| Issuer Company | Open | Close | Size (INR crore) | Yield (%) |

| Edelweiss Financial Services | 8 Jul | 22 Jul | 200 | 11.00 |

| Sakthi Finance | 20 Jun | 3 Jul | 150 | 10.65 |

| Nido Home Finance | 13 Jun | 27 Jun | 100 | 10.75 |

| IIFL Samasta Finance | 3 Jun | 14 Jun | 1,000 | 10.50 |

| 360 ONE Prime | 24 May | 6 Jun | 500 | 9.86 |

| Indiabulls Housing | 13 May | 27 May | 200 | 10.75 |

| Muthoot Mercantile | 6 May | 17 May | 100 | 11.73 |

| Motilal Oswal Financial | 23 Apr | 3 May | 1,000 | 9.70 |

| Muthoot Fincorp | 10 Apr | 25 Apr | 260 | 10.00 |

| Kosamattam Finance | 8 Apr | 23 Apr | 250 | 10.47 |

| Edelweiss Financial Services | 8 Apr | 23 Apr | 200 | 10.46 |

| ICL Fincorp | 5 Apr | 12 Apr | 75 | 13.73 |

| Indiabulls Housing Finance | 5 Mar | 19 Mar | 200 | 10.75 |

| Navi Finserv | 26 Feb | 7 Mar | 600 | 11.19 |

| Chemmanur Credits | 20 Feb | 4 Mar | 100 | 12.25 |

| Nido Home Finance | 13 Feb | 26 Feb | 100 | 10.75 |

| UGRO Capital | 8 Feb | 21 Feb | 200 | 11.03 |

| Sakthi Finance | 8 Feb | 21 Feb | 200 | 14.30 |

| Indel Money | 30 Jan | 12 Feb | 200 | 12.25 |

| Cholamandalam | 19 Jan | 25 Jan | 1,663 | 8.60 |

| Muthoot Fincorp | 12 Jan | 25 Jan | 225 | 9.75 |

| Edelweiss Financial Services | 9 Jan | 23 Jan | 250 | 10.46 |

| Muthoot Finance | 8 Jan | 19 Jan | 1,000 | 9.00 |

| 360 ONE Prime | 11 Jan | 15 Jan | 1,000 | 9.66 |

| Kosamattam Finance | 1 Jan | 12 Jan | 200 | 10.47 |

| Indiabulls Housing Finance | 7 Dec | 20 Dec | 200 | 10.75 |

| Arka Fincap | 7 Dec | 20 Dec | 300 | 10 |

| IIFL Samasta | 4 Dec | 15 Dec | 1,000 | 10.50 |

| Muthoot Mercantile | 4 Dec | 15 Dec | 200 | 11.73 |

| ICL Fincorp | 28 Nov | 11 Dec | 100 | 13.73 |

| Cholamandalam | 28 Nov | 1 Dec | 1,000 | 8.60 |

| InCred Financial Services | 25 Oct | 7 Nov | 300 | 10.30 |

| Indiabulls Housing Finance | 20 Oct | 3 Nov | 200 | 10.75 |

| Piramal Enterprises | 19 Oct | 30 Oct | 1,000 | 9.35 |

| Chemmanur Credits | 16 Oct | 30 Oct | 100 | 12.13 |

| Muthoot Fincorp | 13 Oct | 27 Oct | 225 | 9.44 |

| Edelweiss Financial Services | 6 Oct | 19 Oct | 200 | 10.46 |

| Aditya Birla Finance | 27 Sep | 3 Oct | 2,000 | 8.10 |

| Muthoot Finance | 21 Sep | 27 Sep | 700 | 9.00 |

| More NCD Offers |

Investors want to pick investments that give them a good return and help them keep track of their cash flow and risks. Debentures are long-term financial instruments that a company issues to investors for a set amount of time with the promise of paying them a fixed interest rate. There are two kinds of debentures: those that can be turned into equity and those that can’t i.e. non-convertible. Non-convertible debentures (NCD) can’t be changed into shares or other forms of equity.

What is Debenture?

Businesses need money to run and companies can get money in many ways, such as by selling equity shares, putting money aside from profits, or taking out loans. Debentures are debt instruments that companies use to borrow money from the public and build up their capital. Most of the time, they are medium- to long-term debts that large, well-known companies issue.

The Companies Act of 2013 says that a “debenture” is a debenture stock, bond, or any other corporate instrument that denominates a debt. Debentures are also a way for governments to get the money they need to fix up infrastructure. These debts are called “government bonds,” and they are thought to be one of the safest ways to invest because the government’s finances are more stable than those of private companies. In the US, private debentures are called “bonds,” while government debentures are called “T-Bonds” or “Treasury Bonds.”.

