Stove Kraft Limited – a multibagger IPO stock which listed last year – has seen some interesting developments in recent months. The manufacturer and seller of kitchen appliances under Pigeon, Gilma, and BLACK + DECKER brands has not been spared from heavy correction in the recent selloff. However, insiders and prominent investors are taking advantage of the slide in the price of multibagger IPO stock and are loading up in big quantities.

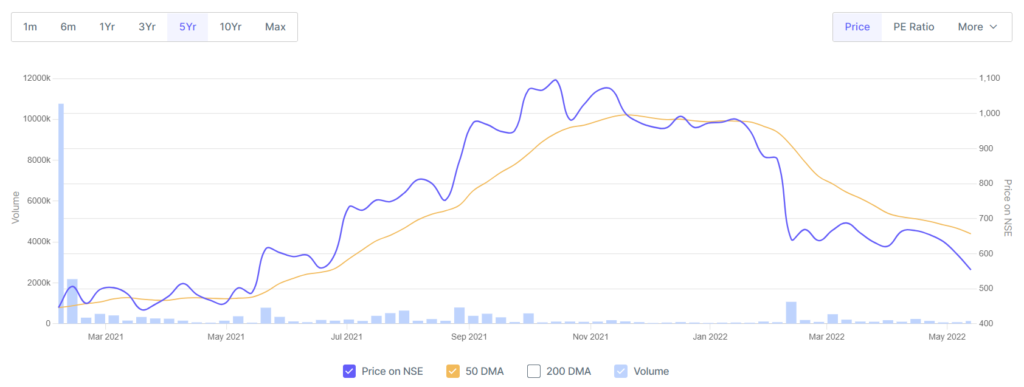

First off, the stock listed in February 2021 after an IPO that saw decent oversubscription of 18 times. After debuting with nearly 30% gains, it saw some profit taking but started moving up soon after kneejerk reaction. By October, it had hit a high of INR1,095 per share, up massively from the IPO price of INR385 per share.

Nevertheless, Stove Kraft stock started its decent in November and the selloff intensified in the subsequent months. It dropped 16% in a single day in early February after reporting a weak set of numbers for the December 2021 quarter. For YTD timeframe, this multibagger IPO stock is down a whopping 45%. This is where it gets interesting!

Insiders, Big Whales make a beeline for multibagger IPO stock

In March, reports indicated that managing director Rajendra Gandhi bought 7.75 lakh shares worth INR50 crore. This was at an average price of INR645 per share. Following the transaction, Gandhi’s shareholding in the company increased to 55.77% as of 31 March 2022, up from 53.4% as of 31 December 2021.

Promoter buying is always considered positive for the stock and this is especially true if the quantities involved are big.

However, it doesn’t stop here. According to the latest shareholding disclosures, it has come to light that Gandhi wasn’t the only one cherry picking Stove Kraft stock at low prices. Ashish Kacholia too picked up 576,916 shares, or nearly 1.8% equity stake through open market transactions. These shares were purchased during the first calendar quarter.

Read Also: Venus Pipes IPO Review – Growth + Boring Industry. Win Win?

Improving Business Fundamentals

If one looks for the possible reasons behind the substantial buying, it would not take long to understand that improving business fundamentals were the driving force. Although the company saw raw material pressures in the latest quarter and the results were somewhat tepid, the business boasts of an impressive ROCE of 31.7% with minimal debt on its books.

Its ROE is even more impressive at 66.7%. All this while maintaining the upward trajectory in revenues and profits. Proof of the pudding is in the fact that its trailing 12 months’ sales are INR1,110 crore and this needs to be seen with a topline of just INR524 crore in FY2018. Last 5-year sales growth is also robust at a CAGR of 21% while its profits have grown a CAGR of 31% in the same timeframe. Clearly, the company has got a good handle on its operations and consumer demands and recent investors feel this multibagger IPO stock can again offer multifold returns.

Interestingly, the stock has been hammered down from its already depressed levels in the wake of the recent meltdown, thereby further boosting its attractiveness. The management has already taken action by increased its product prices to offset raw material price increases. In addition, the company is working on backward integration of its facilities which should increase efficiencies and reduce costs.

For long term investors, the stock’s valuation of Price to Earnings ratio of 26.9 and Price to Sales ratio of 1.62 offer attractive entry opportunity. Similarly, its EV by EBITDA ratio of 17.3 is lowest among its peers including TTK Prestige, Butterfly Gandhimathi, Bajaj Electrical and Whirlpool India.