As more and more investors join the equity culture in India, they are facing issues in understanding the technical terms used in IPOs. In this series, we aim to demystify these terms (or rather jargons) for newcomer investors. One such term that investors struggle with is IPO investor categories i.e. QIB, NII, and RII. Let’s take a closer look.

Table of Contents

IPO Investor Categories in India

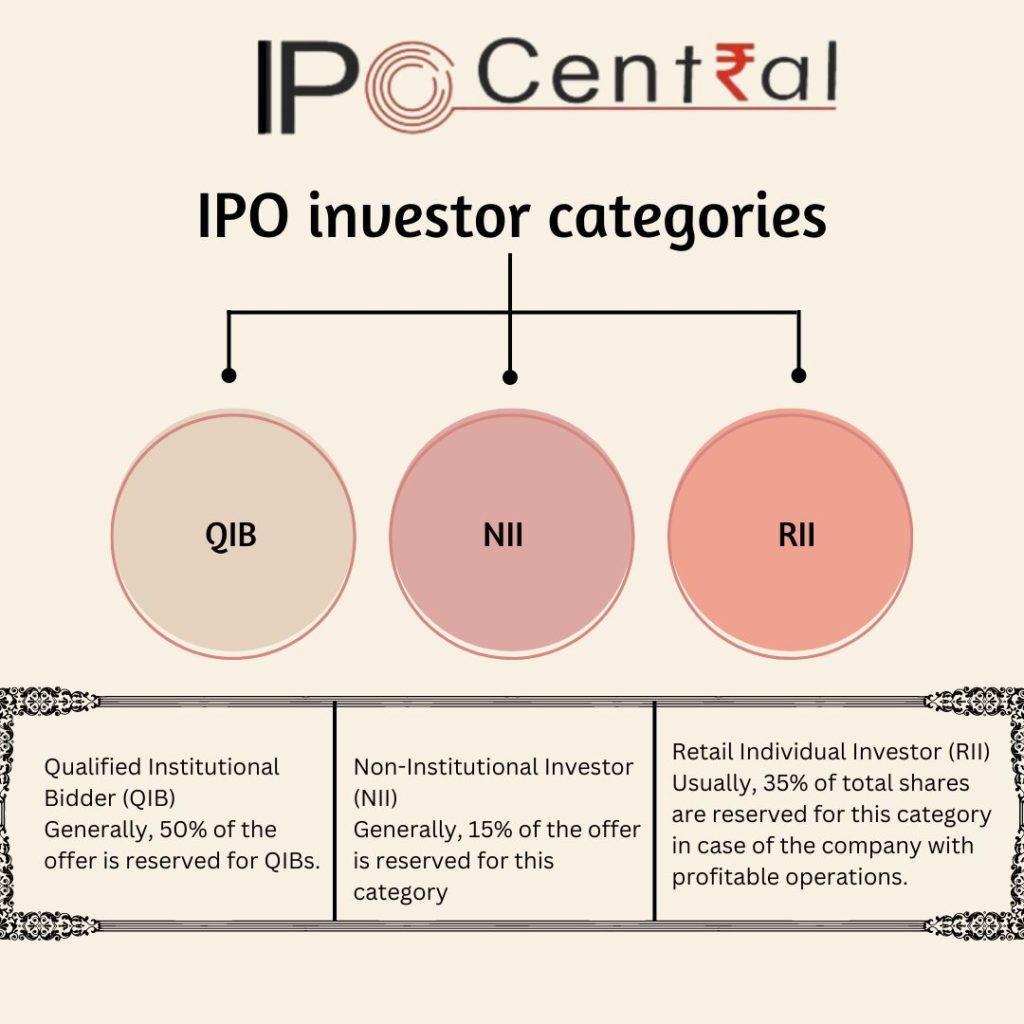

There are broadly the following three types of IPO investors in India based on the quantum of funds deployed.

#1 Qualified Institutional Bidder (QIB)

As the name suggests, QIBs are qualified institutional buyers as defined by SEBI’s Issue of Capital and Disclosure Requirements (ICDR) regulations. Generally, 50% of the offer is reserved for QIBs. Some of these are classified as anchor investors which work towards stabilizing an IPO.

