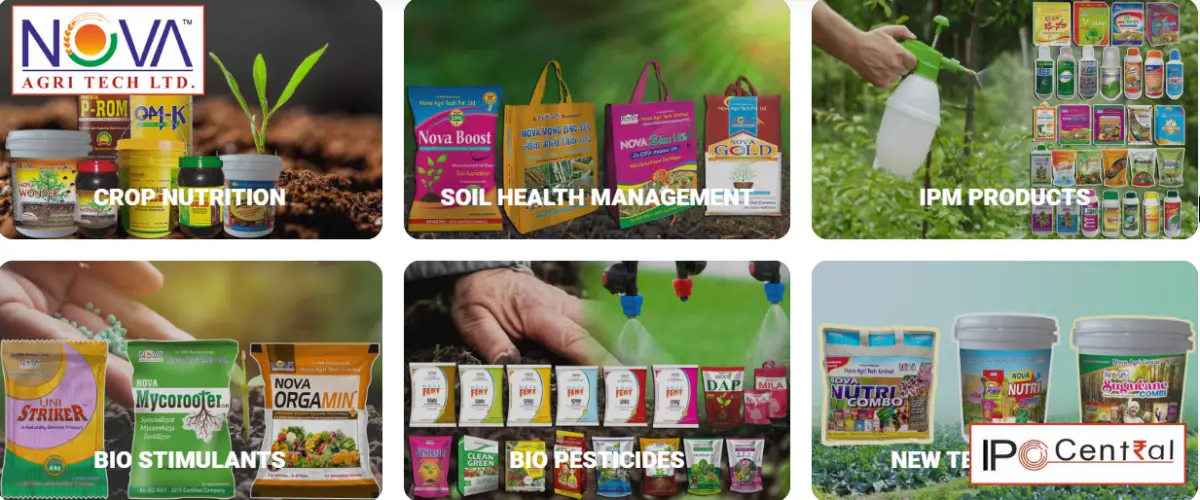

Nova Agri IPO Description – Nova Agritech is a prominent agri-input manufacturer specializing in providing products dedicated to soil health management, crop nutrition, and crop protection.

Nova Agritech engages in the manufacturing, distribution, and marketing of an extensive array of product categories, encompassing (a) products for soil health management; (b) crop nutrition products; (c) biostimulant products; (d) biopesticide products; (e) Integrated Pest Management (IPM) products; (f) innovations in technology; and (g) crop protection products. Notably, the production of crop protection products is currently carried out by its subsidiary, Nova Agri Sciences Private Limited.

As of 31 January 2023, Nova Agri has obtained 629 product registrations. These include 7 registrations in the soil health management category, 168 registrations in the crop nutrition category, 4 registrations in the bio-pesticide category, and 450 registrations in the crop protection category. The company applied for 26 new registrations in the name of Nova Agritech Limited (NATL).

Nova Agritech boasts an extensive dealer network, totaling approximately 10,900 dealers. Among these, around 6,200 dealers are actively engaged, having received product distributions and sales during the ongoing financial year. This robust network spans 16 states in India, namely Andhra Pradesh, Telangana, Maharashtra, Karnataka, Madhya Pradesh, Rajasthan, Chhattisgarh, Tamil Nadu, Uttar Pradesh, Odisha, West Bengal, Bihar, Gujarat, Jharkhand, Uttarakhand, and Jammu & Kashmir, with an additional presence in Nepal.

The company has forged marketing, distribution, and supply agreements with specific third parties in Bangladesh, Sri Lanka, and Vietnam.

