Agriculture serves are the bedrock of the Indian economy, providing a source of livelihood for a staggering 58% of the population. It’s no surprise that this sector forms the backbone of the Indian economy. Recognizing this immense potential, companies like Nova Agritech are emerging, offering innovative solutions tailored for the needs of farmers. Driven by a vision to become a one-stop shop for their agricultural needs, Nova Agritech produces multi-ingredient products, simplifying application and boosting crop yields. Through this Nova Agritech IPO Analysis, IPO Central tries to find out more about the company’s business, financial performance and more details.

Nova Agritech IPO Analysis: Company Profile

Nova Agritech, founded in 2007, specializes in manufacturing products that enhance soil health and fertility. Basically, it manufactures products that help farmers to grow crops better. The company is based in Hyderabad, India and operates through two subsidiaries: Nova Agri Sciences Private Limited and Nova Agri Seeds India Private Limited.

Their diverse product portfolio consists of traditional fertilizers, encompassing chemical, organic, and bio-fertilizers, along with biostimulants. They also offer soil health management solutions, crop protection products, innovative technologies, and even integrated pest management strategies.

Nova Agritech currently manufactures these products at a single plant in Telangana, with a capacity utilization standing at 53.42% in FY 2023. Telangana is a key state for the company, accounting for 76% of its revenues, followed by Andhra Pradesh at 11.5% and other states contributing the remaining 12.25%.

However, Nova Agritech doesn’t stop at manufacturing. It actively distributes and markets its comprehensive product portfolio across various agricultural needs, empowering farmers with diverse solutions to improve their practices and optimize their crop yields.

In the preparation of Nova Agri IPO, this analysis digs further into its business model and provides a comprehensive guide about the company. Keep reading to know more!

Robust Distribution Network

Nova Agritech has a well-established dealer network of approximately 11,722 dealers, with a dedicated contingent of 6,769 actively serving farmers across 18 states – 16 in India and 2 in Nepal. This robust network is backed by a 160-strong sales team, ensuring timely delivery of their diverse product range.

The company caters to the multifaceted needs of farmers by offering a comprehensive portfolio of 720 registered products. These encompass 7 registrations in the soil health management category, 176 registrations in crop nutrition, 4 registrations in bio pesticide, 7 registrations in technical indigenous manufacturing, and 526 registrations in the crop protection category.

Nova Agritech’s ambitions extend beyond national borders. Recognizing the shared struggles of farmers worldwide, they have entered into marketing, distribution, and supply agreements with partners in Bangladesh, Sri Lanka, and Vietnam. This commitment to global reach reflects their dedication to empowering farmers everywhere.

Nova Agritech IPO Analysis: Competitive Edge

Nova Agritech stands as a trusted partner in the agricultural industry, offering a diverse and comprehensive portfolio of branded products across various categories. Whether farmers require solutions for soil health management, crop nutrition, bio stimulants, bio pesticides, or Integrated Pest Management (IPM), Nova Agritech has them covered. As of November 30, 2023, the company boasts licenses to manufacture a staggering 720 products, ensuring a diverse range to meet every agricultural need.

Technology is the driving force behind innovation at Nova Agritech. A dedicated team of 27 researchers and developers are constantly striving to improve existing products and processes, while also pioneering new solutions for the future. This commitment to cutting-edge advancements recently led to the development of Agribot Drones, empowering farmers with faster threat detection and reduced crop scouting time. Additionally, the revolutionary Bhuparikshak device revolutionizes soil health detection, using a mobile app to offer valuable insights in just 90 seconds.

Nova Agritech recognizes the power of knowledge for empowering farmers. Through the Nova Kisan Seva Kendra (NKSK) program, the company provides education on various crop management practices, helping farmers optimize their yields and achieve sustainable success. This outreach program contributes not only to individual farmer growth but also to a thriving agricultural ecosystem as a whole.

