures the bank’s journey in recent years. It shows that Equitas Bank has not only managed to grow revenues in these years but has also performed well on other parameters like expanding margins and lowering costs as compared to income.

Among the most important considerations for any bank is non-performing assets (NPAs). It is not uncommon to see that banks and NBFCs go overboard and offer more and more loans in order to boost revenues which often result in NPA growth during times of distress. Equitas has done well in this department despite the steady growth it has managed and its Gross NPAs have remained at 2.7% of gross advances.

Read Also: Best IPOs in 5 years that doubled investors’ money

Equitas Bank’s financial performance (in INR crore)

| FY2018 | FY2019 | FY2020 | Q1 FY2021 | |

| Revenue | 1,772.9 | 2,394.8 | 2,927.8 | 751.0 |

| Expenses | 1,741.1 | 2,184.3 | 2,684.2 | 693.3 |

| Net income | 31.8 | 210.6 | 243.6 | 57.7 |

| Net margin (%) | 1.8 | 8.8 | 8.3 | 7.7 |

| Net interest margin (%) | 9.0 | 8.5 | 9.1 | 8.6 |

| Cost to income ratio (%) | 80.0 | 70.3 | 66.4 | 67.3 |

| Gross NPA (%) | 2.7 | 2.5 | 2.7 | 2.7 |

Equitas Bank IPO Review: Should you invest?

As mentioned above, ESFB has been able to successfully diversify its loan portfolio and moved away from the microfinance business in recent years. This sets Equitas SFB apart from its peers. Of its gross advances amounting to INR15,572.9 crore as of 30 June 2020, more than 75% were secured advances, indicating a clear shift away from unsecured microfinance business. This needs to be appreciated appropriately since unsecured loans have a higher risk of default, especially at uncertain times like these.

A quick word on its loan book under moratorium due to Covid-19. According to RHP, 36.24% of its loan EMIs due in August 2020 was under moratorium and this figure is down from 51.17% in June 2020. Clearly, India’s reopening economy and unlocks have helped.

Despite Equitas’ evolution into a bank, its focus continues on serving the financially unserved and underserved customer segments in India. This loyal customer base has helped the bank in several ways including the growth in deposits. Between FY2018 and FY2020, its deposits grew at a CAGR of 38.7% to INR10,788.4 crore. Similarly, its CASA ratio is one of the highest among SFBs in India and was second highest in FY2019.

Encouraging operational performance in recent years has played a key role in better financial performance for Equitas Small Finance Bank. While it has maintained NIM of nearly 8%, its Cost to Income Ratio came down from 80% in FY2018 to 66.4% in FY2020.

So far so good, but is this all investors need to consider before deciding whether to subscribe or avoid? Not really since everything comes down to valuations, eventually. Equitas Bank’s Earnings Per Share (EPS) in FY2020 stood at INR2.39. Considering the upper end of the pricing band of INR33 per share, this translates to Price/Earnings (PE ratio) of 13.81.

At the same time, its Return on Net Worth (RONW) for FY2020 stood at 8.92% which is not among the best figures in the industry. For comparison, its bigger peers AU Small Finance Bank and Ujjivan Small Finance Bank have corresponding figures of 15.45% and 11.71%, respectively. As such, Equitas deserves a discount to its peers and this is reflected in the modest pricing of the IPO. While the pricing isn’t a bargain, it is attractive enough to account for lower return ratios.

Overall, Equitas Bank IPO review reveals the story of a lender which is well-diversified, has a sizeable retail presence and lower cost of funds. The best for small finance banks is yet to come and thus, investors need to have a longer timeframe for investments in these banks.

Equitas Bank Customer care number

8388931387@@@9051370935

All time available call know payment refund amount processing are available call now…

Ujjivan Bank Customer care number

8388931387@@@9051370935

All time available call know payment refund amount process such as great experience

Ujjivan Bank Customer care number

8388931387@@@9051370935

All time available call know payment refund amount process is the employee responsible in your account call know

Ujjivan Bank Customer care number

8388931387@@@9051370935

Ujjivan Bank Customer care number

8388931387@@@9051370935

All time available call