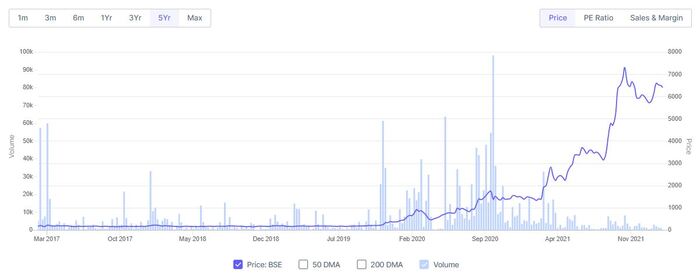

Stock investing is like watching the paint dry they say, alluding to the fact that it takes time. While this adage has withstood the test of time, there have been enough exceptions to this rule. If one wants to know such examples, just look at HLE Glascoat share price history. As a multibagger stock, the scrip surged from INR167.90 (closing price on BSE on 3 February 2017) to INR6495.65 (closing price on BSE on 28th January 2022), registering nearly 3868% gains in nearly 5 years.

However, these gains were not consistent and as one would expect, there were phases of sharp corrections and stock nosediving. During February to March 2020, its price almost halved from a high of INR924 to INR460 per share. In a recent case, HLE Glascoat share price started correcting from INR7,308 per share in October 2021 and dropped to a low of INR5,728 per share in December 2021. Sitting through these corrections isn’t easy, to say the least. Although for someone tracking the business fundamentals, the company demonstrated a good progress in these quarters.

Read Also: Vedant Fashions IPO GMP Today, Kostak, Subject to Sauda

HLE Glascoat share price history

This multibagger stock has risen from INR5,703.20 to 6,495.65 in the last month., appreciating to the tune of near 13.89% in this time. In last 6 months, the share price of HLE Glascoat has risen from around INR3,520.95 to INR6,495.65 apiece levels, clocking around 84.49% rise in this period. In last one year, the stock has given multibagger return of 386% to its shareholders.

Similarly, over the last five years, this multibagger stock has risen from INR164.05 per share to current levels, resulting in a 3,859% increase in this time horizon.

How investors could have benefitted from this multibagger stock?

Using the HLE Glascoat share price history as a guide, if an investor had invested INR1 lakh in this multibagger stock one month ago, it would have turned to INR1.14 lakh today whereas it would have turned to INR1.84 lakh in last 6 months. Similarly, if an investor had invested INR1 lakh in this multibagger stock one year ago, the amount would have zoomed to INR4.86 lakh today.

Similarly, if an investor invested INR1 lakh in HLE Glascoat shares 5 years ago and remained invested in the counter till today, the INR1 lakh would have grown to INR39.60 lakh today. Like we mentioned earlier, this scenario would have required an exceptional level of patience and loss-bearing capacity.

More about HLE Glascoat shares

The company is involved in manufacturing and sales of glass lined equipment and filters and dryers equipment for various industries in the country. This multibagger mid-cap stock has a market capitalization of INR8,867 crore. HLE Glascoat shares’ 52-week high is INR7,549 whereas its 52-week low is INR1,317 on BSE. Its current PE ratio is little over 143, indicating that the stock is in expensive territory. The company’s book value per share is INR180 and its dividend yield is 0.06%.

HLE Glascoat’s success indicates that there are several ways to make money in stock markets. Turnarounds, special situations investing are just some of the ways where investors have reaped immense benefits in multibagger stocks.