Promoters of Nova Agritech – Suraksha Agri Retails (India) Private Limited, Malathi S, and Kiran Kumar Atukuri

Table of Contents

Nova Agri IPO Details

| Nova Agri IPO Dates | 23 – 25 January 2024 |

| Nova Agri IPO Price | INR 39 – 41 per share |

| Fresh issue | INR 112 crore |

| Offer For Sale | 7,758,620 shares (INR 30.26 – 31.81 crore) |

| Total IPO size | INR 142.26 – 143.81 crore |

| Minimum bid (lot size) | 365 shares (INR 14,965) |

| Face Value | INR 2 per share |

| Retail Allocation | 35% |

| Listing On | BSE, NSE |

Nova Agritech Financial Performance

| FY 2021 | FY 2022 | FY 2023 | H1 FY 2024 | |

| Revenue | 160.58 | 185.57 | 210.56 | 103.22 |

| Expenses | 152.26 | 167.17 | 182.77 | 89.21 |

| Net income | 6.30 | 13.69 | 20.49 | 10.38 |

| Margin (%) | 3.92 | 7.38 | 9.73 | 10.06 |

Nova Agri Offer News

- Nova Agritech IPO Analysis: Should You Invest?

- Nova Agri RHP

- Nova Agritech DRHP

- ASBA IPO Forms

- Live IPO Subscription Status

- IPO Allotment Status

Nova Agritech Valuations & Margins

| FY 2021 | FY 2022 | FY 2023 | |

| EPS | 1.00 | 2.18 | 3.27 |

| PE ratio | – | – | 11.93 – 12.54 |

| RONW (%) | 21.41 | 31.69 | 32.08 |

| NAV | 4.69 | 6.89 | 10.19 |

| ROCE (%) | 19.87 | 23.81 | 27.25 |

| EBITDA (%) | 11.08 | 14.97 | 18.39 |

| Debt/Equity | 1.74 | 1.49 | 1.11 |

Nova Agri IPO GMP Today (Daily Trend)

| Date | Day-wise IPO GMP | Kostak | Subject to Sauda |

| 30 January 2024 | 23 | – | 5,500 |

| 29 January 2024 | 22 | – | 5,500 |

| 26 January 2024 | 22 | – | 5,500 |

| 26 January 2024 | 22 | – | 5,500 |

| 25 January 2024 | 25 | – | 5,800 |

| 24 January 2024 | 20 | – | 5,500 |

| 23 January 2024 | 20 | – | 5,500 |

| 22 January 2024 | 20 | – | 5,500 |

| 20 January 2024 | 20 | – | 6,000 |

| 19 January 2024 | 20 | – | 6,000 |

Nova Agri IPO Objectives

The net proceeds of the Fresh Offer, i.e. gross proceeds of the Fresh Offer less the offer expenses apportioned to the company (Net Proceeds) are proposed to be utilized in the following manner:

- Investment in its subsidiary, Nova Agri Sciences Private Limited for setting up a new formulation plant – INR 14.20 crore

- Funding Capital Expenditure in the company, towards the expansion of its existing formulation plant – INR 10.49 crore

- Funding of working capital requirements of the company – INR 26.69 crore

- Investment in its subsidiary, Nova Agri Sciences Private Limited, for funding working capital requirements – INR 56.74 crore

- General corporate purposes

Nova Agri IPO Subscription – Live Updates

| Category | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Shares Offered | 7176461 | 5,471,486 | 12,766,799 | 25,414,746 |

| 25 Jan 2024 | 79.31 | 224.06 | 77.11 | 109.37 |

| 24 Jan 2024 | 1.12 | 71.87 | 37.52 | 34.64 |

| 23 Jan 2024 | 0.62 | 14.68 | 12.77 | 9.75 |

Nova Agritech – Comparison With Listed Peers

| Company | Face Value | PE ratio | EPS | RONW (%) | NAV | Revenue (Cr.) |

| Nova Agritech | 2 | 12.54 | 2.18 | 31.69 | 6.89 | 185.61 |

| Aries Agro | 10 | 9.59 | 10.22 | 5.93 | 172.43 | 443.94 |

| Aimco Pesticides | 10 | 22.54 | 11.12 | 21.11 | 52.68 | 312.83 |

| Basant Agrotech | 1 | 8.59 | 2.09 | 12.39 | 16.91 | 448.33 |

| Best Agrolife | 10 | 26.03 | 38.22 | 27.88 | 132.08 | 1,139.63 |

| Bhagiradha Chemicals & Industries | 10 | 22.44 | 43.02 | 18.83 | 227.81 | 436.52 |

