Mahanagar Gas IPO (MGL IPO) is open for subscription in the price band of INR380-421 per share between 21 and 23 June 2016. Applications can be made for 35 shares and in multiples thereafter. According to the price band, MGL’s issue size is in the range of INR9.38 billion (INR938.4 crore) and INR10.39 billion. The upcoming IPO will be managed by Kotak Mahindra Capital Company Limited and Citigroup Global Markets India Private Limited while Link Intime India Private Limited will be the registrar.

MGL IPO comes after excellent listings of Equitas Holdings, Thyrocare Technologies, and Ujjivan Financial Services while Parag Milk Foods also did not disappoint after reducing the price band. All of this means investors have high expectations from MGL IPO. Read more to find out in this IPO review if this public issue can match returns of the last four IPOs. Shares of Mahanagar Gas are proposed to be listed on BSE and NSE and listing is expected on 1 July. Here are some important details about the IPO before we delve deeper in the analysis.

MGL IPO details

| IPO dates | 21– 23 June 2016 |

| Price Band | INR380 – 421 per share |

| Issue Size | INR938.4 – 1039.6 crore |

| Fresh Issue | Nil |

| Offer for share (OFS) | 24,694,500 shares (INR1039.6 crore at upper band) |

| Minimum Bid | 35 shares |

| Retail allocation | 35% |

MGL IPO Structure

Since the upcoming IPO is purely an offer for sale (OFS) from existing shareholders GAIL and British Gas (BG Group) plc, Mahanagar Gas will not get any funds from the offer. GAIL and British Gas (BG Group) plc – which hold 45% stake each in the company – will sell 12.5% of their shareholding or 12,347,250 shares each.

|

Biggest shareholders in Mahanagar Gas |

||

| Name of shareholder | Equity Shares | Percentage (%) |

| GAIL | 44,449,990 | 45 |

| BGAPH (British Gas/Royal Dutch Shell) | 44,449,960 | 45 |

| Government of Maharashtra | 9,877,778 | 10 |

| Total | 98,777,778 | 100 |

Mahanagar Gas = Monopoly

Incorporated in May 1995, Mahanagar Gas Limited (MGL) is an equal stake joint venture between Indian gas transmission player GAIL and British Gas (BG Group) plc. Both parties hold 45% stake each while the government of Maharashtra holds 10% ownership. Since BG Group has been taken over by Royal Dutch Shell, the latter now has the ultimate ownership of the stake BGAPH (BG Asia-Pacific Holdings Pte. Limited) owns in Mahanagar Gas.

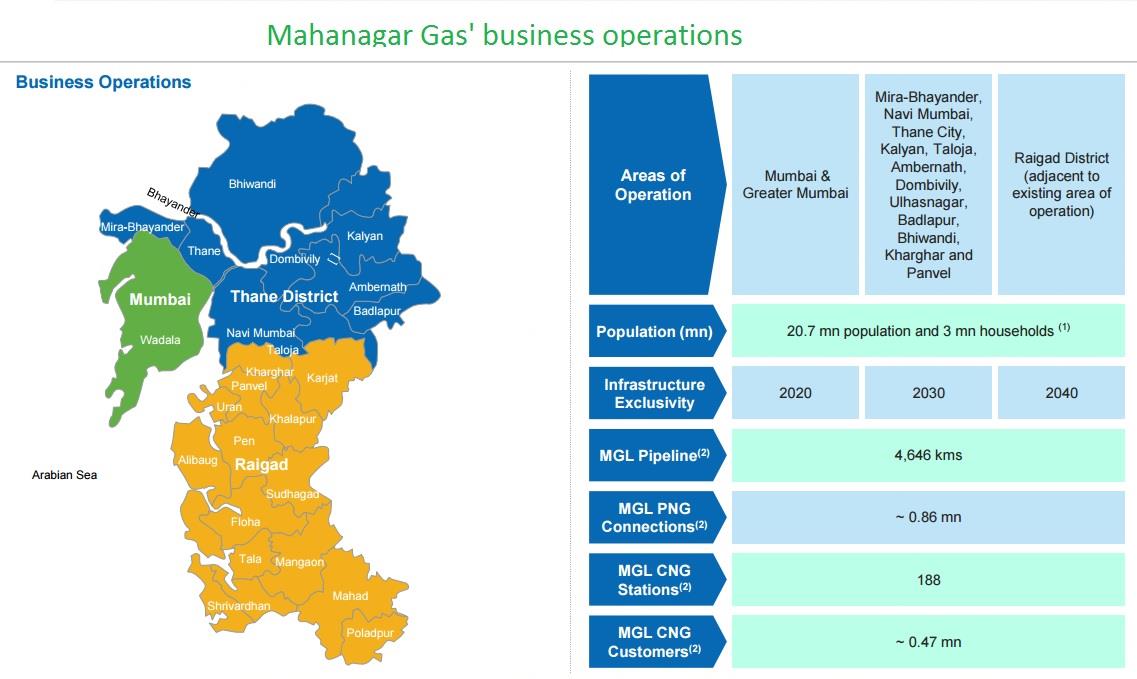

MGL is presently the sole authorized distributor of compressed natural gas (CNG) and piped natural gas (PNG) in Mumbai, its adjoining areas and the Raigad district in Maharashtra. Mahanagar Gas’ monopoly in the distribution business is valid until 2020 for Mumbai, until 2030 for the Adjoining Areas and until 2040 for the Raigad district. Furthermore, this exclusivity is extendable in blocks of 10 years as per the government regulations.