Nova Agritech IPO Analysis: Financial Performance

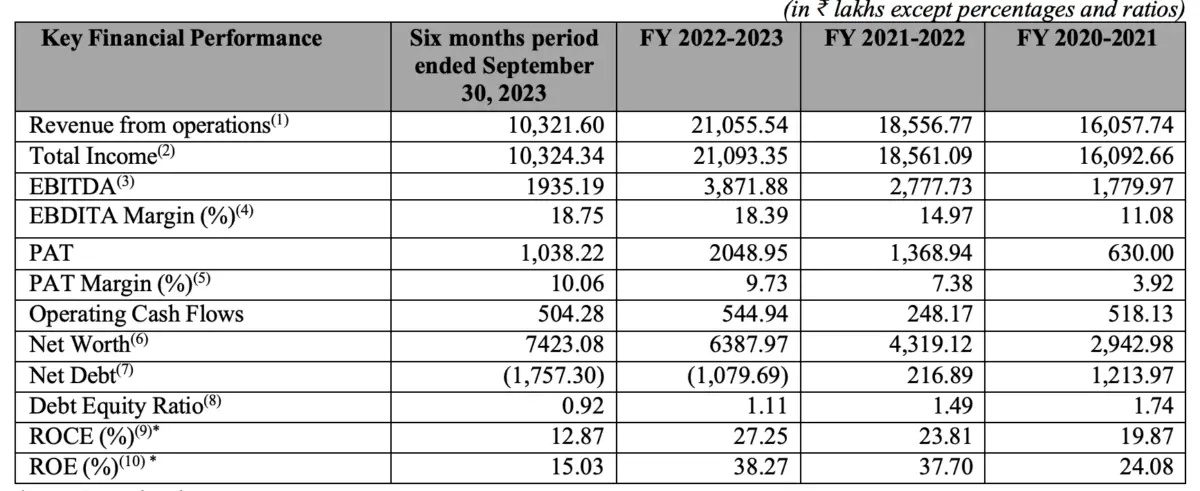

Nova Agritech’s financials paint a promising picture. Revenues have steadily climbed from INR 160 crore to INR 210 crore in 2023, and profits have jumped from INR 6.3 crore in 2021 to INR 20.4 crore in 2023. This impressive growth trajectory showcases the company’s strong execution and market traction.

Furthermore, Nova Agritech trades at a very attractive valuation. Its P/E ratio of 12.5 sits comfortably below the industry average of 15-25, indicating potential for upside. On top of that, its return on equity (ROE) of 38.27%, return on capital employed (ROCE) of 27.27%, and net margin of 9.73% are all exceptionally strong, highlighting the company’s efficient use of resources and its ability to generate healthy profits.

However, a recent increase in net debt to INR 17.5 crore raises a point of concern. This rise is attributed to the company’s seasonal business nature, requiring higher working capital during peak seasons. Collections tend to slow down in the off-season, impacting liquidity and necessitating increased borrowing. Addressing this seasonal working capital challenge will be crucial for Nova Agritech to maintain its financial health and unlock its full potential.

| Particulars (in crore) | FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 |

| Revenue | 160.58 | 185.57 | 210.56 | 103.22 |

| Expenses | 152.26 | 167.17 | 182.77 | 89.21 |

| Net income | 6.30 | 13.69 | 20.49 | 10.38 |

| Margin (%) | 3.92 | 7.38 | 9.73 | 10.06 |

Nova Agritech IPO Analysis: Peer Comparison

Nova Agritech faces stiff competition from industry heavyweights like Aries Agro and India Pesticides. However, the company shines in terms of valuation. Its Return on Net Worth (RoNW) of 38.27% is the highest among its peers, and its P/E ratio of 12.8% makes it appear undervalued.

Despite being a newcomer, Nova Agritech boasts a rapidly expanding product portfolio, offering immense potential for future revenue and earnings growth. By setting up new formulation plants and addressing working capital needs, the company can unlock its full manufacturing capacity and significantly boost revenue generation. This will further solidify its position in the competitive landscape.

Nova Agri IPO Review: Issue Structure

Nova Agritech Limited is gearing up for its initial public offering with a price band of INR 39 to INR 41 per share. The total issue size will be INR 143.81 crore, comprised of a fresh issue of INR 112 crore and an offer for sale of INR 31.81 crore.

The fresh issue proceeds will be used to invest in Nova Agri Sciences Limited, a subsidiary of Nova AgriTech. This investment will facilitate the establishment of a new formulation plant and address working capital requirements.

In the offer-for-sale segment of INR 31.8 crore, Nutalapati Venkatasubbarao, the sole selling shareholder, intends to sell 77,58,620 shares. Additionally, 35% of the IPO will be reserved for retail investors.

Nova Agri IPO Review: Should You Invest?

The Indian biofertilizer market is poised for an impressive 11% compounded growth by 2028. This surge will be fueled by government support, rising demand for grains, and a growing organic farming trend, all of which bode well for Nova Agritech.

However, Nova Agritech faces hurdles. Seasonality, competition, and over-reliance on a single state might affect its profits. On the positive side, the upcoming capital injection aims to fix this by boosting high-margin product volumes and capacity utilization.

Meanwhile, the company’s financial position is promising. Its net profit margins have skyrocketed over the past three years, thanks to a strategic shift from high-volume, low-margin products to high-margin offerings. This has led to impressive revenue and profit growth in recent years.

Currently, Nova Agritech’s P/E ratio (12.5x) is lower than the industry average, while its EBITDA margin (18.39%) is strong. Revenue is growing at a CAGR of 14.56%, indicating high potential for expansion.

Beyond financials, Nova Agritech IPO analysis shows a deep commitment to farmer success. Its extensive dealer network, dedicated sales team, diverse product portfolio, and international expansion efforts all point towards a company focused on local and global agricultural prosperity. A healthy doe of grey market premium for this IPO also bodes well for offer investors.