Last Updated on July 12, 2024 by Anurag Gupta

Mindspace Business Parks REIT (NSE:MINDSPACE) came with its IPO in July 2020 and was nicely lapped up by the investors. Even though the offer came in the wake of Covid-19 selloff, Mindspace REIT IPO did well to garner subscription of nearly 13 times. While Mindspace REIT returns on listing were positive (10% to be precise), the idea of REIT investing is to own a fraction of real estate assets and get regular income without putting money into a single property.

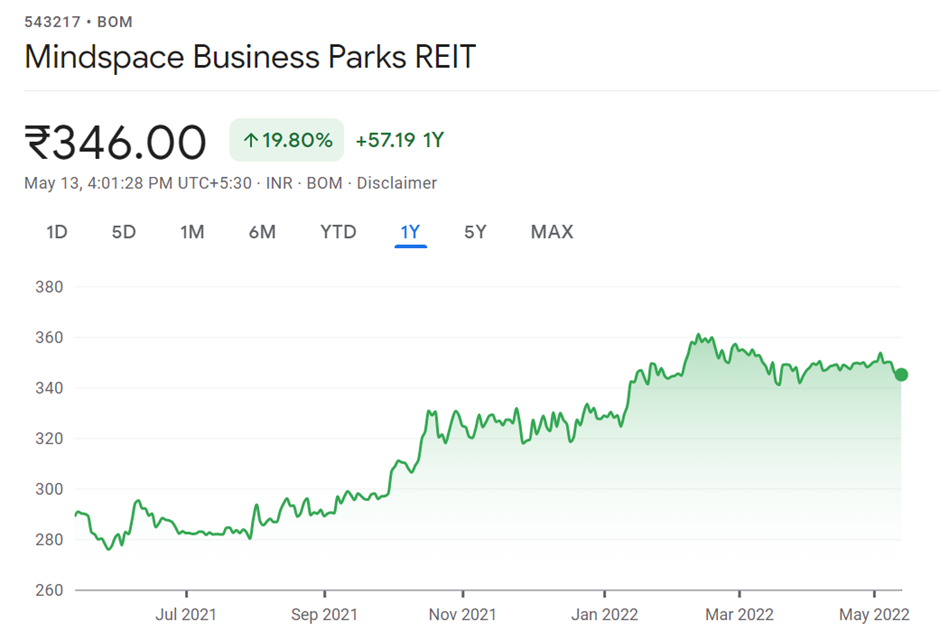

Mindspace REIT Returns: Impressive performance

On this front, it is good to see that the REIT has performed well in generating regular income. Mindspace REIT has declared regular dividends totalling to INR18.45 per share in the last 12 months. At Friday’s closing price of INR346 per unit, this works out to a dividend yield of 5.33%. However, investors who purchased the REIT units a year ago at the rate of INR288 per unit to enjoy these dividends, had an effective yield of 6.4%.

Mindspace REIT Distribution History

| Q1 | Q2 | Q3 | Q4 | |

| Declaration Date | 13 August 21 | 12 November 21 | 10 February 22 | 12 May 22 |

| Record Date | 19 August 21 | 18 November 21 | 16 February 22 | 18 May 22 |

| Payment Date | On or before 28 August 21 | On or before 27 November 21 | On or before 25 February 22 | On or before 27 May 22 |

| Distribution Per Unit (INR) | 4.60 | 4.60 | 4.64 | 4.61 |

| Interest Per Unit (INR) | 0.37 | 0.32 | 0.32 | 0.31 |

| Dividend (INR) | 4.23 | 4.28 | 4.31 | 4.30 |

| Other Income | – | – | 0.01 | – |

| Total Distribution till date in FY22 | 4.60 | 9.20 | 13.84 | 18.45 |

In addition, there has been a handsome capital gain of nearly 20% over the last 12 months. Overall, Mindspace REIT returns have been impressive considering the fixed income elements of REITs.

Read Also: REIT Investing – Meaning, Examples, Best REIT Stocks in 2022

In totality, investors can’t really complain about Mindspace REIT returns. Promoted by K Raheja group, the REIT has a portfolio of office properties in four key markets of Mumbai Region, Hyderabad, Pune and Chennai.

Read Also: Multibagger IPO Stock Falls 45%; Insiders, Big Whales Lap Up

The Road Ahead

So what does it mean for investors looking to purchase now? Can investors expect similar performance going forward?

There are no easy answers to these questions, especially regarding the capital gains. However, what’s is known to us is that Mindspace REIT has delivered a good set of numbers recently and its dividend distribution is likely to keep pace with the past.

With offices opening again after Covid-19, it is also likely for occupancy rates to go up and some of it is already visible in the latest results. Accordingly, there may be scope for capital appreciation. Nevertheless, there is no taking away the fact that the primary reason for REIT investing is to get regular cashflows from real estate in the form of dividends.

Read Also: IPO Central’s Momentum Portfolio Experiment

According to SEBI regulations, REITs must invest 80% of their assets in established and income-generating assets and need to pay 90% of distributable cash flows to the investors. By the virtue of owing real estate assets, a REIT is bound to get some benefit of land appreciation in its prices. With office spaces in four key markets of India – Mumbai Region, Hyderabad, Pune and Chennai – Mindspace REIT is geographically diversified and is particularly suited to benefit from capital appreciation in its assets.

Even though the REIT has delivered fantastic capital appreciation, Mindspace REIT dividend yield is equally impressive and nothing to be scoffed at. The usefulness of regular money hitting bank accounts is what makes REITs attractive for investors, especially in times like these when capital appreciation through direct investing in real estate stocks happens on paper and evaporates in a matter of a few days.

Interested in NSE? More Articles For You

- NSE IPO News

- NSE IPO Update

- NSE Emerge Platform: All You Need to Know

- NSE IPO Timeline: 1 IPO, 5 SEBI Chiefs, 10 Years

- NSE Unlisted Share Price

- Is NSE Undervalued or BSE Overvalued? NSE IPO May Be the Reset Trigger!

- ASBA e Forms – Download IPO Application Form, BSE & NSE IPO Forms 2026

- Difference Between NSE and BSE – Accurate Comparison

- NSE IFSC: Important Points About Investing in US Stocks

- How Many Companies are Listed in NSE and What are NSE Series?

- NSCCL: 7 Most Important Points about NSE Clearing

- Stock Market Holidays 2026 – BSE, NSE trading holidays