The company’s monopoly also extends to getting a preferential treatment in supply of natural gas. CNG and domestic PNG customers are considered priority sector by the Ministry of Petroleum and Natural Gas and thus, Mahanagar Gas gets natural gas at lower rates to service the priority sector. According to the red herring prospectus, the company’s cost of natural gas last year was at USD3.06/MMBTU which was substantially lower than the market price of imported natural gas. Although natural gas prices have crashed this year and India’s cost of imported natural gas now stands at USD5/MMBTU, MGL’s cost is still on the lower side. Moreover, this supply is ensured at 110% (calculated every six months) of MGL’s CNG and domestic PNG requirements. The good news is that this priority sector accounts for more than 85% of Mahanagar Gas’ annual revenues.

Read Also: Here is what you should know about Mahanagar Gas IPO

For the industrial and commercial PNG consumers, MGL source Regasified Liquefied Natural Gas (RLNG) from a number of sources on term and spot basis. Rates of raw material in this segment are higher and closer to market rates but Mahanagar Gas’ exposure to this business is limited to just 15% of its revenues.

Financial Performance

MGL has been benefitting not just from its monopoly in the region, but also from tremendous urbanization in Mumbai. This is evident in the company’s revenue growth during the last five years where its sales declined only in FY2016 and that too, just marginally. As one can imagine, this small decline was due to lower prices of natural gas even as the company’s sales volume during the year increased to 2.43 MMSCMD, up 2.1% from 2.38 MMSCMD in FY2015. A related development was that the company’s cost of natural gas declined even though its sales volumes increased. As a result, profits went up in FY 2016 – not by a great value but a respectable 2.6%. Still, profitability of Mahanagar Gas has been errant in recent years but margins seem to have stabilized now.

|

Mahanagar Gas’ consolidated financial performance (in INR millions) |

|||||

| FY2012 | FY2013 | FY2014 | FY2015 | FY2016 | |

| Total revenue | 13,090.3 | 15,143.8 | 18,851.5 | 20,949.3 | 20,789.3 |

| Total expenses | 8,744.3 | 11,038.8 | 14,778.6 | 16,863.4 | 16,529.8 |

| Profit/(loss) after tax | 3,077.4 | 2,985.1 | 2,972.5 | 3,010.0 | 3,086.9 |

| Net margin | 23.5 | 19.7 | 15.8 | 14.4 | 14.8 |

Should you invest??

Without doubt, this is the most important question and things are looking good so far. But the stock market is a future discounting machine and chest thumping about past laurels is simply pointless. So here is some forward-looking analysis.

Coming back to its core business, the number of CNG operated motor vehicles has been growing steadily in Mumbai and its adjoining areas. According to the data released by the government, the figure grew at an average rate of 13.75% between March 2009 and March 2016. It would not be a stretch to assume that this trend will gain further momentum in coming years as the crackdown by the National Green Tribunal (NGT) against diesel will help CNG fuel. Apart from Delhi, the tribunal has banned registration of diesel vehicles above 2.0-liter engines in six cities in Kerala also. As a result, Mahanagar Gas can expect its business to continue growing for the next several years.

At the same time, assured supplies at lower prices take away other big variable from the profitability equation which means Mahanagar Gas is in a sweet spot. For FY2016, CNG and PNG businesses accounted for 74.09% and 25.91%, respectively, of the total volume of natural gas sold, and 65.10% and 34.90%, respectively, of its total gas sales revenue.

On the basis of diluted earnings of INR31.36 per share in FY 2016, Mahanagar Gas IPO is valued at 13.4 times. This compares with a PE ratio of 20.8 for Indraprastha Gas Limited (IGL) which is the closest competitor of Mahanagar Gas. Another peer Gujarat Gas Limited (GGL) is valued at a PE of nearly 21 at current rates. It is important to highlight that Gujarat Gas mostly caters to industrial sector. With a return on net worth (RONW) of 20.2% in FY 2016, MGL beats both its peers hands down on this parameter as well. Considering robust financial performance and strong balance sheet (long-term liabilities of just INR43.8 million), this discount appears excessive and is likely to be plugged once MGL shares are listed.

One of the other highlights is the generous dividend Mahanagar Gas pays to its shareholders. The company is yet to announce dividend for FY 2016 but has INR17.5 per share every year in each of the previous three years. At the upper end of the price band, this translates into a yield of 4.1%. It is generally observed that PSUs and their subsidiaries are regular with dividend payouts because of majority of shareholding by the government.

As one can sense, there is little in the concerns department and that’s not because we are playing favorites (we have no connection to the company, not even a piped gas connection :)). End of marketing exclusivity is cited as an overhang but let’s not forget that gas distribution is a capital-intensive business and Mahanagar Gas has a huge advantage by having a well-developed infrastructure. Even in the case of its monopoly coming to an end, any new operator will need to use MGL’s distribution network upon the payment of transportation tariff. Overall, MGL IPO comes across as a reasonably priced offer with high earnings visibility. We will round-up broker recommendations in the coming days; meanwhile, check out this page to see grey market premium (GMP) and what our readers have got to say about MGL IPO.