Typical examples of QIBs are foreign portfolio investors (FPIs) (other than Category III FPIs), scheduled commercial banks, mutual funds registered with the SEBI, venture capital funds registered with SEBI, foreign venture capital investors (FVCIs), alternative investment funds (AIFs), multilateral and bilateral development financial institutions, state industrial development corporations, insurance companies registered with the Insurance Regulatory and Development Authority (IRDA), provident funds with a minimum corpus of INR 250 million, pension funds with a minimum corpus of INR 250 million.

When it comes to IPOs, Qualified Institutional Buyers (QIBs) often snap up a hefty chunk of shares. These investors can include banks, insurance companies, and mutual funds. There’s no lock-in period for QIBs, which means they can start selling their shares the moment the stock hits the exchange floor.

#2 Non-Institutional Investor (NII)

This category is a fancy term for affluent investors who can invest more than INR 2,00,000. In other words, these are high networth individuals (HNIs). Generally, 15% of the offer is reserved for this category. Bids in the category need to exceed INR 200,000. Typical examples include Category III FPIs, resident Indian individuals, HUFs (in the name of Karta), companies, corporate bodies, eligible NRIs, scientific institutions, societies and trusts. For HNIs, there’s no IPO lock-in period. They can sell their allocated shares right when the market opens, without any restrictions.

Read Also: IPO Lock-in Period for IPO Investor Categories

#3 Retail Individual Investor (RII)

This category is purely meant for small investors, whose bid should not exceed INR 2,00,000 per person. Usually, 35% of total shares are reserved for this category in case of the company with profitable operations. In the event of the IPO-bound company not fulfilling this criterion, only 10% shares are reserved for retail investors. This is to safeguard small investors from risky businesses, although this may change going forward. Resident Indian individuals, HUFs (in the name of the Karta) and eligible NRIs not falling in the NII category can apply under the RII category. As you can clearly see, the biggest differentiating criterion between NII and RII is the size of application.

Retail investors are also not bound by any lock-in period. This means they’ve got the freedom to jump on market shifts right away. It gives them the reins on their investments, letting them manage risks better by not being stuck waiting to sell. While these three categories are mutually exclusive with no overlap, there are some more types of IPO investors where the norms are slightly different.

#4 Employee

Sometimes, IPO-bound companies also reserve some shares for their employees. These shares are not part of the Net Offer and there may additionally be a discount on offer price to encourage employees to subscribe. Investors in employee category may also apply under retail category in an IPO. Therefore, this category of IPO investors has a unique advantage. Recently, LIC IPO featured reservation for its employees and also offered them a handsome discount. There is no mandatory lock-in period applicable to the employee category.

#5 Shareholders

Similar to employee quota, an IPO-bound company may reserve some shares for shareholders in its parent firm. A relevant example in this case is of ICICI Securities IPO where ICICI Bank shareholders had a separate quota. Similar to the employee category, shareholders in the parent company are eligible to put in multiple applications. There is also no mandatory lock-in period applicable to the shareholder category.

#6 Policyholder

Given the huge size of LIC IPO, the company had reserved shares for its policyholders as well. This is an exception and the only example of this type. It is also unlikely to be repeated by any insurance company going forward. There is no mandatory lock-in period applicable to the this category.

The IPO Lock-in period plays a crucial role in IPO investor categories, ensuring stability and investor confidence in IPOs across different categories. SEBI has updated lock-in periods for promoters and anchor investors to enhance liquidity and encourage public listings. For mainboard IPOs, as of August 2021, promoters face an 18-month lock-in for up to 20% of post-issue capital, down from 3 years, while holdings exceeding 20% have a 6-month lock-in, reduced from 1 year.

In December 2024, SEBI revised rules for SME IPOs, capping promoter sales at 20% and individual shareholders at 50%, with phased unlocking of excess promoter holdings—50% after 1 year and the rest after 2 years—to ensure long-term commitment. Anchor investors, vital for IPO stability, must retain 50% of their shares for 30 days, with the remaining 50% locked for 90 days, ensuring gradual liquidity and market confidence.

Read Also: IPO Grey Market Premium and Discussion

This is to be noted that the above IPO investor categories are valid only for equity offers. For debt public offers such as Non-Convertible Debentures (NCDs), the definitions are different. For example, retail investors can make an application of up to INR 5,00,000.