November turned out to be a blockbuster month for retail investors with as many as 11 listings of mainboard IPOs and 16 listings of SME IPOs. Given this positive backdrop, investors have all the more reasons to look forward to upcoming IPOs in December 2023.

What is really encouraging from investors’ point of view is that most IPOs last month were priced sensibly and therefore, all 11 of them offered positive returns while average returns on listing day stood at 41.74%. Here is a sampling of the important public offers in December.

Allied Blenders and Distillers – Leading Name Among the Upcoming IPOs in December 2023

The company behind the Officer’s Choice, Officer’s Choice Blue, and Sterling Reserve brands is gearing up for a listing this month. It received SEBI approval to float its IPO on 16 December 2022 and thus, has limited time at hand to fulfil the listing criterion.

Allied Blenders and Distillers is among the largest Indian-made foreign liquor (IMFL) players in India and has product range in four main categories, i.e., whisky, brandy, rum, and vodka. It is second coming for the Chhabria family which was earlier involved in some of the most famous (or rather infamous) takeover battles, including a successful bid for liquor giant Shaw Wallace, in late 80s.

Clearly, the Chhabria family is a veteran when it comes to liquor business and this will go a long way in their favour. According to its draft papers, the company is looking to mobilize INR 2,000 crore through a mix of fresh shares and an Offer for sale (OFS).

DOMS Industries – Fast-growth, Happy Investors

Gujarat-based DOMS Industries is also an interesting name among the forthcoming IPOs in December. The company has emerged as a formidable player in India’s Stationery and Art products market in recent years and has successfully gained market share from leaders such as HB Pencils and Camlin.

The company aims to raise INR 350 crore by issuing fresh shares while existing shareholders plan to sell shares worth up to INR 850 crore, taking the IPO size to INR 1,200 crore.

Highlight – The company has shown exceptional growth in revenues and this has remarkably improved other financial metrics such as net income, EBITDA margins etc. This is likely to work in DOMS’ favour.

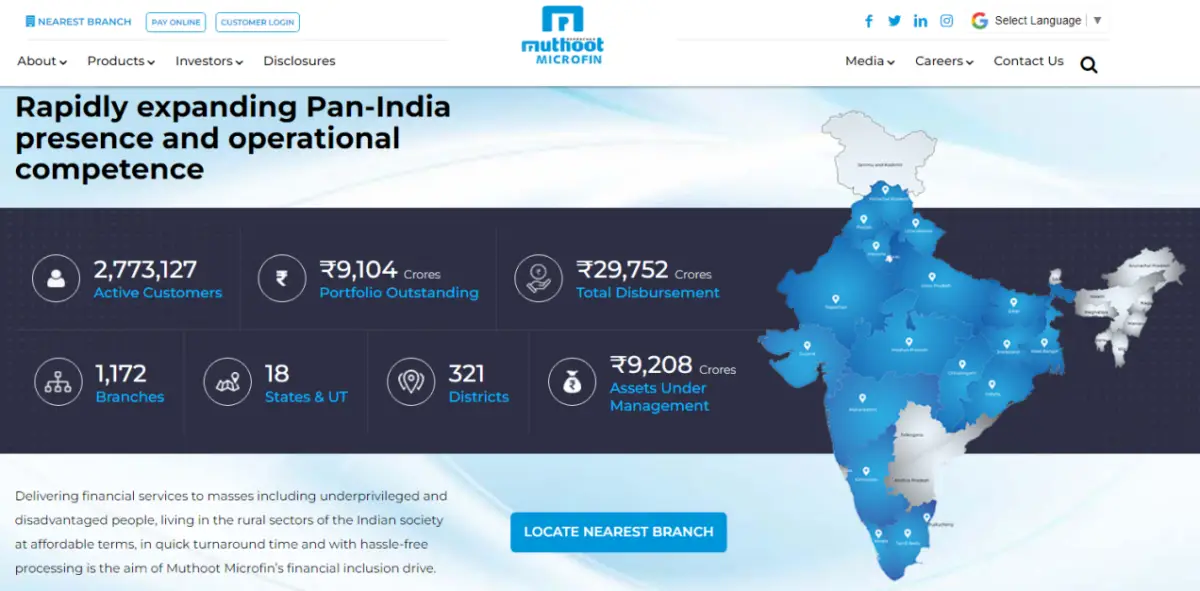

Muthoot Microfin – From Microfinance to IPO Street

Microfinance player Muthoot Microfin is also likely to launch its maiden public offer this month. The Kerala-based company is the fourth-largest NBFC in microfinance category and takes the leadership position in its home state. Muthoot Microfin IPO is likely to raise INR 1,350 crore.

The company follows joint liability group (JLG) model caters exclusively to women in lower-income households. This focus has allowed the company to post impressive and consistent revenue and profit growth.

Highlight – Presence of global private equity investors Creation Investments India and Greater Pacific Capital. Strong track record of other listed microfinance players is likely to help its cause.

Motisons Jewellers – Among Jewellery IPOs in December

Jaipur-based Motisons Jewellers is looking to tap primary markets with a view to raise nearly INR 150 crore. The company currently operates four showrooms in Jaipur and has plans to expand operations.

Motisons also recently completed a pre-IPO placement and raised INR 33 crore from prominent investors including Sunil Kothari & Sons, Manish Parakh, Isha Parakh, Manish Parakh HUF, Rajesh Kumar Kabra, Jagdamba Coal House, Prabhudas Lilladhar Advisory Services, Readiprint International LLP, and Rajan Propcon Private Ltd.

Highlight – Dream run of jewellery stocks in the recent months may prompt investors to follow it aggressively.

IPOs in December 2023 will also take cues from grey market and thankfully, this indicator is in the pink of its health.

As always, this list of upcoming IPOs in December is not final and may see some additions and deletions depending on the performance of secondary markets. Meanwhile, there are no updates about the IPOs of EbixCash and SPC Lifesciences and it looks these have been put in cold storage for now by the merchant bankers.

Small retailers must be alloted atleast one lot ,as per SEBI ruling