Incorporated in 2003, Spandana Sphoorty Financial Ltd is a rural area focused NBFC-Microfinance Institution. It is engaged in offering small-ticket unsecured loans to help the women in the low-income bracket in rural and urban areas. The company provides income generation loans, business loans and loans against gold jewelry. Spandana Sphoorty IPO review is aimed at evaluating the positive and negative factors of the business.

Spandana has a presence across 15 states in India with 4,045 employees and 694 branch network. By offering the loan products to low-income households, the company is strengthening the socio-economic condition and improving their livelihoods.

Spandana Sphoorty IPO Review: Issue Details

Dates – 5 – 7 August 2019

Price – INR853 to 856 per share

Minimum Lot – 17 Shares

Minimum Application Amount – INR14,501 to 14,552 per lot

Total Issue Size – INR1,200 crore (INR400 crore Fresh + INR800 crore OFS)

Objects of Issue – The company proposes to utilize the Net Proceeds from the Fresh Issue towards augmenting its capital base to meet future capital requirements.

Promoters of the company – Ms. Padmaja Gangireddy, the company’s Individual Promoter, and Managing Director has over 24 years of experience in social development and microfinance sector. She also founded SRUDO in 1998 and promoted Spandana Sphoorty in 2003. She has been the Managing Director of the company since then.

Spandana Sphoorty IPO Review: Risks

Concentration Risk – As of June 30, 2019, they conducted their operations through 929 branches in India, of which 149, 149, 136, 111 and 83 branches, were located in Orissa, Madhya Pradesh, Karnataka, Maharashtra, and Chhattisgarh, respectively. As of March 31, 2019, 20.01%, 19.98%, 13.48%, 10.77%, and 8.70%, respectively, of their Gross AUM originated in Madhya Pradesh, Orissa, Karnataka, Maharashtra, and Chhattisgarh.

Their business is vulnerable to interest rate risk, and volatility in interest rates could have a material adverse effect on net interest income, net interest margin and financial performance.

Their business, financial condition, cash flows and results of operations have been adversely affected in the past by certain state regulations.

The focus client segment for micro-loans is women in Rural Areas. As of June 30, 2019, 99.82% of the clients were women. Their clients typically have limited sources of income, savings and credit histories and as a result, are usually adversely affected by declining economic conditions.

Competition from MFIs, banks and other financial institutions, as well as state-sponsored social programs, may adversely affect the profitability and position in the Indian microcredit lending industry.

Spandana Sphoorty IPO review: Key Growth Drivers

According to the 2011 Census of India, there were about 640,000 villages in rural India and close to 68% of the total population residing in them. Rural India accounted for about 47% of the Net Domestic Product (“NDP”) but only 10% of the country’s total credit in comparison to 90% for urban India, which only contributed to 53% of the country’s NDP, as of 2011.

The RBI and the government of India have launched various schemes for improving the penetration of credit, banking services, insurance, and other social security programs over the past three to four years.

Read Also: All about Sterling & Wilson Solar IPO

Spandana Sphoorty IPO review: Strengths

A seasoned business model with resilient performance through business cycles

A high degree of client engagement and robust risk management, leading to superior asset quality and collections

Streamlined systems and processes and high employee productivity leading to low operating expense ratio

Focus on the high potential and under-served rural segment

Geographically diversified operations leading to risk containment and business resilience

Significant industry experience of Promoter and management team

Spandana Sphoorty IPO Review: Opportunities

Leverage their popular income generation loan products to derive organic business growth

Leverage existing branch network by increasing loan portfolio and enhancing employee productivity

Increase presence in under-penetrated states and districts

Further diversifying the borrowing profile and reduce the cost of borrowings

Read Also: Sterling & Wilson IPO Review: Should you subscribe or avoid?

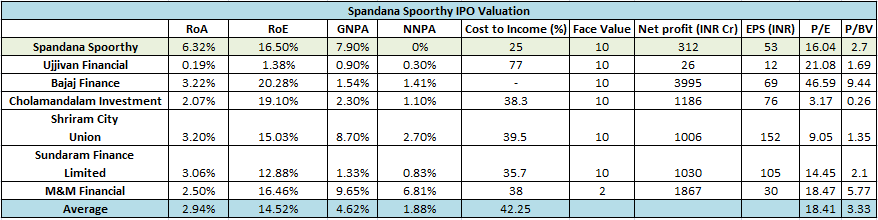

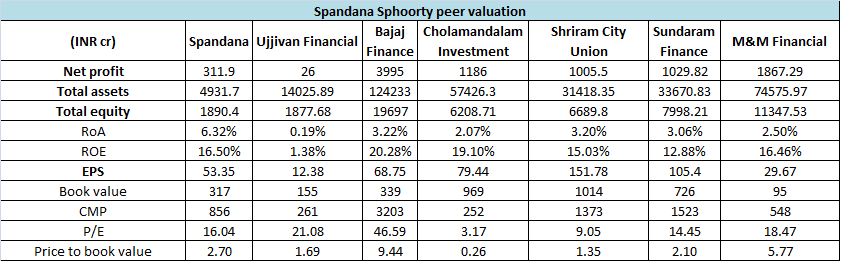

Spandana Sphoorty IPO Review: Valuations & Peer Comparison

Conclusion – Indian stock markets are in a stressed environment with the fallout of IL&FS and a lot of NPAs coming out. This has thrown the Indian financial system out of gear with an increased cost of credit, stressed asset increase and inability to pay dues on time. While Spandana Sphoorty’s valuations are in line with its competition, it will take more than just appropriate pricing to succeed amid the ongoing bearish sentiments.

For more details about the IPO, head to this discussion page. Check out the latest grey market rates here.