| Heranba Industries | 10 | 9.44 | 47.25 | 26.46 | 178.55 | 1,469.72 |

| India Pesticides | 1 | 16.68 | 13.82 | 24.81 | 55.43 | 729.31 |

| Madras Fertilizers | 10 | 5.55 | 10.06 | (32.06) | (31.37) | 2,333.87 |

| Dharmaj Crop | 10 | 14.09 | 11.62 | 33.79 | 34.40 | 396.29 |

Nova Agri IPO Allotment Status

Nova Agri IPO allotment status is now available on Bigshare Services’ website. Click on this link to get allotment status.

Nova Agri IPO Dates & Listing Performance

| Nova Agri IPO Opening Date | 23 January 2024 |

| Nova Agri IPO Closing Date | 25 January 2024 |

| Finalization of Basis of Allotment | 29 January 2024 |

| Initiation of refunds | 30 January 2024 |

| Transfer of shares to demat accounts | 30 January 2024 |

| Nova Agri IPO Listing Date | 31 January 2024 |

| Opening Price on NSE | INR 55 per share (up 34.15%) |

| Closing Price on NSE | INR 57.75 per share (up 40.85%) |

Nova Agri IPO Reviews – Subscribe or Avoid?

Angel One –

Anand Rathi –

Axis Capital –

Antique Stock Broking –

Arihant Capital –

Ashika Research –

Asit C Mehta –

BP Wealth – Subscribe

Capital Market – Neutral

Canara Bank Securities – Subscribe

Choice Broking – Subscribe

Dalal & Broacha –

Elite Wealth –

GCL Broking –

Geojit –

GEPL Capital – Subscribe

Hem Securities –

ICICIdirect –

Investmentz –

Jainam Broking –

Keynote Financial – Not Rated

DR Choksey –

LKP Research –

Marwadi Financial –

Motilal Oswal –

Nirmal Bang –

Reliance Securities –

Religare Broking –

Samco Securities – Not Rated

SMC Global – 2/5

Stoxbox by BP Equities – Subscribe

Swastika Investmart – Subscribe

Ventura Securities – Subscribe

Nova Agritech IPO Lead Manager

KEYNOTE FINANCIAL SERVICES LIMITED

The Ruby, 9th Floor, Senapati Bapat Marg,

Dadar (West), Mumbai – 400028

Tel: 022– 68266000

E-mail: [email protected]

Website: www.keynoteindia.net

Nova Agri Offer Registrar

BIGSHARE SERVICES PRIVATE LIMITED

S6-2, 6th Floor, Pinnacle Business Park,

Next to Ahura Centre, Mahakali

Caves Road, Andheri East, Mumbai – 400 093

Phone: +91 22 6263 8200

Email: [email protected]

Website: www.bigshareonline.com

Nova Agri Contact Details

NOVA AGRITECH LIMITED

Sy.No. 251/A/1, Singannaguda Village,

Mulugu Mandal, Siddipet, Medak, Telangana – 502279

Phone: +91 84 54253446

Email: [email protected]

Website: www.novaagri.in

Nova Agri IPO FAQs

How many shares in Nova Agri IPO are reserved for HNIs and retail investors?

The investors’ portion for QIB – 50%, NII – 15%, and Retail – 35%.

How to apply in Nova Agri Public Offer?

The best way to apply in Nova Agri public offer is through Internet banking ASBA (know all about ASBA here). You can also apply online through your stock broker using UPI. If you prefer to make paper applications, fill up an offline IPO form and deposit the same to your broker.

What is Nova Agri IPO GMP today?

Nova Agri IPO GMP today is INR 23 per share.

What is Nova Agri kostak rate today?

Nova Agri kostak rate today is INR NA per application.

What is Nova Agri Subject to Sauda rate today?

Nova Agri Subject to Sauda rate today is INR 5,500 per application.