Hyderabad based Penna Cement has filed draft papers with market regulator SEBI to float its maiden public offer. Penna Cement IPO aims to mobilize as much as INR1,550 crore (INR15.5 billion), through a combination of a fresh issue of equity shares (INR1,300 crore) and an offer for sale (OFS) of up to INR250 crore by promoters. The integrated cement player’s plans coincide with those Nuvoco Vistas which is also seeking regulatory permission to launch IPO.

Penna Cement IPO: Debt reduction on cards

The IPO proceeds are likely to be used towards debt reduction and funding capital expenditures. From the draft prospectus:

- Repayment/pre-payment, in full or part, of certain borrowings – INR550 crore

- Funding of capital expenditure requirements towards the KP Line II project – INR105 crore

- Funding of the capital expenditure requirements towards upgrading the raw grinding and cement mill at Talaricheruvu – INR80 crore

- Funding of ca pita l expenditure requirements setting up the waste heat recovery plant at Tandur – INR130 crore

- Funding of capital expenditure requirements towards setting up the WHR Plant at Talaricheruvu – INR110 crore

- General corporate purposes

Edelweiss Financial Services, Axis Capital, ICICI Securities, JM Financial and Yes Securities have been appointed lead managers of the offer.

Penna Cement: Business operations

The company commenced operations in 1994 and through capacity expansion and acquisitions. As of 31 March 2021, Penna Cement operates out of 4 ISO certified integrated manufacturing facilities and two grinding units across Andhra Pradesh, Telangana and Maharashtra with an aggregate capacity of 10 MMTPA. The current expansion projects are likely to expand its capacity to 16.5 MMTPA by FY2024.

In May 2019, the company acquired Singha Cement, a Sri Lankan Cement Company that operates a packing terminal in Colombo, to augment its focus on having a port-based distribution strategy. Additionally, it has commissioned one of the largest port-based cement terminal in India at Krishnapatnam with an automated ship loading facility and packing terminals at Cochin, Gopalpur and Karaikal ports.

Penna Cement’s Financial performance

In terms of financial performance, Penna Cement has posted higher revenues, even during Covid-19 pandemic. However, its profits haven’t seen a similar trend, although its EBITDA margin and realization have posted impressive growth.

Penna Cement’s Financial Performance (INR crore)

| FY2019 | FY2020 | FY2021 | ||

| Revenue | 2,159.1 | 2,176.3 | 2,599.4 | |

| Expenses | 2,103.7 | 2,137.8 | 2,369.4 | |

| Net income | 84.7 | 21.9 | 97.8 | |

| Margin (%) | 3.9 | 1.0 | 3.8 | |

| Capacity Utilization (%) | 53.9 | 52.5 | 54.3 | |

| EBITDA (%) | 14.3 | 15.6 | 19.4 |

As of 31 March 2021, the company’s total indebtedness stood at INR1,351.9 crore with a debt/equity ratio of 1.17. Following the IPO, this ratio is set to go down sharply.

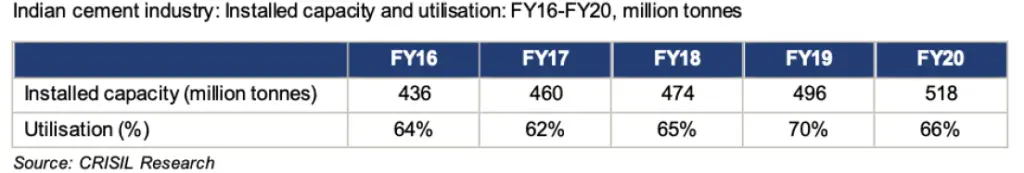

Cement industry has seen a revival in fortunes lately and this trend is likely to continue for at least next few years, thanks to revival in end use industries.

Meanwhile, cement stocks have also moved up and have found new takers. This bodes well for companies like Penna Cement planning IPOs. This is the company’s second attempt to tap primary markets. Earlier, Penna Cement received SEBI approval in June 2019 but didn’t launch the IPO due to adverse market conditions.

Penna Cement’s Financial performance look they are growing very fast