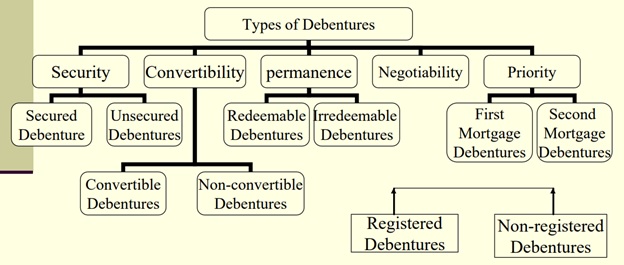

Types of Debentures

The different kinds of debentures that a company can issue can be put into groups based on:

(1) Security

- Secured Debentures: These are bonds that are backed by something of value. A charge that is put on a fixed asset that the company owns is called collateral. This means that if the company doesn’t pay back the secured debentures, the people who own the debentures will own the asset that was used as collateral.

- Unsecured Debentures: These are debts that are not backed up by any collateral.

(2) Convertibility

- Convertible Debentures: After a certain amount of time, debenture-owners can turn them into equity shares.

- Non-Convertible Debentures: NCDs can’t be changed into equity shares and always remain debentures.

(3) Permanence

- Redeemable Debentures: These are debts that need to be paid back by a certain date. When debentures are redeemed, debenture-owners are paid back. This means that their principal amount is paid off.

- Irredeemable Debentures: These are debts that can’t be paid back until the company goes out of business. Because of this, holders of Irredeemable Debentures are not guaranteed to get the value of their debentures back, since loans like debentures are some of the last debts to be paid back.

(4) Negotiability

- These debentures, which are also called “non-negotiable instruments” because they can’t be sold and can’t be moved just by giving the debenture certificates to someone else. Instead, the Companies Act says that transfer deeds must be signed and that the transfer must be registered by the company.

Also Read: Difference Between IPO and FPO – Is there an Actual Difference?

What is Convertible Debenture?

A convertible debenture is a type of hybrid security that is both a loan and an investment. Companies issue convertible debentures as fixed-rate loans and pay fixed-interest payments to the debenture holder on a set schedule. Debenture holders can keep the instrument until it matures and get their money back, or they can turn the bond into stock. Most of the time, the debenture can only be turned into stock after a certain amount of time, which is stated in the bond’s offering.

Since the debt holder can turn the debenture into stock, the interest rate on a convertible debenture is usually lower compared to NCD. Investors are willing to accept a lower interest rate in exchange for the option to turn the bonds into common shares. Investors can take part in the rise in the share price by buying convertible debentures.

What are Non-Convertible Debentures?

Debentures that can’t be changed into shares of stock or equity are called non-convertible debentures. Non-Convertible debentures have a fixed date of maturity, and interest can be paid along with the principal amount monthly, quarterly, or annually, depending on the fixed tenure. Compared to convertible debentures, they give investors better returns, liquidity, low risk, and tax benefits.

For example, you can buy non-convertible debentures when the company announces them or after they have been traded on the secondary market. You must look at the credit rating of the company, the credibility of the issuer, and the coupon rate of the non-convertible debentures.

Let’s see the difference between debentures and shares

| Debentures | Shares |

| Debenture holders are the ones who owe money to the company. | Shareholders are the owners of a company. |

| Debenture holders don’t have the right to vote, so they can’t change anything about how the company is running. | Shareholders have the right to vote, which means they control everything about the company. |

| Debenture interest is paid at a fixed rate that has already been decided. It has to be paid whether or not there is a profit. Debentures get paid their interest first, before any other type of stock. | Dividends on equity shares are paid at a rate that changes based on how much profit a company makes (however, dividends on preference shares are paid at a fixed rate). |

| Interest on debentures is a charge against profits, and it can be deducted as an expense when calculating the company’s taxable profit. | Dividends come from a company’s profits, so they can’t be deducted as expenses. |

| There are different kinds of debentures, such as Secured/Unsecured, Redeemable/Irredeemable, Registered/Bearer, Convertible/Nonconvertible, etc. | There are only two types of shares: Equity Shares and Preference Shares. |

| Debentures can’t be lost because calls weren’t paid. | Shares can be lost if the allotment and call money are not paid on time. |

| At the end of the term, debenture-holders get their money back, according to the terms and conditions of redemption. | Shareholders can’t get their money back before the company goes out of business (however, preference shareholders can get their money back before liquidation). |

| When a company goes out of business, debenture holders get paid before the shareholders do. | After paying debenture holders, creditors, etc., shareholders are finally paid when the company goes out of business. |

Conclusion

A debenture is a document under the company’s seal which provides for the payment of a principal sum and interest thereon at regular intervals, which is usually secured by a fixed or floating charge on the company’s property or undertaking and which acknowledges a loan to the company.

– Thomas Evelyn

A company can get money for a long-term loan called a debenture by selling bonds. Convertible debentures can be turned into equity whereas non-convertible debentures cannot.